Although many commentators in the finance media have found reasons to write excitedly about the Australian stock market during the last two months I have been unable to do so. Yes some ASX listed shares have risen sharply in price and profits have been there for some investors, but overall it’s been a very dull and boring few months apart from a correction that I wrote about at the end of August.

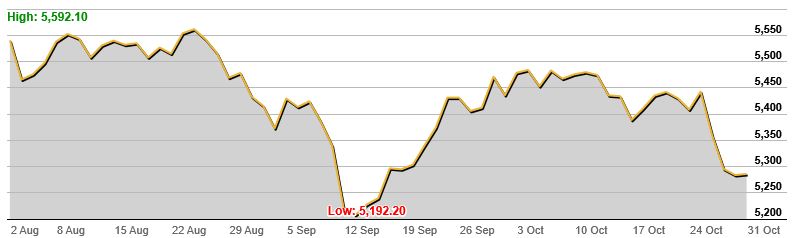

From late August until the middle of September the S&P/ASX 200 slumped from a high of 5592 to a low of 5192. Afterwards there was a bounce back towards 5,500 but that fizzled out in October and at the time of writing the ASX 200 was around 5300. As shown by the chart below, the Australian stock market has also slid backwards during the last three months and the next three months may see the market slide back even further.

S&P/ASX 200 Index 3 Months Chart (October 2016)

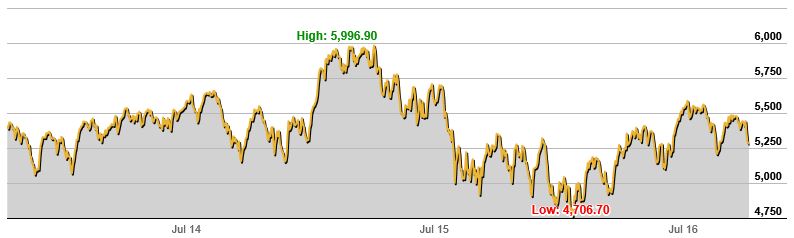

Looking at the longer term it’s clear that the Australian stock market has struggled to post and hold on to major gains. The only rally that genuinely lent itself to bullish media headlines during the last three years was back in early 2015 when the ASX 200 made a serious run towards 6000. However after flirting with 6000 for a few weeks all the gains were given up and then the market fell to a multi-year low of just above 4700.

The ASX 200 and ASX All Ordinaries are both around the same level as they were three years ago. Looking at the 3 year chart of the ASX 200 below we can see that the market has essentially been drifting sideways (yet again) apart from the rally in early 2015.

S&P/ASX 200 Index 3 Year Chart (October 2016)

Currently the ASX 200/ASX All Ords are both trading well below the highs of late 2007 and have never reached those highs again since the global financial crisis. It also seems unlikely that the Australian stock market will move past 6500 next year and so the “ASX Lost Decade” will soon be a reality. Looking forward there’s not a lot to suggest that the market will rally and hold onto significant gains this year although there might be a post U.S election bounce.

As I have mentioned before the financial and resource sector stocks move the ASX 200. Many people may think that it has been the mining stocks that have been dragging the market lower recently, but it’s actually been the banks that have come under selling pressure. Meanwhile many mining & resource related stocks have been slowly edging upwards. We can see this reflected in the share price charts of Westpac Banking Corporation (AX:WBC) and BHP Billiton (AX:BHP).

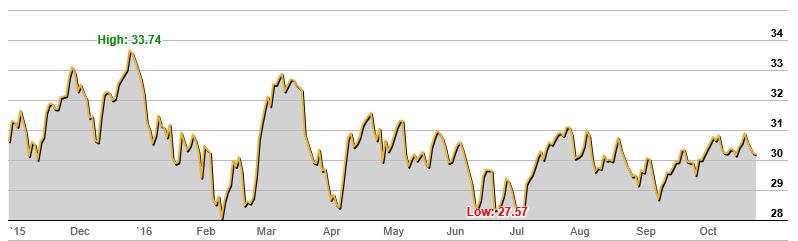

Westpac Banking 1 Year Stock Price Chart (October 2016)

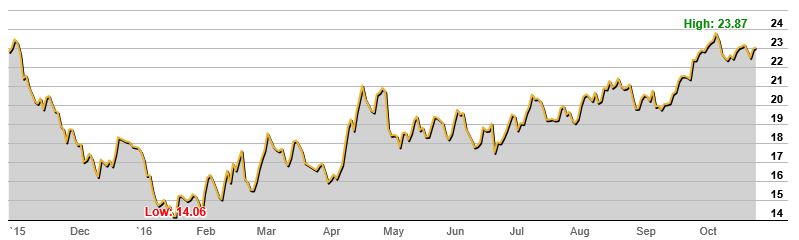

BHP Billiton 1 Year Stock Price Chart (October 2016)

During the last 12 months Westpac (WBC) shares have bounced around within a fairly narrow range with the end result being that the share price is approximately at the same level as it was 12 months ago. Meanwhile BHP has been somewhat of a quiet achiever and whilst much of the reporting about the resources sector and BHP has been negative, its share price has nonetheless rallied strongly after hitting a multiyear low of $14.06 back at the start of 2016.

During the next few months I’m expecting that banks stocks will struggle to remain around current levels and probably fall as the property market in Australia cools. On the other hand the resources sector has probably past the worst of a cyclical low and stocks like BHP may continue to gradually edge upwards. Overall my view of the Australia stock market is that it will continue to struggle for some months to come and perhaps struggle well in 2017. But along the way there should be opportunities to pick-up some blue-chip stocks for those investors who are willing to wait some years for a reasonable return.