This week will be relatively quiet in terms of economic data. The main events are Treasury auctions for 2-year, 5-year, and 7-year notes, scheduled around 1 PM Tuesday, Wednesday, and Thursday.

Investors will be watching closely to see if fresh data backs up Fed Chair Jerome Powell's claim of a resilient U.S. economy. Thursday's second-quarter GDP report will serve as a key test of that.

While inflation has cooled, Powell remains cautious to declare victory just yet. Friday’s release of the Personal Consumption Expenditures (PCE) index, the Fed’s favored inflation gauge, will shed more light on inflation’s trajectory.

Week Ahead to Show Market's True Reaction to Rate Cut

Other than a few Fed speakers and limited economic releases, the market will likely reveal its true reaction to the Fed’s recent rate decision.

These days, it’s harder to get a clear sense of market direction in the immediate aftermath of a Fed decision, mainly because there’s so much noise around implied volatility and bond market positioning.

Unfortunately, that initial knee-jerk reaction takes a few days to settle.

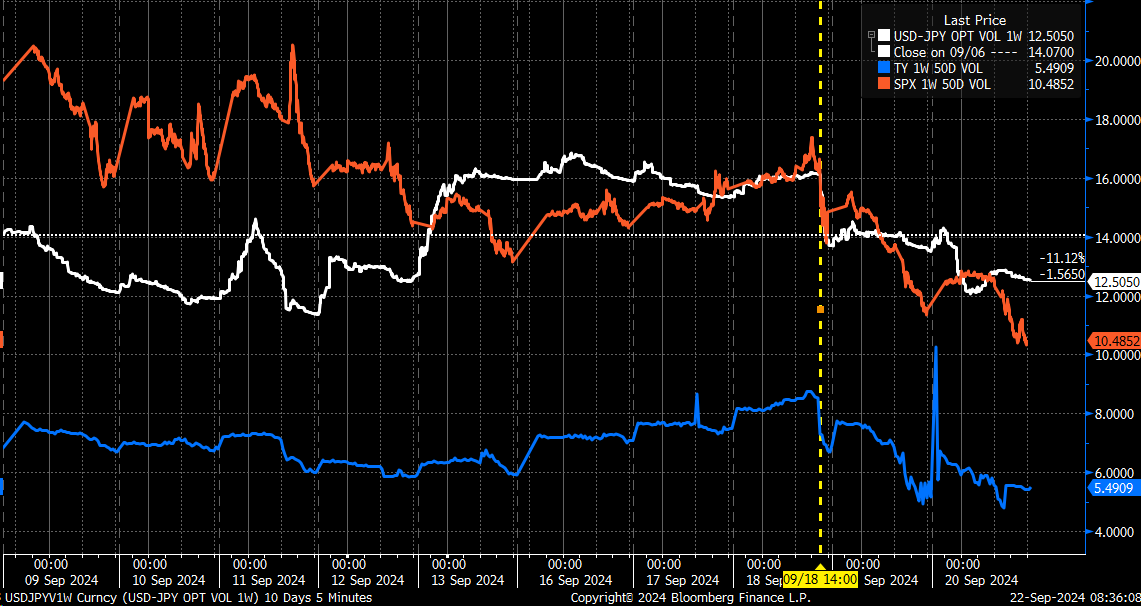

Implied volatility affects everything, and a similar pattern plays out across different assets. The chart below shows implied volatility in 2-year Treasury Futures, USD/JPY, and the S&P 500.

Everything dropped at 2 PM ET following the Fed announcement, but it wasn’t until the end of the day on Friday that the market fully absorbed the news, mainly because the BOJ meeting also carried significant weight.

Implied volatility resets and market bets on both sides have made the unwinding process confusing. However, I believe that the noise will clear up this week.

S&P 500 at Risk of Giving Back Post-Fed Gains

Last Friday’s options expiration, with the big gamma level at 5,700, was too strong for the equity market to trade freely.

This explains why the S&P 500 hovered around 5,700 during the last two trading days. It formed a diamond pattern, on top of the “hole-in-the-wall” gap that opened Thursday morning.

This suggests we may fill that gap early this week, potentially seeing the index give back the post-Fed meeting gains and drop back toward 5,615.

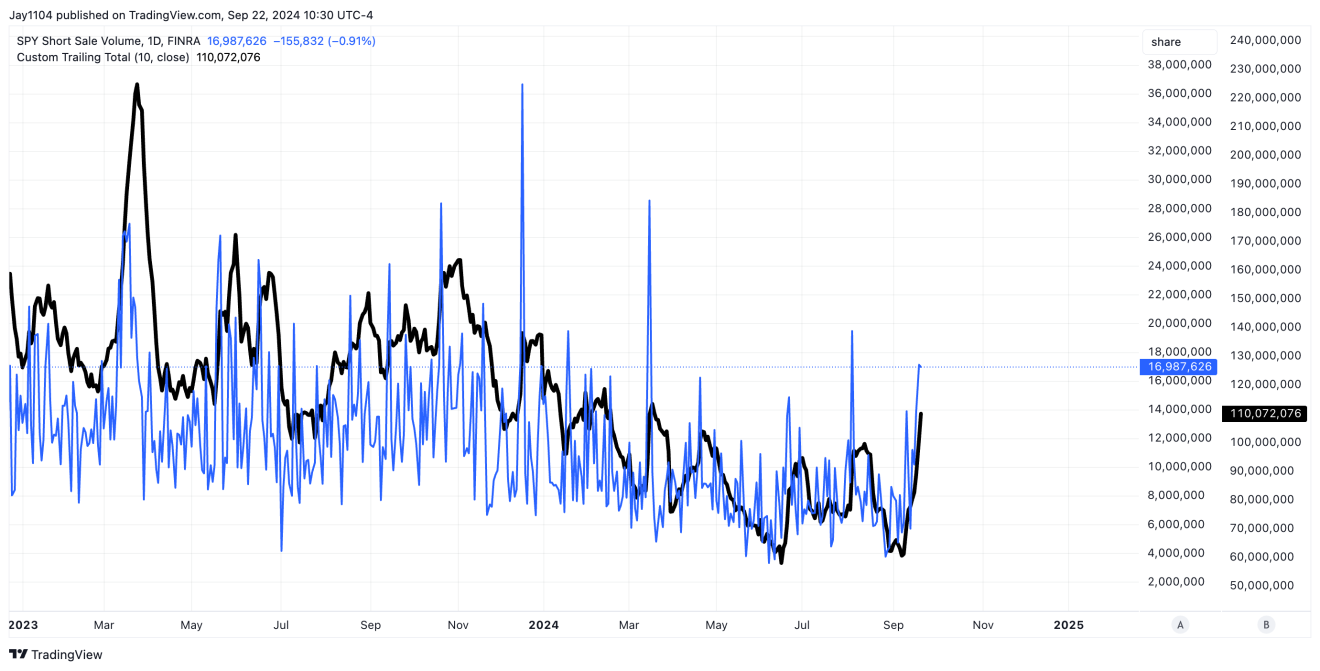

Short sale volume in the SPY ETF was also unusually high on both Thursday and Friday and on a rolling 10-day basis, it has reached its highest level since mid-March.

An interesting observation is that increasing short-sale volumes on a rolling 10-day basis can sometimes precede market downturns.

This trend becomes particularly evident when inverted and compared with the price action of the S&P 500. Last Thursday and Friday, short sellers appeared to be aggressively establishing new positions

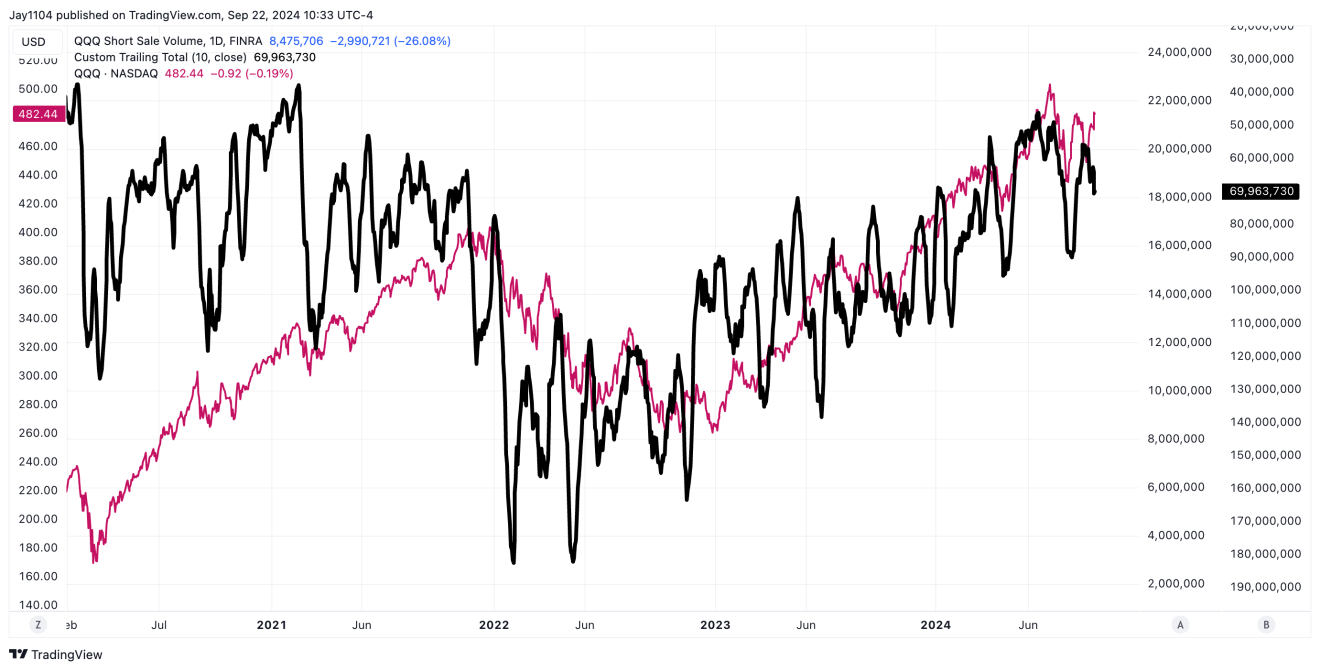

The same case can also be made for the QQQ ETF, which has seen short-sale volume pick up.

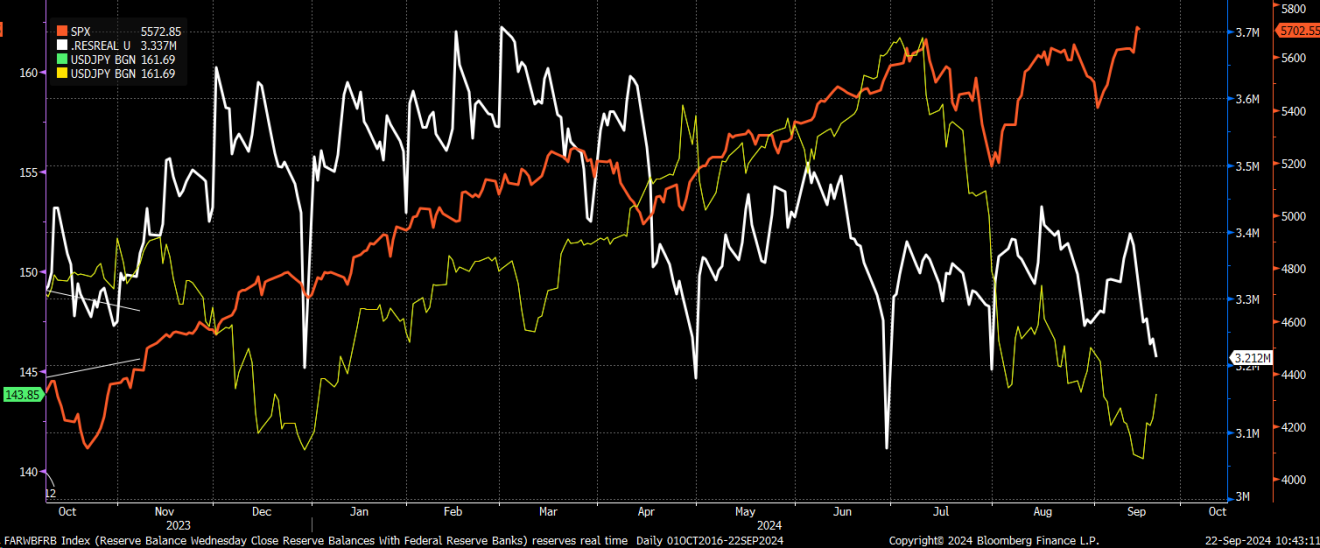

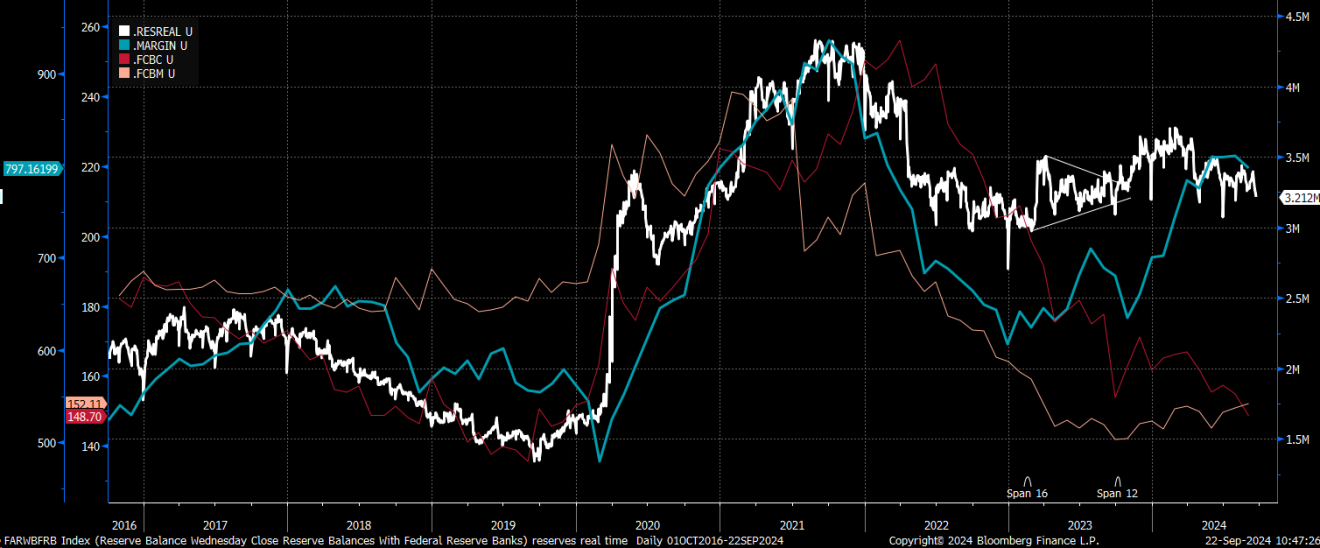

This coincides with a sharp drop in reserve balances last week. More recently, it seems that the S&P 500 is trading with a few days lag relative to changes in reserves.

The steep drop in reserves wasn’t felt as strongly in June, likely given the offset in additional funding from the yen carry trade. But given the carnage in the Yen carry trade, those funding effects will likely be significantly diminished.

If the Yen carry trade effects have been neutralized, and the S&P 500 is trading with a lag to reserves, we should feel those effects this week. If those effects are not felt, perhaps reserve balances do not matter anymore. However, I sense that they still do.

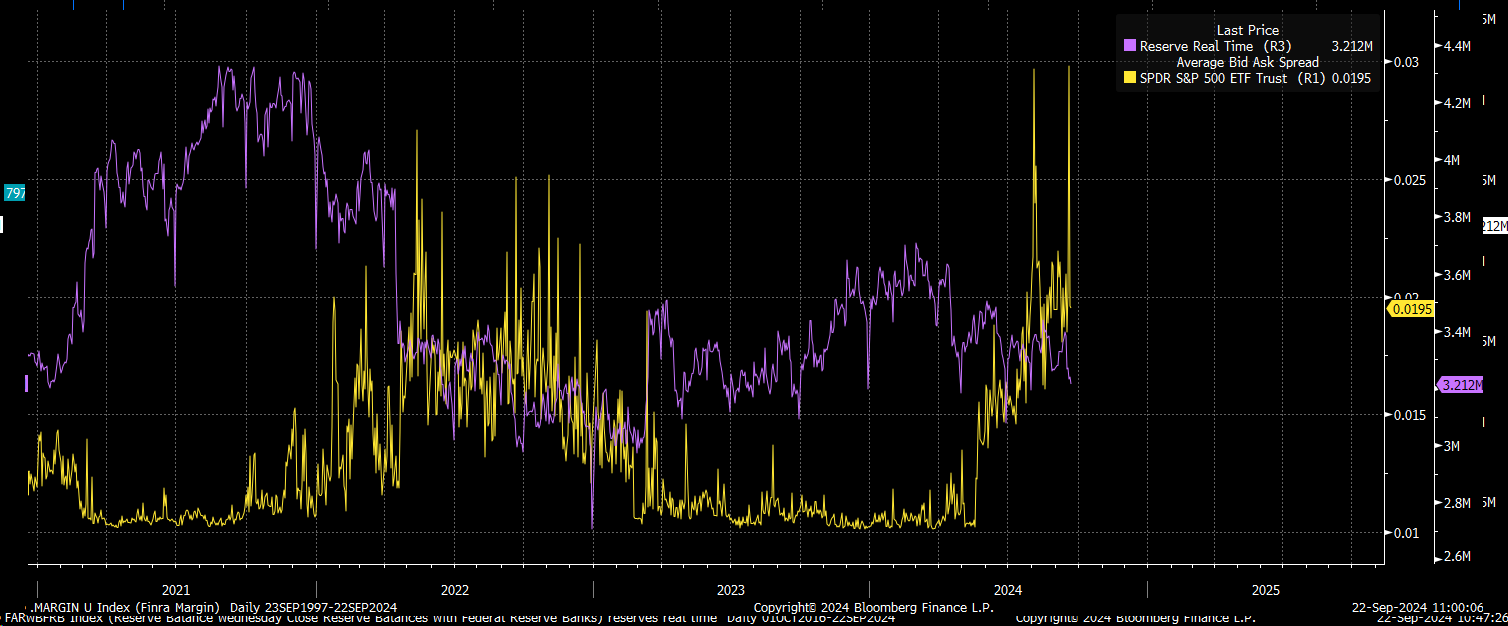

I think it still matters because we have seen margin balances continue to change with reserves over time.

Reserves fell further by the end of August, and margin balances declined in August. Additionally, data from FINRA shows that free credit balances in cash accounts have dropped to very low levels—the lowest since December 2019.

Remember, the market turned higher in the fall of 2019 because the Fed started “NOT QE,” which still led to expanding the balance sheet and reserves.

Also, changes in reserve balances appear to have some effect on bid-ask spreads, as seen with falling reserve balances and widening bid-ask spreads in the SPY ETF. It’s not the largest sample size, but it’s worth continuing to track.

We will see what the week brings, but this week may be a little more challenging than most expect.