- Tesla stock has been surging this week.

- Meanwhile, Alphabet's Waymo has surged ahead in the Robotaxi race.

- Tesla remains under pressure to deliver more innovations amid falling deliveries.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Tesla (NASDAQ:TSLA) stock has defied challenges, climbing over 7% in the last week. This bullish momentum comes despite setbacks in the Robotaxi race and ongoing issues with the Cybertruck.

Source: Investing.com

Meanwhile, in the fiercely competitive realm of autonomous driving, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) has surged ahead of Tesla in the Robotaxi race. Elon Musk's ambitious vision for Robotaxis, set to potentially catapult Tesla's stock beyond its previous $300 peak, faces formidable competition from Waymo, an Alphabet subsidiary specializing in self-driving vehicles.

After 15 years of research and a staggering $8 billion investment, Waymo has boldly launched its Waymo One Robotaxi service to all San Francisco residents as of June 25.

"With tens of thousands of weekly rides, our Waymo One service provides safe, sustainable, and reliable transportation for both residents and visitors to the city," announced the Google-controlled company on X.

Despite lingering safety concerns, Alphabet undeniably leads Tesla in this groundbreaking innovation poised to transform the mobility landscape.

Cybertruck Problems Persist for Tesla

However, Tesla's challenges persist. The Cybertruck, heralded as an "unbreakable" pickup truck inspired by Blade Runner, continues to encounter setbacks.

Initially delayed due to regulatory issues, Tesla faced another setback in April when it recalled 4,000 units to address accelerator pedal issues. More recently, over 11,600 models were recalled for malfunctioning windshield wipers, with an additional 11,300 vehicles flagged for trunk floor installation problems.

Falling Deliveries Pose Future Risks

In the second quarter, Tesla's deliveries fell short of expectations. Analysts at RBC Capital recently projected a 4.3% shortfall compared to the average forecast, marking a 2.5% decline from the previous quarter's figures in the United States.

The drop in deliveries poses a significant challenge for Tesla amidst ongoing issues with the Cybertruck and a competitive Robotaxi market. This setback could compel Tesla to consider further reductions in Model 3 prices to stimulate consumer demand.

Tesla's Fair Value and Target (NYSE:TGT) Price

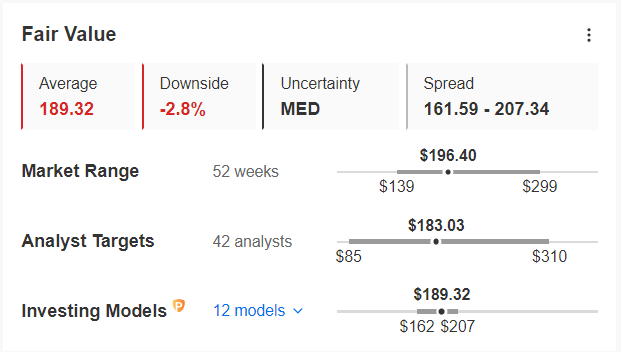

According to InvestingPro, Tesla's current stock price reflects a 2.8% decrease in fair value assessments. Analysts, on the other hand, anticipate a further decline, setting an average target price of $183.03 - 6.8% below the closing price of $196.40 on Wednesday, June 26.

Source: InvestingPro

Market Demands More Innovations

RBC Capital analysts highlight a surge in global demand for electric vehicles, underscoring Tesla's continued leadership despite heightened competition.

However, the company's future success hinges on innovation beyond current offerings like the Cybertruck and Robotaxi. Investors, who have previously shown strong confidence in Tesla, now look to Elon Musk to unveil new groundbreaking initiatives that can restore the company's stature among Wall Street's elite.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.