When analyzing oil fundamentals, traders must assess demand from a regional perspective. In the last few years we have seen regular talk that India will not be a major player in the future of demand because of some as-yet not clarified clean energy plans. Do not listen to this.

Today, India is a major consumer of oil and oil products, and it will only be a more significant consumer in the years to come. Despite media attention focused on clean energy growth, traders have every reason to believe that India’s oil demand will grow significantly more than any other country’s oil demand in the decade. Therefore, every trader needs to watch India and its demand.

There has been and will continue to be much chatter about India’s transition to clean power. A recent Bloomberg article covering the release of an IEA report on India’s energy outlook was headlined, “India needs to spend $1.4 trillion more on clean energy shift.” That $1.4 trillion might be split over 20 years, but it still comes out to $70 billion per year. This is an unreasonable figure, and it adds up to 70% more than India’s current policy desires. Such plans and aims are wholly unrealistic.

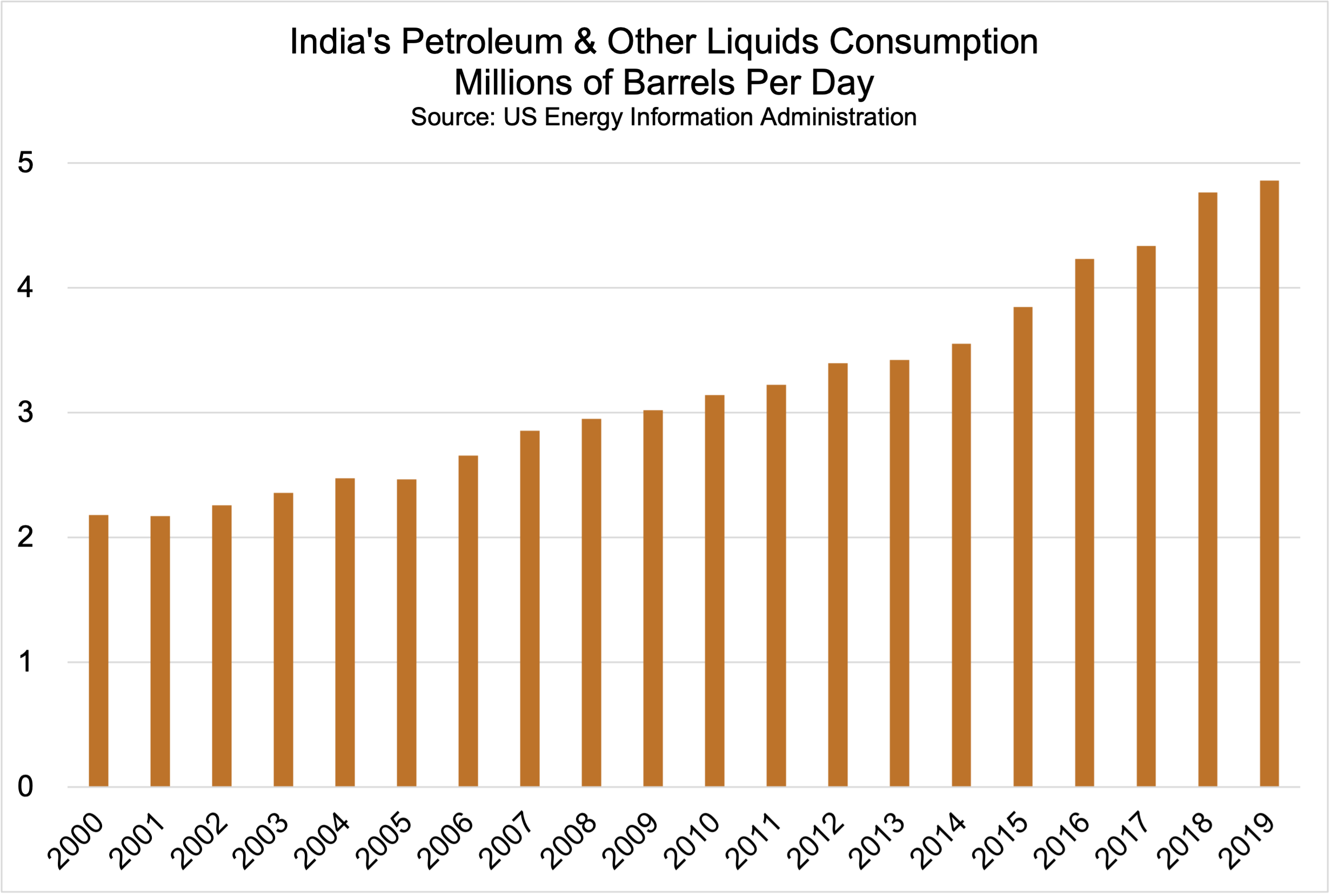

In 2019, India was the third-largest consumer of oil and petroleum products, after the United States and China. Demand that year reached 4.9 million bpd, but many believe it would have been even higher had an economic slowdown and heavy monsoon season not hampered demand growth.

It's difficult to make predictions for the post-coronavirus economic future, but even the IEA agrees that India is a “key driver” for oil demand growth. The IEA predicts that India’s oil demand will grow to 6 million bpd by 2024. In short, India’s oil demand is not going away.

Instead of believing unrealistic clean energy investment targets, traders should focus on the following points when it comes to understanding how India’s demand growth will impact oil market fundamentals:

- India is currently a net exporter of refined products, but with changes in consumption patterns, India could soon become a net importer if it does not significantly increase its own refining capacity. India says it plans to grow its refining capacity from 5 million bpd to 8 million bpd by 2025, but the IEA does not think that kind of growth is feasible and believes India’s refining capacity will only grow to 5.7 million bpd by 2024. If the IEA is correct, then India will need to import more gasoline and diesel fuel along with crude oil in order to keep up with domestic consumption. However, there is a great deal of interest from international oil companies in building new refineries in India. The process has been slow, in part because of India’s business system. For traders, the distinction between oil and refined products is key. If India does not expand its refining capacity, its oil demand will plateau, but it will only import more and more refined product.

- Traders need to be aware of where India’s oil comes from. India’s domestic oil reserves are smaller than China’s, and India’s production capacity is less than China’s. Therefore, India’s oil imports are expected to rise significantly as the population’s demand for oil grows. Currently, 65% of India’s oil imports come from the Middle East. This makes India vulnerable to geopolitical tensions in that area. Right now, Iraq is India’s largest Middle East oil supplier, but Iran will likely increase its sales to India if the sanctions are lifted. India is under pressure to diversify its sources of oil to avoid strategic risks, and it may look to the United States, Canada and Brazil to supply more crude oil in the future.

- Natural gas traders and those concerned with associated natural gas should also watch India. Even though major organizations both within India and internationally are pushing solar and wind energy investments for India, India could make major strides towards improving its emissions profile if it pivots toward natural gas. As of 2019, coal made up 45% of India’s energy consumption. Petroleum and other liquids were 25%, and biomass and waste (likely wood and dung) were 20%. Natural gas only supplied 6% of India’s needs. Expanding natural gas use to replace coal and biomass and waste would decrease emissions in India. In fact, India seemed poised to increase its natural gas use when three Indian companies entered a consortium with Iran in 2008 to develop an offshore natural gas field in the Persian Gulf. That relationship recently fell through, reportedly because India delayed work due to U.S. sanctions. If these sanctions are lifted by President Biden's administration, it is possible that the Indian companies might resume their work with Iran and could bring more natural gas to India.

- Most of these green energy plans for India are impractical. Start with the IEA’s $1.4 trillion proposal. India’s total budget for 2020-2021 is about $420 billion. In 2020, its GDP was estimated at less than $2.6 trillion. In other words, India cannot afford $70 billion per year for environmentalist causes. And if India is going to invest in massive infrastructure changes, its people will benefit more from the fixing of immediate needs like providing universal clean water. In 2017, the minister in charge of energy and power said that by 2030 there would be no more domestic sales of gasoline or diesel cars. That was an absurd idea given the transportation needs within India, the state of EV technology, and the income level of the average Indian family. EV’s take a long time to charge and have limited range, so they are not useful over long distances. They also waste battery power in the heat, and it's often hot in India. EV’s would be useless and perhaps dangerous while driving through the jungles of central India or on Himalayan roads. Moreover, no one has been able to build inexpensive EV’s that could compete in the Indian market versus some of the internal combustion engines sold by Tata (NS:TAMO) and its local competitors. Traders should expect oil to be used for transportation for quite some time in India.

- However, traders should not expect the astronomical growth in demand in India that was seen in China over the last six years. One of the reasons China’s demand grew so significantly was that it took advantage of low oil prices beginning at the start of 2015. China massively expanded its strategic petroleum reserve, and nominally private firms in China also expanded their inventories (likely under the supervision of central authorities). India also has a strategic petroleum reserve, but it did not copy China’s strategy. Traders should not expect that kind of huge bump in Indian demand, as India is unlikely to spend so much continually expanding inventory. Rather, India’s demand should more closely align with the amount it can refine.