By Chaim Siegel of Elazar Advisors, LLC

On March 1st the US economy gave the Fed an inflation scare. That's when the Fed's favorite inflation measure, the PCE Price Index, reported a breakout higher.

Most Fed officials scrambled to announce they were flipping from dove to hawk. But that was then.

Yesterday morning however, the CPI release calmed the Fed enough so that they stuck to their pre-March 1st original plans. The real news yesterday was that, after all that huffing and puffing from Fed officials for the last couple of weeks, in the end, aside from the quarter-point rate increase which was widely expected, not much really changed.

That gives gold the green light to push higher.

Quick Review: March 1st Inflation Scare

Source: CME Group

Above, a chart of the Fed Funds Futures. A drop means futures are expecting a greater chance for a higher Fed Funds rate. March 1st saw the biggest drop. That’s when the PCE Price Index reported its breakout.

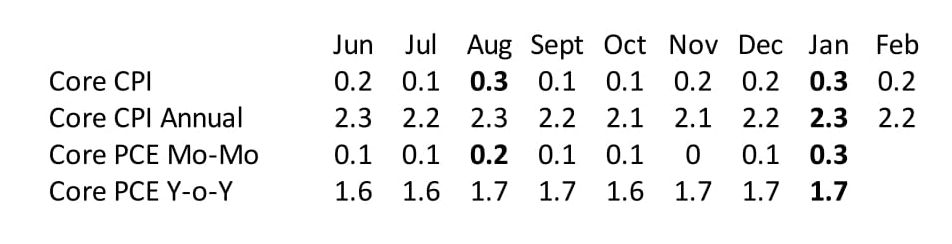

On March 1st the street saw PCE jump from 0 and .1 to .3. Some Fed officials may have had a preview. This was the main reason Fed officials felt the need to say something publicly about a hike.

But that was then.

Comes yesterday, March 15th, and that PCE report was put to bed by the CPI release. February CPI came in slower than the previous read.

That’s important because both times during the last year or so that CPI was strong, the Fed’s inflation measure followed with strength (as can be seen in the grid above).

With a heads-up from the slower CPI reading released just hours before the rate decision announcement yesterday, the Fed was able to calm down and hike.

Aside From A Hike, Fed Had No Changes. That’s The Shocker

While most will probably over-analyze the language of the FOMC statement, we think the most important piece of information was the forecasts. The Fed issues updates to these forecasts after every other Fed meeting.

This time, there were absolutely no changes to their forecasts.

All the worry about higher inflation and a pickup in sentiment was a two-week hamster wheel spin to nowhere. The Fed changed nothing after all that running around to the media.

Let’s see:

- Their core inflation expectation for 2017 went from 1.8% to 1.9%. That's no change.

- Their GDP forecast went from 2.1% to 2.1%. That's no change.

And most important (drum roll please): their target for Fed Funds by the end of the year went from 1.4% to … 1.4%. No change.

Does anybody remember the Fed hysteria the past couple of weeks with multiple, official Fed announcements about a hike “soon” and major brokerage firms upping targets across the board? We do.

All that for… No change. The Fed changed… Nothing.

Green Light For Gold

As we explained last week, if gold, via SPDR Gold Shares (NYSE:GLD), doesn’t have to contend with multiple, unexpected rate hikes it can go higher. We noted than that higher rates can cause gold to go lower. Since the Fed did not change forecasts thanks to a more benign CPI number, gold is able hold up.

Last week we said:

“Currently we are not completely sold that gold will break down. Though we highlight this major catalyst, still, we want to see how gold reacts around the news. A break is negative, but if gold holds on the news, that would be bullish action.”

Here’s the chart we showed in that post:

The line we drew acted as major support and resistance for critical action. Yesterday’s bullish news and the close above that key line is positive.

Here’s the close as of yesterday:

This is a positive move for longer term traders. For now, on a shorter term basis, we don’t want to chase gold because we think it can give back some of yesterday’s move shorter term, as equity markets move higher.

One Other Factor Helping Gold: No Growth

Did anybody hear what Fed Chair Yellen had to say about growth yesterday? Not a word. Nothing. As long as PCE and CPI remain tame, rates have no reason to go up. That is bullish longer term for gold.

Listen to what Fed Chair Yellen said about growth in her press conference yesterday.

“Haven’t seen any hard evidence of a change in spending decisions.”

Despite seeing a pickup in confidence and jobs, the Fed has not seen spending pick up which is really what matters.

All the hubbub about the economy picking up and the Fed isn’t seeing it.

As for fiscal policy, they don’t expect much of that either. When asked if Fed officials are factoring planned fiscal spending initiatives Yellen answered:

“There's nothing that we've done or anticipate that is a speculation.”

That’s Fed-speak, politely calling planned spending initiatives speculation. In other words, they don’t give much credence to fiscal spending passing Congress.

If Ms. Yellen is correct, gold will not have to contend much with growth, fiscal spending or unexpected higher rates. The Fed’s just not seeing it.

Conclusion

One big, fat, Fed no-change helped gold hold yesterday. That's a bullish fundamental change, reversing a key fear after a high PCE release on March 1st. Looks like CPI saved gold bugs yesterday.

Disclaimer: ETFs reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this article may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.