Today sees the 155th running of the Melbourne Cup at 3pm AEDT; the $6.2 million race has not seen such a short price favourite in Fame Game since So You Think in 2010, and has not seen this many international raiders in its history.

The Japanese stayer would be the second Japanese horse to win if it gets up after Delta Blues, which wore the same colours Fame Game will wear today.

So You Think might have finished third in 2010 behind Americain and Maluckyday but it’s only been two years since a favourite won the Cup in Fiorente in 2013. This gave Gai Waterhouse her first Cup win and saw an Irish horse take the Cup. However, the 2013 race was one of the widest markets of the past decade. Today appears to be a three- or maybe four-horse race.

What is almost certain is the Cup will be on a plane travelling overseas by tonight, with the top 10 rated horses all owned offshore. The race that stops a nation has completely embraced globalisation and whether it is France, Japan, the UK or Ireland that takes the Cup home at 3pm this afternoon, the big winner remains Melbourne and the economic benefit the Cup gives it every year.

The RBA

What might jump the gun on today’s race is the RBA meeting. The board is meeting half an hour before the big race and there is certainly an ‘excitement’ around the possibility of a cut. It is, however, not the odds on move

Thing that have changed since the October meeting that might cause an ‘upset’:

· House price momentum is slowing at a faster rate than the month of September, particularly in Sydney. House prices rose 0.2% in October and are expected to slow further in November.

· Clearance rates have also begun to fall away with Sydney and Melbourne seeing rates fall from an average of 70% to 75% on August and September to a low of 60% at the end of October.

· The trade deficit widened further and commodity prices in some instances fell to three-month lows.

· Inflation is hanging on to the RBA’s ‘comfort band’ by its finger nails with the trimmed mean figure of 2.1% year-on-year. The last three quarters have seen the slowest rate of inflation in the past 16 years.

The ‘odds’

· The RBA has moved rates 10 in November the past 25 times the past 25 on Cup day – six of these have come during the tenure of Glenn Stevens.

· The interbank market is pricing in a 40% chance of a cut. Economists are also sitting at this level, with 12 out of 29 expecting a cut. The majority say no move either today or on 1 December.

Ahead of the Australian open

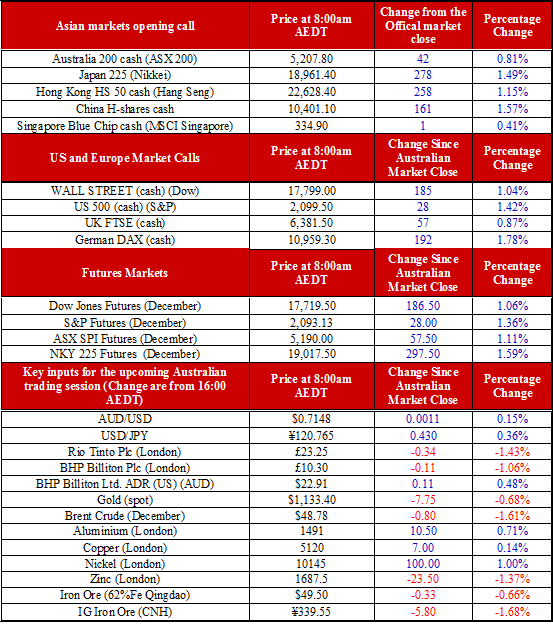

With Victoria on holidays for the Melbourne Cup and Japan on holidays for Culture Day, trade will be soft today. However, the rally in the European and US markets overnight should see the S&P/ASX 200 breaking out on a six-day losing streak.

The savage selling yesterday particularly looked to be overdone and an overreaction to what has a fairly benign bank reporting season. Cost are up, bad and doubtful debts also increases and margins are weakening. If house slows further in 2016, the bank are likely to disappoint further.

Ahead of the open we are calling the ASX up 47 to 5212.