- Tesla cuts car prices at the expense of margins

- But, the EV maker's financial condition gives no cause for concern

- The stock is currently recovering after the recent downtrend

Faced with underwhelming sales figures, particularly in the fiercely competitive Chinese market, Tesla's (NASDAQ:TSLA) leadership sprung into action, escalating the price war.

The Elon Musk-led company slashed the prices of the Model X and Model S in the US, along with the Model 3 in China.

While the price cuts led the a margin shrinkage in Q2 earnings, the latest sales data for August indicate that this maneuver is starting to yield results, effectively putting the brakes on the stock price decline that lasted from mid-July to mid-August.

From a fundamental perspective, the company appears to be in a strong position, particularly in terms of core revenue and net income ratios, which remain at relatively high levels.

The upcoming months will be crucial in terms of sales data, and if positive demand momentum continues, we may witness another uptrend in the Tesla stock.

There are also high expectations for the development of Full Self-Driving (FSD) software, which is ultimately expected to achieve fully autonomous driving.

Tesla's Price Cuts Boost Demand

The latest sales figures for August reveal that Tesla sold 84,500 cars in China, marking a 9.3% year-on-year improvement and a significant 30.9% increase over July for the Model 3 and Model Y.

This indicates that the price cuts garnered the expected response and boosted demand.

Throughout the second quarter, the company sold 466,000 vehicles, a substantial increase compared to the same period in 2022, when sales reached 254,700 units.

The reduction in prices is affecting sales margins, which have already fallen to 17.8% in the first half of the year, down from 27.8% in the same period the previous year. This trend is likely to continue over the next six months.

Concerns about margins are further heightened by the fact that the price of the Full Self-Driving (FSD) system has been reduced from $15,000 to $12,000.

Such a significant price reduction raises questions about whether the next version of the system will bring the brand closer to achieving fully autonomous cars.

Given these factors, the upcoming quarterly results will be of utmost importance as they will reveal the impact of the pricing strategy on the company's financials.

Tesla's Strong Fundamentals

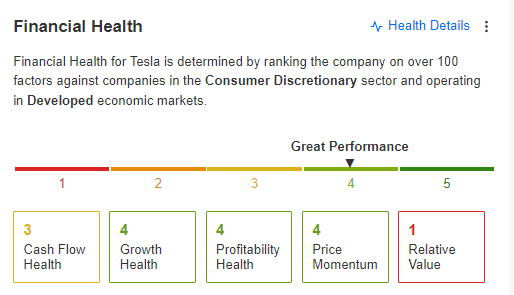

When looking at Tesla's fundamentals, one notable aspect is its stable financial condition, evident in its high overall financial health index score.

Source: InvestingPro

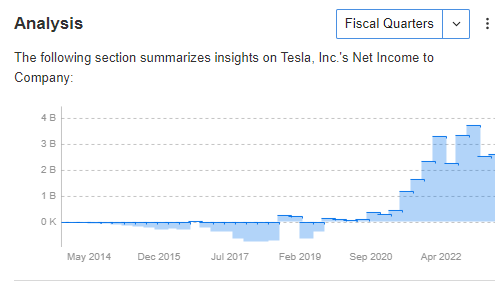

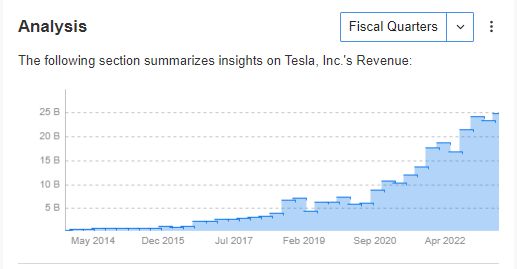

Q2 2023 earnings exceeded expectations, maintaining both revenue and net profits at impressive levels, notably pushing revenue figures to historic highs.

Source: InvestingPro

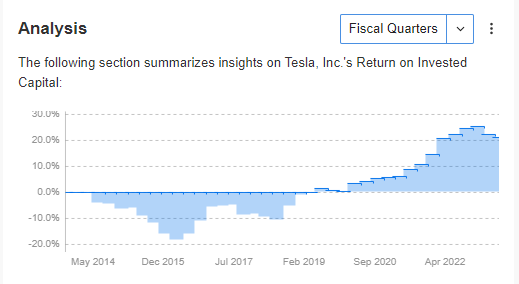

It's also worth highlighting Tesla's return on invested capital, which currently sits at 21%. This figure significantly surpasses the sector's average of 5% for higher-end goods.

Source: InvestingPro

Tesla: Technical View

As there was a noticeable recovery in the latter part of August, Tesla's stock price currently appears to be in a local consolidation phase. A breakout from this consolidation will likely determine the short-term direction of its movements.

If the breakout occurs to the upside, it could pave the way for an attempt to reach this year's peak, which sits just below the psychological barrier of $300 per share.

Alternatively, a similar scenario could result in a retest of a critical support zone ranging from $210 to $220 per share. A robust response in demand within this range could suggest that buyers remain interested if such a retest happens.

It's important to note that the upcoming Federal Reserve meeting, scheduled for September 20, should be taken into consideration when analyzing the EV maker's stock price action.

***

Disclaimer: This article is for information purposes only; it is not intended to encourage the purchase of assets in any way, and does not constitute a solicitation, offer, recommendation, opinion, advice or investment recommendation. We remind you that all assets are considered from different angles and are extremely risky, so that the investment decision and the associated risk are specific to the investor.