Forex markets were filled with hope for MOAR from Jackson Hole on Monday night. DXY was smashed and EUR surged:

The Australian dollar launched:

And the usual action followed a weak DXY. Commodities and EMs to the moon:

Even big miners managed a tiny big cat bounce though iron ore kept falling:

The US curve still flattened:

Stocks went nuts led by growth:

Westpac has the data:

US flash August PMIs (Markit) were slightly below estimates but remained expansionary.

Manufacturing slipped to 61.2 (est. 62.3, prior 63.4), services fell to 55.2 (est. 59.2, prior 59.9), and the composite measure fell to 55.4 (prior 59.9). The service sector once again noted difficulty in finding suitable staff.Existing home sales surprised on the upside with high median prices, even though inventory rose. Sales rose to 5.99m (est.5.83m), with median prices +17.8%y/y to USD359,900.

Eurozone flash August PMIs were slightly below estimates but remained expansionary (“close to a 15-yr high”) with the slight miss attributed to ongoing supply constraints.

Manufacturing slipped to 61.5 (prior 62.8, est. 62), services 59.7 (prior 59.8, est. 59.5), and composite 59.5 (est. 59.6, prior 60.2).UK PMIs were more nuanced, with manufacturing holding firm, but a slip in services attributed to staff shortages. Manufacturing was solid at 60.1 (est. 59.5, prior 60.4), services fell to 55.5 (prior 59.6, est. 59.1), and composite fell to 55.3 (prior 59.2, est. 58.7).

Event Outlook

New Zealand: Westpac expects the Q2 real retail sales report to show that spending continued to rise at a robust pace through the quarter, with volumes up 2%. Additionally, prices are expected to take a sizeable step higher on supply disruptions and strong demand.

US: The market expects July new home sales to rise following three consecutive declines, with financial conditions and labour market gains tailwinds for demand (market f/c: 699k). Further, the August Richmond Fed index will offer insight into delta’s varied impact across the nation.

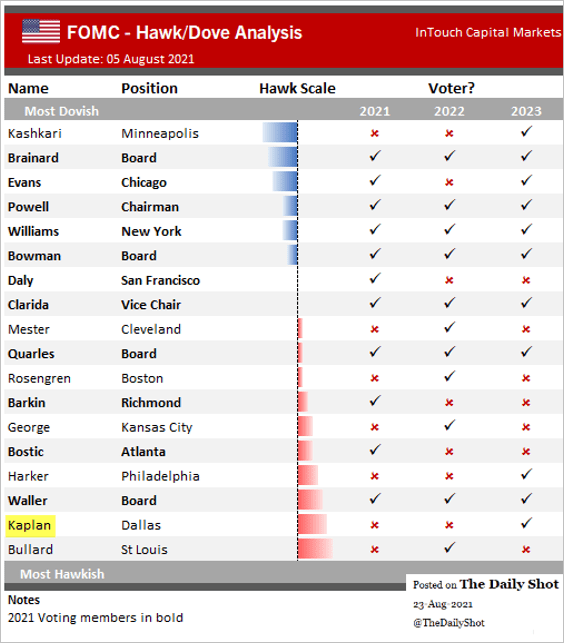

The big news was the Fed:

Dallas Federal Reserve President Rob Kaplan said he may rethink his call for the Fed to quickly start to taper its $120 billion per month in bond purchases if it looks like the spread of the coronavirus delta variant is slowing economic growth.

The chart:

As I have said repeatedly, the problem is not Delta. It is fading stimulus and liquidity that is disrupting markets. Delta is actually the number one hope to reverse a correction given it will bring MOAR.

That said, I expect the Fed to have an each-way bet at Jackson Hole and for US data to keep fading throughout H2 so taper may well be cooked.

That will mean a relief rally for AUD.

But I can’t see it getting far with China still slowing and iron ore headed to $100 and below with a bullet, COVID apartheid sitting on any Aussie recovery and the RBA set to resume asset purchases.

Still lower ahead.