The market bottomed last October despite ongoing concerns about inflation, higher rates, recessionary risks, and a banking crisis. While the media headlines and Youtube podcasts are filled with “crisis” headlines, as noted in “Analysts Raise Estimates,” expectations for growth and earnings are rising.

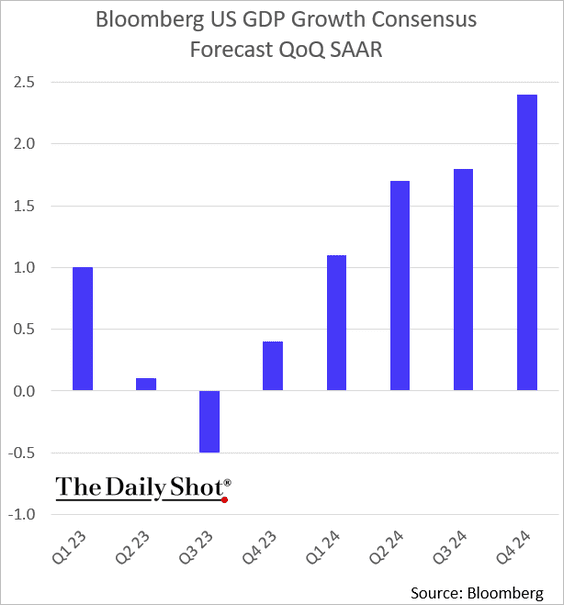

“If there is ‘no recession in 2023,’ then such would suggest the decline in corporate earnings and profit margins is complete. Therefore, such would suggest that equities are fairly valued at current levels supporting the return of a more bullish trend. Currently, the Bloomberg Economic Growth Consensus for the U.S. economy is rising, with only one-quarter of negative growth expected.”

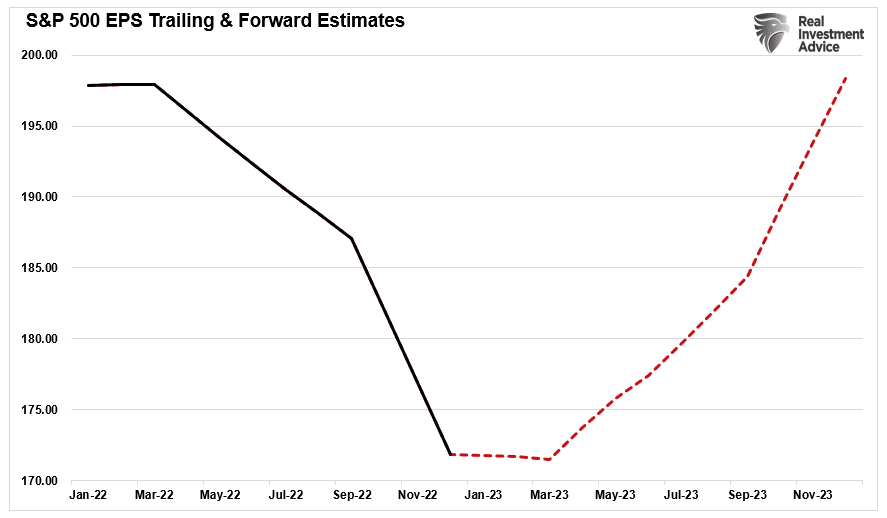

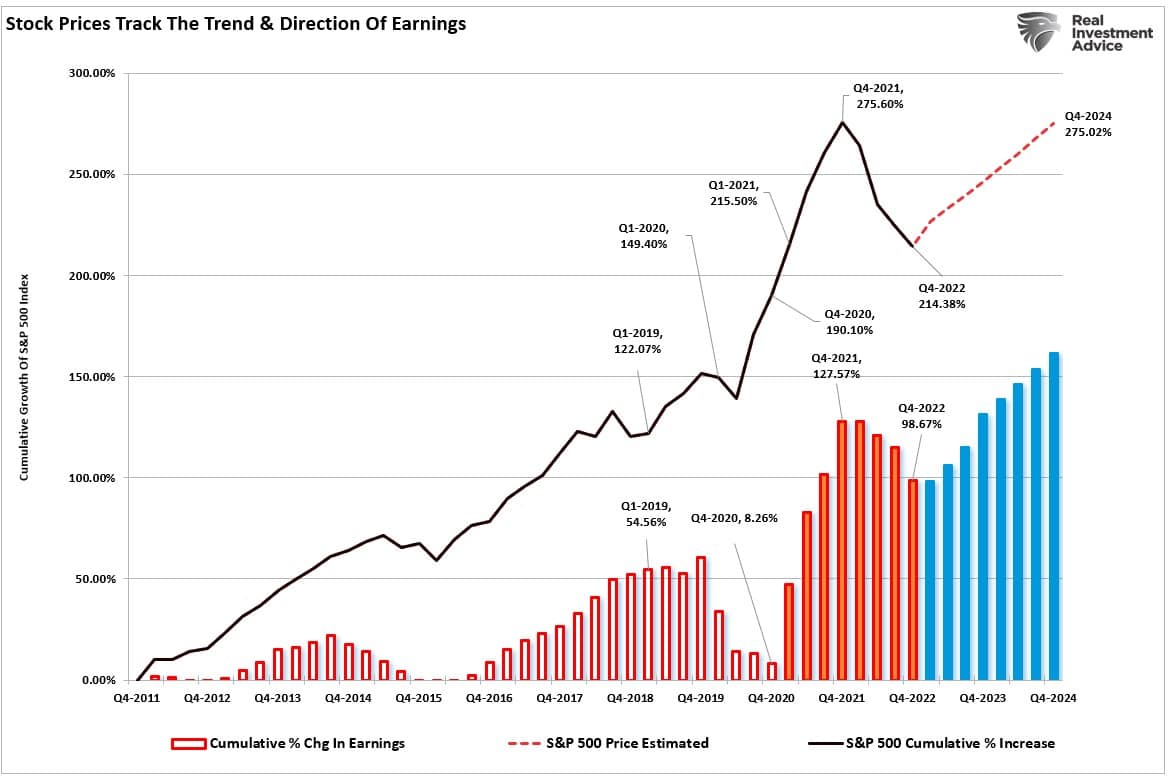

“Given that earnings are derived from economic activity, then the current decline in earnings should bottom before the trough in economic activity. Interestingly, in mid-March, S&P Global released its earnings forecast for the S&P 500 through the end of 2024. As with economic analysts, S&P sees earnings bottoming in the first quarter and returning to its January 2022 peak.”

“Interestingly, the financial markets have factored in these improving outlooks since the October lows. Such is unsurprising as investors begin to pay up for investments based on more robust forecasts. Therefore, if the earnings forecasts are correct, the market should reflect those forecasts and rise toward the previous market peak.”

While economists and analysts are basing their views on the premise of a “no recession” scenario, the market bottomed in October on hopes of a reversal of monetary tightening by the Federal Reserve. It is currently unclear if either view is correct.

Nonetheless, as investors, several technical indicators support the notion that the market bottomed in 2022, suggesting an alternative view of an ongoing bear market.

Still In A Correction

While there have been many discussions about the “bear market” last year, such is not the case. Yes, the market was down more than 20% last year, which is the media’s definition of a bear market. However, is an arbitrary 20% decline still a valid measure?

To answer the question of validity, let’s agree on a basic definition.

- A bull market is when the market price trends higher over a long-term period.

- A bear market is when the previous positive trend ends, and prices trend lower.

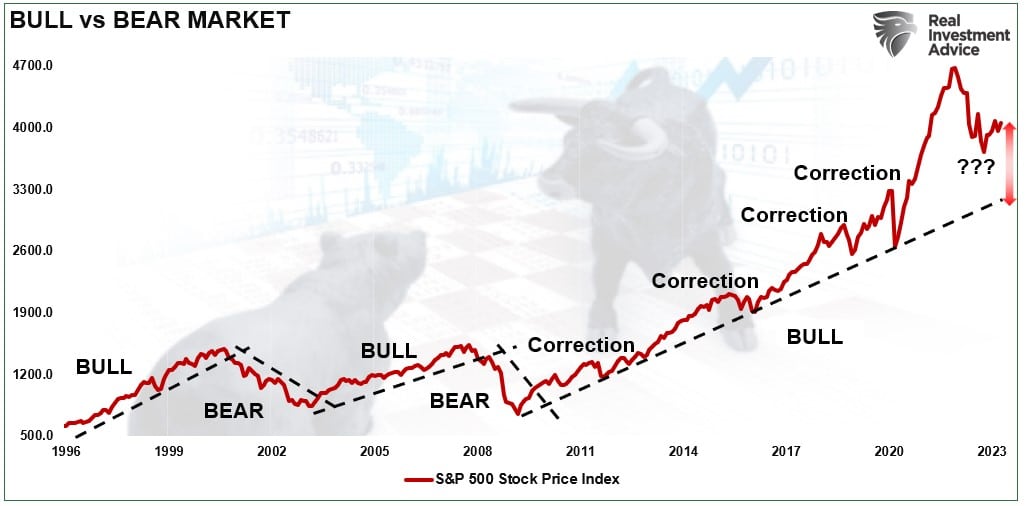

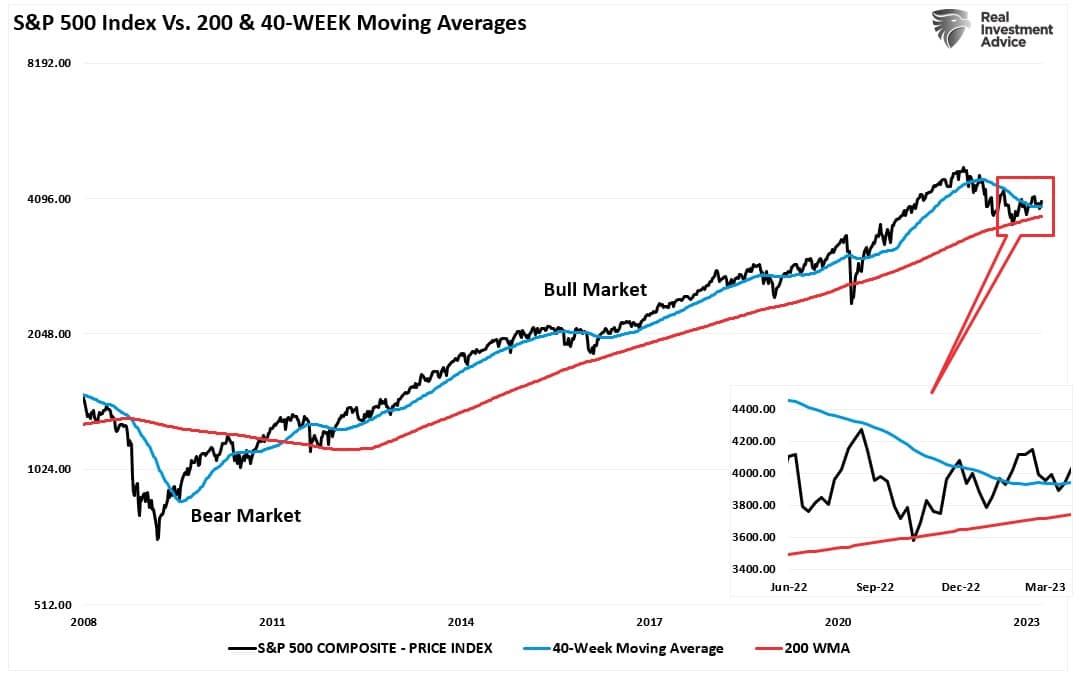

The chart below provides a visual of the distinction. When looking at price “trends,” the difference becomes apparent and valuable.

The distinction is also essential to understanding the difference between “corrections” and “bear markets.”

- “Corrections” generally occur over short time frames, do not break the prevailing price trends, and are resolved by markets reversing to new highs.

- “Bear Markets” tend to be long-term affairs where prices grind sideways or lower over several months to two years as valuations “mean revert.”

A good example of the inaccuracy of the 20% rule was the 35% price decline in March 2020. That decline was unusually swift using monthly closing data. However, that decline did not break the long-term bullish trend and quickly reversed to new highs, suggesting it was a “correction.”

The massive fiscal impulse into the financial system and the economy in 2020-2021 led to an unprecedented deviation above the bullish trend. The market is in the process of correcting that excessive deviation but has yet to retest the previous bullish trend. Given such a large deviation, that correction process will require a deeper price decline or a long period of price consolidation.

Regardless of how the price deviation is resolved during the correction process, the secular bull market that started in 2009 remains intact as long as the rising price trends continue.

The long-term technical structures of the market also confirm this view.

Long-Term Technicals Remain Bullish

Daily price charts can provide a short-term view of market psychology from days to weeks. The problem with daily price analysis is volatility can cause short-term swings in the market that can disconnect from the market’s underlying trend or fundamental data.

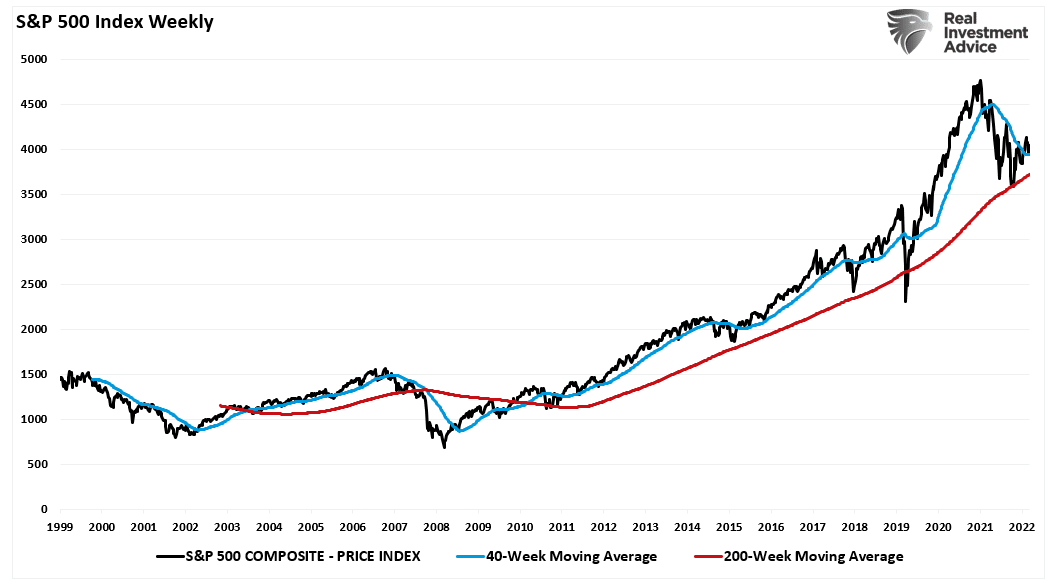

If we slow that price action by examining weekly pricing data, the volatility gets smoothed out. Such reveals a clearer picture of the market delivering a more bullish message.

The S&P 500 scored seven weekly closes above its 40-week moving average and then successfully retested that breakout level. Such suggests the return of a more bullish trend. Assuming supports continue to hold, the next major resistance levels are the February highs of 4,200, then the August 2022 peak at 4,325.

Notably, the October lows held critical support at the 200-week moving average, which remains support for the market since the 2009 lows.

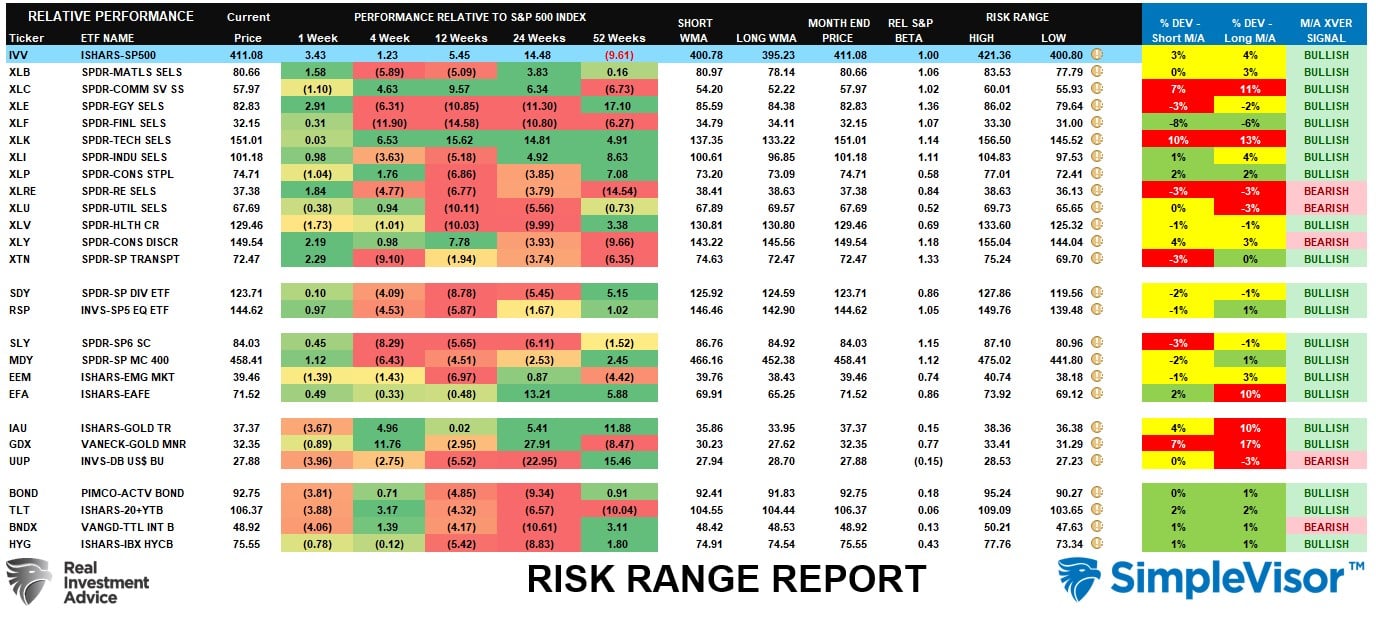

Furthermore, the vast majority of the major markets and sectors have registered weekly buy signals. Such has historically denoted a more bullish bias to the overall market for the next 12 months.

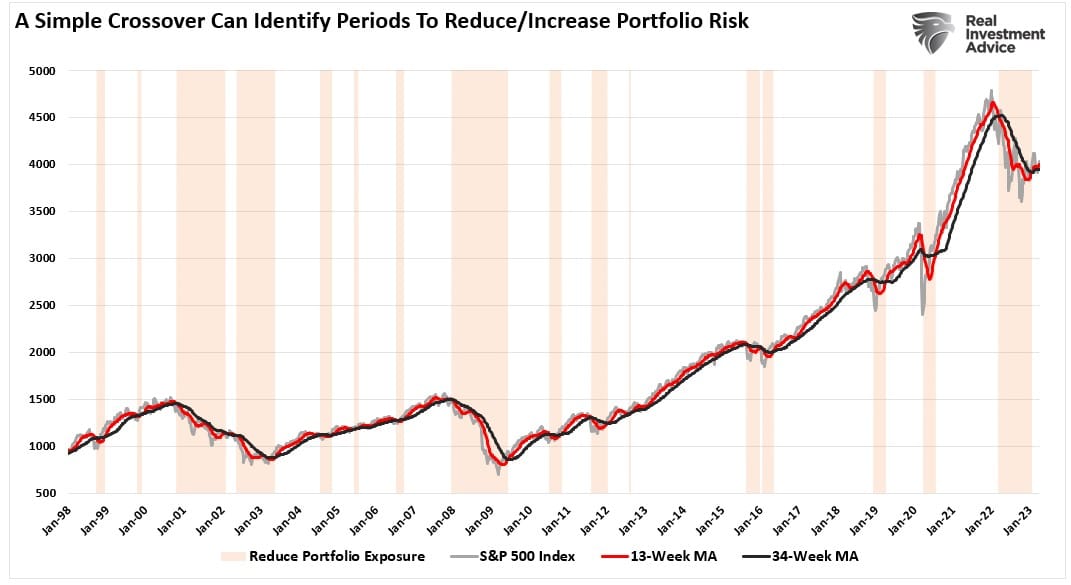

The chart below shows the moving average crossover signal back to 1998. The orange bars are periods where equity exposure should be reduced. As you will note, the periods of a positive cross, where equity exposure should be increased, usually last for a year or more. Since 1998, there were only two false signals to increase equity exposure in 2002 and early 2016.

From an investment viewpoint, the technical action of the market suggests that the market bottomed in 2022. However, much like we saw in 2002, there is a risk that one more leg lower is possible.

Navigating What Comes Next

As noted, investors’ biggest problem is discerning between market action and the economic and fundamental dynamics. Let me be very clear…I have no idea if the market bottomed in October or not.

However, there are some rules we can follow.

Rule #1: Cut Losers Short & Let Winners Run.

It takes tremendous humility to navigate markets successfully. There can be no such thing as hubris when investments do not go how you want them. Investors plagued with big egos cannot admit mistakes, or they believe they’re the most significant stock pickers who ever lived. To survive in markets, one must avoid overconfidence.

Rule #2: Investing Without Specific End Goals is a Big Mistake.

Before investing, you should already know the answer to the following two questions:

- At what price will I sell or take profits, if I’m correct?

- Where will I sell it if I am wrong?

Hope and greed are not investment processes.

Rule #3: Emotional & Cognitive Biases Are not Part of the Process.

If your investment (and financial) decisions start with:

- I feel that

- My friend told me

- I heard

- I hope

You are setting yourself up for a bad experience.

Rule #4: Follow the Trend.

“80% of portfolio performance is determined by the underlying trend. “

Rule #5: Don’t Turn a Profit Into a Loss.

Investing is about creating returns over time. If you don’t harvest gains and allow them to turn into a loss, you have started a “financial rinse cycle.”

Most importantly, “getting back to even” is not an investment strategy.

Rule #6: Odds of Success Improve Greatly When Technical Analysis Supports Fundamental Analysis.

The market, for a long-time, can ignore fundamentals. As John Maynard Keynes once said:

“The stock market can remain irrational longer than you can remain solvent. “

Applying a technical overlay to determine the “when” to invest can significantly improve the return and control the capital risk of the “what” fundamental analysis uncovers.

Rule #7: In Bull Markets, You Should be “Long.” in Bear Markets – “Neutral” or “Short.”

Investing against the market’s major “trend” is generally a fruitless and frustrating effort. During secular bull markets – remain invested in risk assets like stocks or initiate an ongoing process of trimming winners.

During bear markets, investors can reduce risk asset holdings to their target asset allocations and build cash. An attempt to buy dips believing you’ve discovered the bottom or “stocks can’t go any lower” generally doesn’t work out well.

Rule #8: Invest First With Risk in Mind, not Returns.

Investors focusing on risk first are less likely to fall prey to greed. We tend to focus on the potential return on investment and treat the risk taken to achieve it as an afterthought.

Responsible portfolio management aims to grow money over the long term to reach specific financial milestones and consider the risk taken to achieve those goals. Managing to prevent significant drawdowns in portfolios means giving up SOME upside to prevent the capture of most of the downside. While portfolios may return to even after a catastrophic loss, the precious time lost while “getting back to even” can never be regained.

Rule #9: The Goal of Portfolio Management Is a 70% Success Rate.

Think about it – Major League batters go to the “Hall Of Fame” with a 40% success rate at the plate.

Portfolio management is not about always being right. It is about consistently getting “on base” that wins the long game. There isn’t a strategy, discipline, or style that will work 100% of the time.

Once you understand that, the other 8 rules above become much simpler to incorporate.

As an investor, stepping away from your “emotions” momentarily is most important. Look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend much on how you answer that question and manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham