Exxon Mobil (NYSE:XOM), along with other fossil fuel producers, faces three major headwinds.

- The commodity cycle, specifically the relationship to inflation and interest rates which adds uncertainty. A range of commodities, including oil, rose substantially during early 2021 in anticipation of surging inflation, but subsequently declined as market concerns about inflation have abated.

- Uncertainty as to the rate of the economic recovery from COVID, especially as the Delta variant has spread.

- Increasing concern about climate change among individual investors and, more significantly, institutional investors. The huge question is how XOM can thrive in a carbon-constrained world?

After closing at a YTD high of $64.66 on June 25, at the time of writing XOM had fallen 14.1% to reach $55.55 giving a YTD total return of 41.6%. At publication the shares were trading at $54.52. The rise and fall have been generally coincident with the commodity markets.

Source: Investing.com

The TTM earnings for XOM are negative, but the forward P/E is 13.66. The dividend yield is 6.3%. The company reduced its total debt by $7 billion since the end of 2020. The company has reported solid earnings in the past two quarters, adding confidence in the expectation of a return to more normal conditions. As the economy recovers and demand for energy and chemical products increases, XOM looks quite inexpensive.

To formulate a view on XOM, I rely on two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus rating and price target. The second is the market-implied outlook, a probabilistic projection of returns for a stock that is derived from options prices. The price of an option reflects the market’s consensus estimate for the probability that the price of the underlying stock will rise above (call option) or fall below (put option) a specific level between today and the option expiration date.

By analyzing puts and calls at a range of strikes and a common expiration date, it is possible to calculate the statistical outlook for returns that reconciles the options prices. The market-implied outlook is, in effect, the market’s consensus estimate of the probabilities of price returns. For those who are not familiar with this concept, I have written an overview post that includes examples and links to the relevant financial literature.

Wall Street Consensus Outlook for XOM

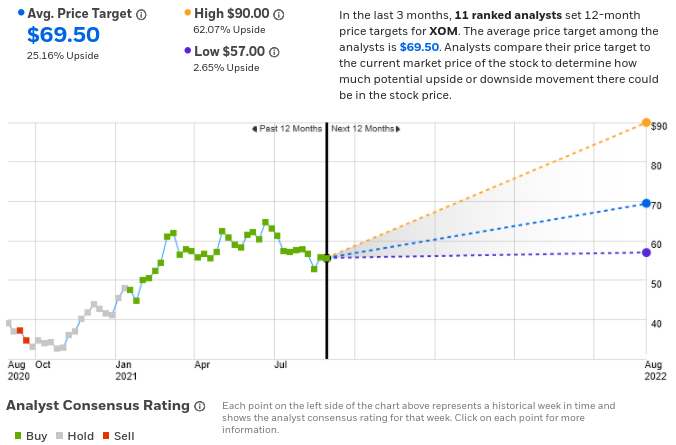

eTrade’s version of the Wall Street consensus outlook combines the views of 11 ranked analysts who have published opinions over the past 90 days. Of the 11 analysts, 5 give XOM a buy rating, 6 are holds, and 0 are sells. The aggregate rating is bullish and the consensus 12-month price target is $69.50, 25.16% above the current price.

Even the lowest analyst price target implies a price return of 2.65%. The consensus 12-month price target is significantly higher and implies a substantially higher annual price appreciation than when I wrote about XOM at the end of January. Back then, the 12-month consensus price target was $51.88, 12.6% above the share price at that time.

Source: eTrade

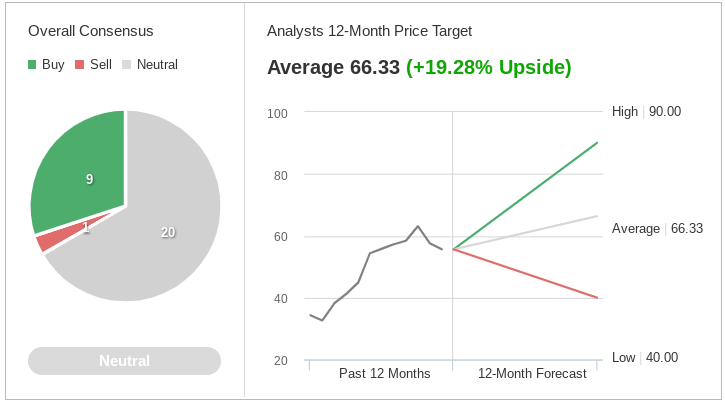

Investing.com’s calculation of the Wall Street consensus is calculated from the ratings and price targets of 30 analysts. The majority of the analysts are neutral, but the number of bullish ratings pushes the consensus rating to be a buy. The consensus 12-month price target is $66.33, 19.3% above the current price.

Source: Investing.com

With consensus price targets of 25% and 19%, along with a dividend yield of 6.2%, the prevailing outlook from Wall Street equity analysts is that XOM is going to have a very strong upcoming year.

Market-Implied Outlook for XOM

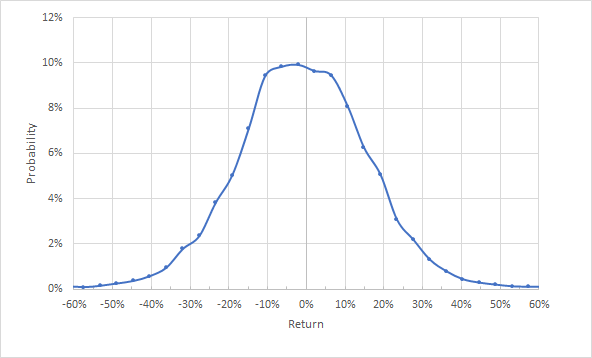

I have analyzed options expiring on Jan. 21, 2022 to build a market-implied outlook for the next 4.7 months. I have also calculated a 7.4-month outlook using options expiring on Apr. 14, 2022. I selected these two expiration dates to provide a view through the end of 2021 and into early-to-mid 2022. These options also had significant trading volume, increasing confidence in the outlooks.

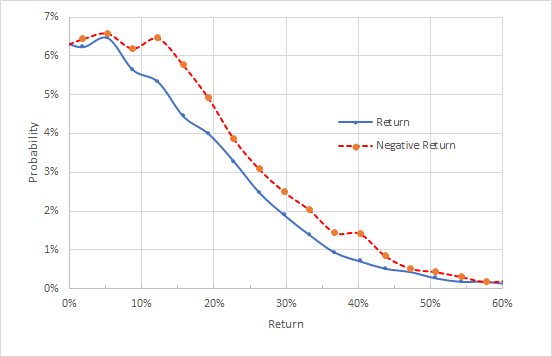

The standard presentation of the market-implied outlook is in the form of a probability distribution of return, with probability on the vertical axis and price return on the horizontal axis. Market-implied price return probabilities for XOM for the 4.7-month period from today until Jan. 21, 2022

Source: author’s calculations using options quotes from eTrade

The market-implied outlook is generally symmetric. There is no well-defined peak in probability, but the maximum probability corresponds to a price return of -2.13% over the next 4.7 months. The annualized volatility derived from this distribution is 30.5%. To make it easier to directly compare the probabilities of positive and negative returns, I look at a version of the market-implied outlook with the negative return side of the distribution rotated about the vertical axis (see below).

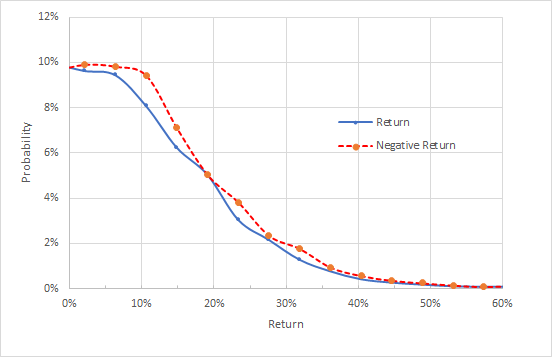

Source: author’s calculations using options quotes from eTrade. The negative side of the distribution has been rotated about the vertical axis

The probabilities of negative returns are slightly elevated relative to the probabilities of positive returns of the same magnitude (the red dashed line is above the solid blue line). Dividend-paying stocks tend to have reduced upside probability relative to downside because some portion of earnings is returned to shareholders. In addition, risk-averse shareholders tend to bid up the prices of put options to hedge their downside risk. In considering both of these factors, this market-implied outlook is neutral to slightly bullish.

Compared to my last analysis of XOM at the end of January of 2021, the current market-implied outlook is significantly more bullish. At that time, I calculated the 4.7-month market-implied outlook using options expiring on June 19, 2021. The probabilities of negative returns were markedly higher than for positive returns of the same magnitude (the red dashed curve was substantially above the blue curve) and the annualized volatility was 40%. At that time, I interpreted the market-implied outlook to be bearish.

Looking out further in time, I have also calculated the 7.4-month market-implied outlook for XOM. derived using options that expire on April 14, 2022. The market-implied outlook is slightly more bearish, with higher probabilities of negative returns, as compared to positive returns of the same magnitude. I interpret this market-implied outlook as slightly bearish. The annualized volatility derived from this distribution is 30.7%.

Source: author’s calculations using options quotes from eTrade. Negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlook for XOM is neutral to slightly bullish between now and early 2022, becoming neutral to slightly bearish looking out 7-8 months. The near-term outlook is considerably improved from when I last analyzed XOM at the end of January and the expected volatility is considerably lower.

Summary

XOM has a YTD total return above 40%, even after a 14% decline since late June. The consensus outlook for earnings implies a forward P/E of 13.7 and the dividend yield is 6.2%.

Earnings appear to be on track for a robust recovery from the COVID-driven economic downturn. The consensus outlook from Wall Street implies 12-month price returns of around 20% and the consensus rating is bullish, although many analysts have a neutral / hold view. The analyst consensus price target is considerably more bullish than when I analyzed XOM at the end of January. The market-implied outlook to mid-January is neutral to slightly bullish, a substantial improvement from my last analysis.

The expected annualized volatility calculated from the market-implied outlook is about 31%, considerably lower than the value at the end of January. With a consensus 12-month outlook for total return of 25% or more, expected volatility at around 31%, and a slight bullish tilt in the market-implied outlook to early 2022, I am changing my view on XOM from neutral to bullish.

Given the longer-term uncertainties, I plan to revisit this analysis in early 2022.