The Fed’s Inflation Complication:

With all eyes on tonight’s FOMC decision as to whether the Fed will in fact hike rates and change any monetary policy projections, this morning’s daily market update will be a short one just looking at what happened yesterday.

What has been interesting as we head into the decision has been every single one of this week’s data releases from the US have missed expectations, just adding fuel to the ready made wait and see excuse that the Fed has at its disposal. Last night’s inflation figures saw CPI m/m come in at -0.1% v the 0.0% expected and have been blamed on falling energy costs. With the Fed constantly repeating that weak inflation is a huge factor in why they are in no rush to hike, this number again pushes the economy further away from the 2% target and muddies the water just that little bit more.

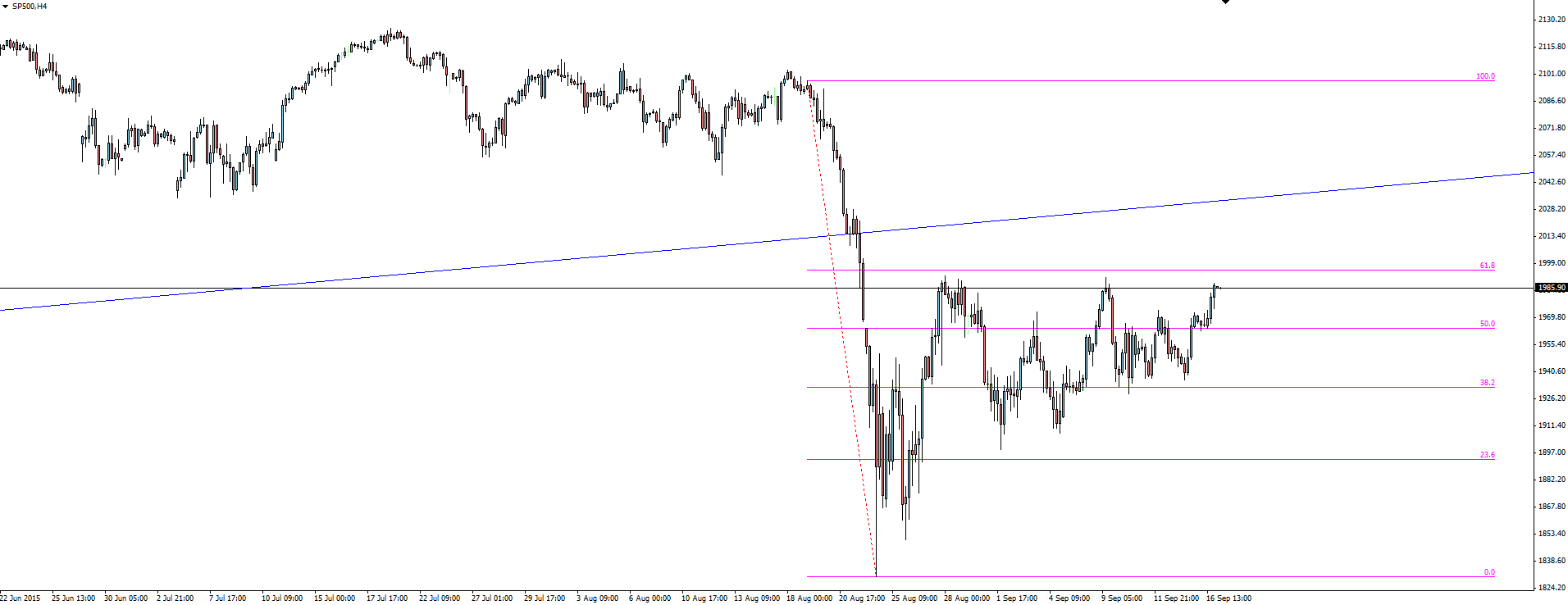

SP500 4 Hourly:

With inflation driven doubt combined with the general squaring of long USD positions, stocks again benefited, with the S&P 500 rallying back to test its most recent swing highs (and the 61.8% fib retracement for you tech heads) heading into the decision.

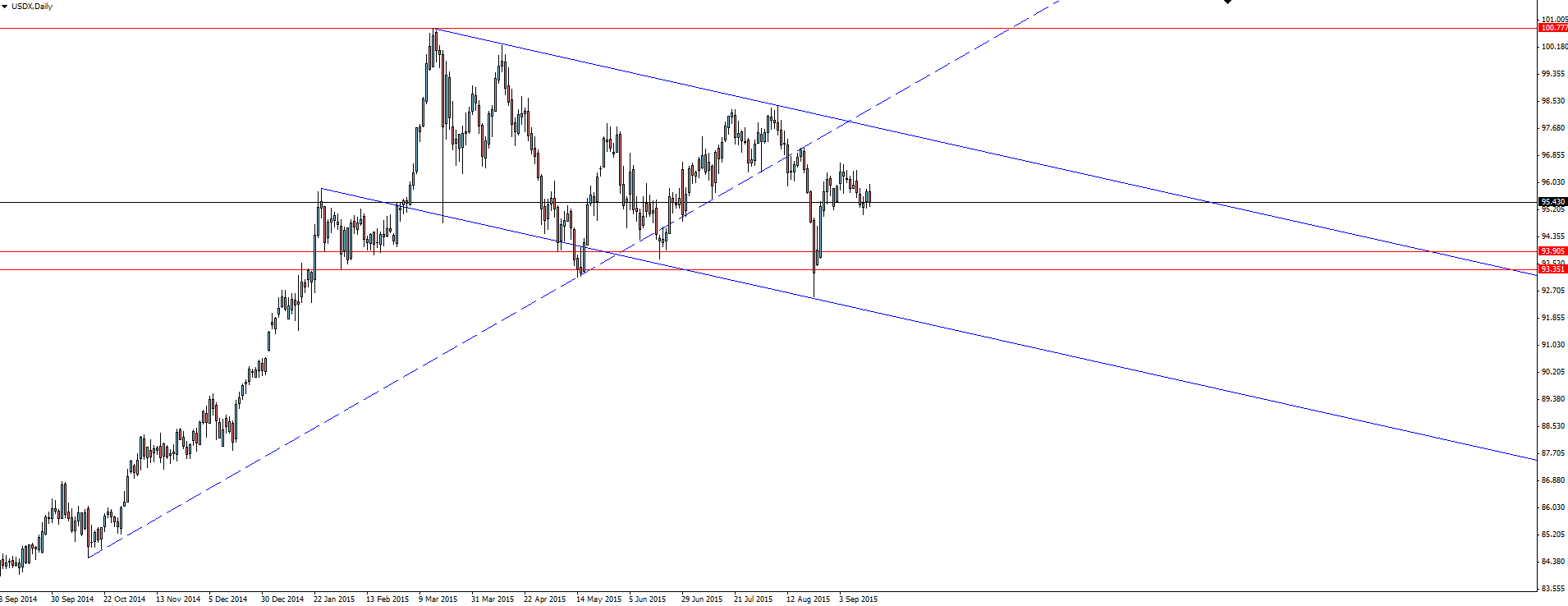

USDX Daily:

Moving onto the US Dollar Index, with price sitting in the middle of this short term bearish channel, we really are in no man's land heading into the FOMC. Once again, take these moves as sideways drift and the squaring of positions in a low liquidity environment.

On the Calendar Thursday:

NZD: GDP q/q (0.4% v 0.5% expected)

JPY: BOJ Gov Kuroda Speaks

CHF: Libor Rate

CHF: SNB Monetary Policy Assessment

GBP: Retail Sales m/m

USD: Building Permits

USD: Unemployment Claims

USD: Philly Fed Manufacturing Index

USD: FOMC Economic Projections

USD: FOMC Statement

USD: Federal Funds Rate

USD: FOMC Press Conference

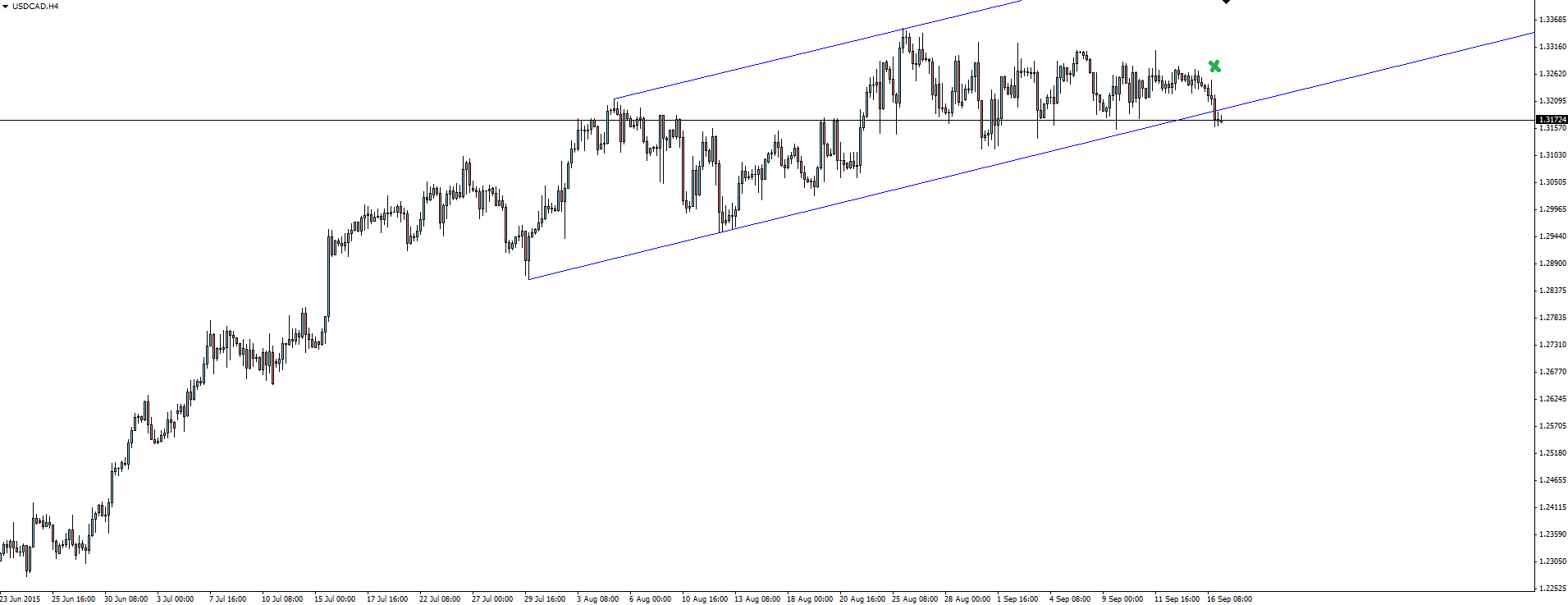

Chart of the Day:

Today’s chart of the day provides an update on a USD/CAD channel that we’ve been watching over the last couple of weeks.

USD/CAD 4 Hourly:

Price has broken to the downside after last night’s squaring of USD longs heading into the FOMC decision. As we spoke about yesterday, I would be very cautious in looking for follow through on any breakouts like this in the low liquidity conditions we are currently experiencing.

This looks more like a sideways drift type breakout rather than a move with any sort of momentum behind it.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex Broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade Forex. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.