Financial technology (fintech) stocks have been hot in recent years. And the explosion of e-commerce in 2020 has put companies that facilitate digital transactions firmly in the limelight.

Within the financial technology innovation space, investors initially think of US-based heavyweights like PayPal (NASDAQ:PYPL), Square (NYSE:SQ), Visa (NYSE:V), Mastercard (NYSE:MA) and Fiserv (NASDAQ:FISV). Recent newcomers like Bill Com (NYSE:BILL) also get significant market attention.

The trend toward cashless and contactless payments is not limited to the US, however, as the volume of online shopping and digital payments as well as the number of fintech-related companies are increasing globally. Potentially high-growth technology firms aiming to ride the wave of digitalization are expanding into new markets across the globe.

Today, we introduce the UK-based small-cap stock PayPoint (LON:PAYP). It is a member of the FTSE All-Share Index, which currently has 631 constituents.

Evolving Operations

PayPoint’s operations go back to 1996. Residents or visitors to the UK are likely to have noticed the company’s yellow logo or possibly used its services at local convenience stores or supermarkets like Tesco (LON:TSCO) (OTC:TSCDY) and Sainsbury (LON:SBRY) (OTC:JSAIY).

In the early days, PayPoint’s focus was more on cash payments, money transfer, offering ATMs in convenience stores, and bill payments (mainly for utilities).

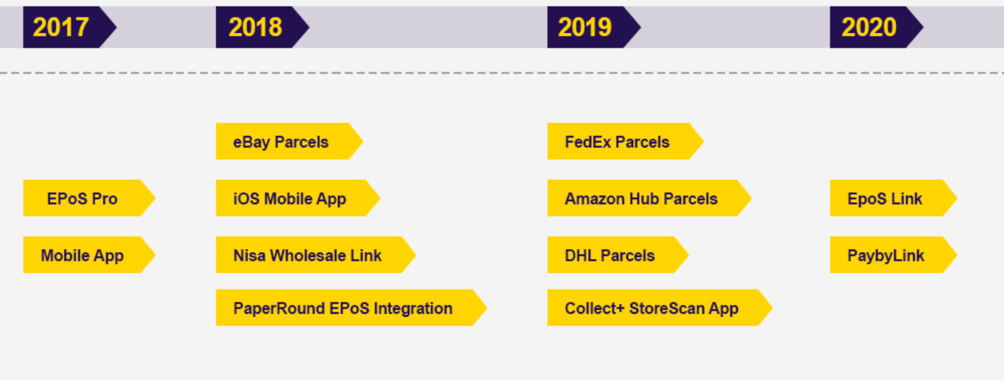

Over the past several years, however, the company’s operations have evolved to offer omni-channel payment solutions. It has also been working to take advantage of the growth in e-commerce and the related increase in parcel delivery.

Its payment terminals are located in more than 40,000 small retailers. The focus on the independent retail sector now means that in the UK,

“99.5% of the urban population live within one mile of a PayPoint retailer partner and 98.3% of the rural population live within five miles."

The services include card payments, EPoS (Electronic Point of Sale), phone sim card top-ups, cash bill payments for individual customers as well as stock management and sales reporting for businesses.

The group also owns the Collect+ parcel drop-off service, available at about 10,000 locations in the UK. In 2020, Collect+ has handled close to 25 million parcels in a country with a population of over 67 million people.

In 2020, the company also worked with numerous local authorities on various governmental programs, like school meal vouchers and COVID-19 related hardship funds.

PayPoint’s Recent Performance

PayPoint shares started trading in April 2003, shy of 200p. In January 2020, they were well over 1,000p.

Yet, 2020 proved a challenging year for the stock as it is down about 35% over the past 52 weeks and the current share price stands at 655p. Passive income seekers might be interested to know that the dividend yield is over 5%.

In recent months PayPoint has come under regulatory scrutiny by the Office of Gas and Electricity Markets (Ofgem) in the UK.

Ofgem highlights:

“PayPoint held a dominant position in the market for over-the-counter payment services for prepayment energy customers for at least the period running from April 2009 to October 2018.”

Ofgem’s allegation that the company breached competition law has put pressure on PayPoint shares.

On Jan. 21, PayPoint released a quarterly trading update for the period that ended Dec. 31. Recent results from the company show a shift, with increasing revenues from online services and parcel transactions and decreased revenues from ATM transactions and bill payments.

In the trading update, management highlighted:

“PayPoint is well placed to take advantage of the continued shift from cash to digital payments, the growing demand for online shopping fulfilment and the increase in shopping local…. Strong card payment volumes [were] maintained, growing significantly by 46.2% year on year to 49.7 million transactions. UK parcels transactions increased by 6.6%, delivering a resilient performance despite COVID-19 restrictions.”

Bottom Line

Digitalization trends are likely to benefit from increased tailwinds in the coming quarters. Therefore, PAYP shares could be attractive to investors interested in exposure to this trend in the UK.

Compared with US based competitors, the company has not offered very high share price growth. However, it does offer a consistent dividend that may interest some investors.

PAYP stock’s forward P/E and P/S ratios stand at 13.51 and 2.17, respectively. Any potential drop of 5%-7% in price would improve the margin of safety. Meanwhile, given its outreach to small retailers as well as consumers, the group could potentially find itself as an acquisition target.

Those investors who are not ready to commit capital to PayPoint but are interested in the sector could instead consider an exchange-traded fund (ETF). Examples include ARK Fintech Innovation ETF (NYSE:ARKF), the Global X FinTech ETF (NASDAQ:FINX) and the Ecofin Digital Payments Infrastructure Fund (NYSE:TPAY). Over the past year, these three funds are up 115.4%, 45.5%%, and 30.1%, respectively.

Several of the names held by these funds are Adyen (OTC:ADYEY), Afterpay (OTC:AFTPY), Discover Financial Services (NYSE:DFS), Fiserv, Bill.com, Mastercard, PayPal, Square, Tencent Holdings (OTC:TCEHY), Visa and Worldline (PA:WLN).