A busy week lies ahead, with tons of data and much Fed speak. This will make for plenty of headlines and possibly a volatile week as the focus shifts back to the economy.

Powell will continue his West Coast tour with a visit to Stanford on Wednesday, where he will talk about the economic outlook and conduct a Q&A session. Of course, we will also be getting economic data this week, like the ISM manufacturing report on Monday, the JOLTS report on Tuesday, the ADP and ISM services report on Wednesday, and the Job report on Report.

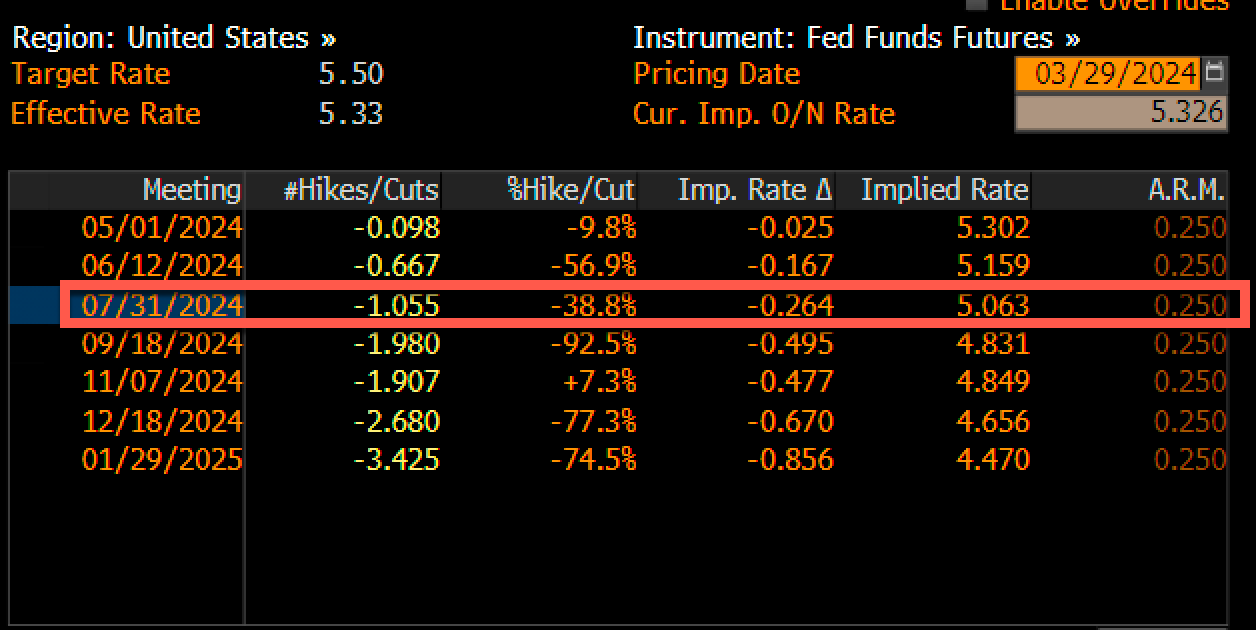

So, robust economic data coupled with what I would imagine is pretty hawkish Fed speak should continue to trim the outlook for rate cuts in 2024. The first full rate cut is now expected in July, and the calendar setup of the FOMC meeting, more than three rate cuts, is probably all but ruled out at this point because I can’t imagine the Fed cutting in September in front of the election, barring some unforeseen event.

(BLOOMBERG)

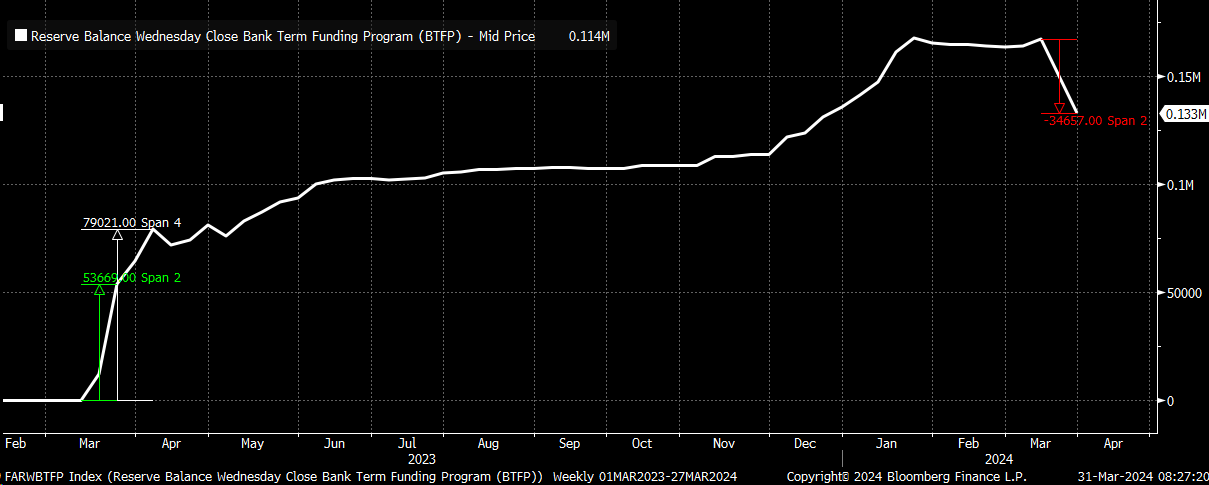

Meanwhile, this week, we saw the Fed’s Bank Term Funding Program facility drop to $133 billion from $152 billion. Through the first two weeks of the drain, about $34.7 billion has left the facility, while in the first two weeks of the program last year, $53.6 billion entered the program, and through the first four weeks, $80 billion entered. So we aren’t tracking 1-for-1 on the way out, but still the drain is underway.

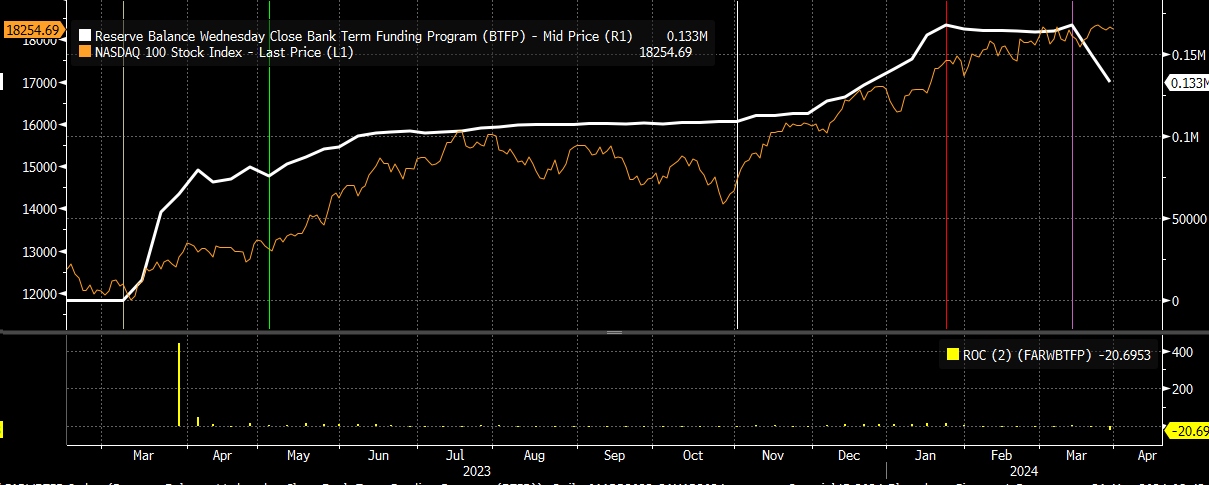

Is it by chance that every significant pivot point in the NASDAQ 100 and the BTFP seemed to line up nicely? I don’t know. But the BTFP topped out last January, and the Nasdaq topped out, calling it in mid-February.

So, let’s say that the BTFP program is running two weeks ahead of the NASDAQ 100, and the BTFP started draining on March 13. Then, if this is right, the NASDAQ 100 should start giving back its gains over the next week; if this is right, of course.

(BLOOMBERG)

Indeed, changes in reserve balance seem to match up reasonably nicely to all of this, going back to the closing low set in December 2023 in the NDX. Reserves change daily, and now that we are past quarter end, they may rise slightly over the next week.

Still, I think, more generally speaking, with the draining of the BTFP and QT, we have likely seen peak reserves, which is why the Fed wants to change the pace of QT at this point because they know that reserves less BTFP puts real reserves somewhere close to $3.36 trillion and not $3.496 trillion, and with QT running at $95 billion per month, we are only about 3 to 4 months away, assuming all else is equal, to hitting the lower bound of what I think the Fed would consider being ample reserves around $3 trillion.

(BLOOMBERG)

So, the ascending broaden wedge pattern we have been tracking certainly makes sense from the standpoint that if this is the case, the liquidity flow is shifting. It could even mean we are likely to see the lower bound of that pattern be tested in the too-distanced future at 17,850.