With the cash rate at 4.35%, and a higher likelihood of it increasing rather than decreasing in the coming months, Australia looks set for another extended period of high term deposit returns.

ING cracked 5.30% p.a. for one year terms this week, but it remains to be seen whether the 5.50% p.a. rate that was briefly on offer at Bank of Sydney earlier in the year will be topped.

After moving last week, Judo drew level with AMP and Bank of Sydney on 5.25% p.a. for one year terms, just 5 basis points behind ING.

Those on the hunt for a longer term deposit can either jump in now to lock in these rates or hold fire a little longer to see if rates go up any further.

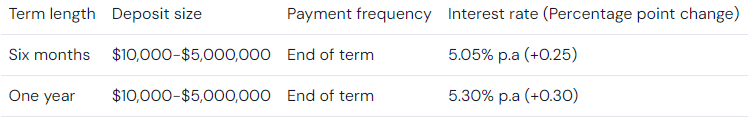

This week's headliner was ING. It took one year terms to a market leading 5.30% p.a.

That means investing the minimum $10,000 would yield $530 by this time next year.

Some readers will note CPI inflation for the September quarter was 5.40% and, thus, might be apprehensive about getting into a term deposit with a rate lower than inflation.

However, the RBA is projecting inflation will moderate to about 3.50% by the end of 2024, so investors are still likely to come out ahead.

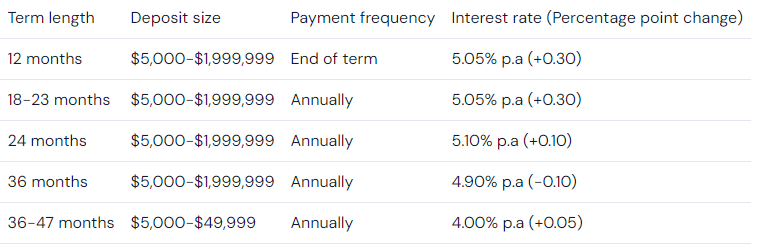

After Westpac moved last week, taking the rate on its special offer term deposit (12-23 months), CommBank returned serve, with 30 basis point increases.

A 5.05% p.a. return on one year terms and 5.10% p.a. for two are both now the highest on offer at any of the big four banks.

These rates are available from today (17 November) for a limited time only, available on term deposits opened or renewed by existing CommBank personal or Self-Managed Super Fund (SMSF) customers.

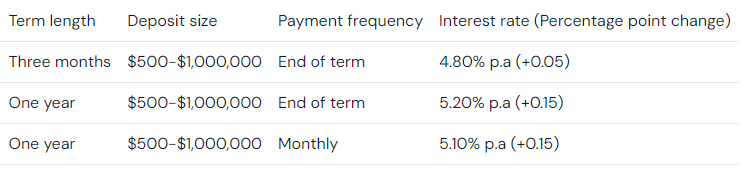

After this week's increase, Bank Australia's one year term deposit is 5 basis points behind Judo, AMP, and Bank of Sydney, and 10 basis points behind the market leader, ING.

One advantage offered by Bank Australia is a comparatively low minimum deposit of just $500; Judo and Bank of Sydney both have a $1,000 minimum while, at AMP, deposits start at $5,000.

A $500 deposit at 5.20% p.a. would net a grand total of $26 at the end of the term, though, so it's probably worth saving up for a bigger deposit anyway.

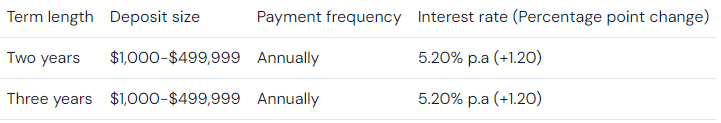

The most dramatic movement this week came from The Mutual, with 120 basis point increases to its two and three year term deposit products.

Slightly discounted rates are available for more frequent interest payments.

Other movers

- Bankwest increased rates up to 85 bps, including a nine month term at 5.00% p.a.

- Australian Mutual Bank increased rates by up to 20 bps

- Rabobank increased rates by up to 25 bps

"Term deposit rate changes, 13-17 November" was originally published on Savings.com.au and was republished with permission.