The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events.

Here are some quick thoughts about what we at RIA Advisors think about the stock and bond markets in 2025.

Stock Markets

Upside Potential: During the Trump presidency, he will focus on ensuring the Tax Cut and Jobs Act, passed in 2017, does not sunset in 2025, which will keep corporate tax rates at 21%. However, it is not unlikely that he will also push for a new corporate tax cut bill at a lower rate, nearer 15%, which was his original goal during his first term.

While maintaining the corporate tax rate at 21% will help corporations maintain current profitability, a lower rate would benefit certain sectors like consumer discretionary and technology, where earnings are especially sensitive to tax changes. Financial stocks could also benefit from Trump’s history of deregulation, potentially leading to more mergers and investment opportunities. In fact, during his first term, the S&P 500 rose nearly 70%, partly due to those pro-business policies.

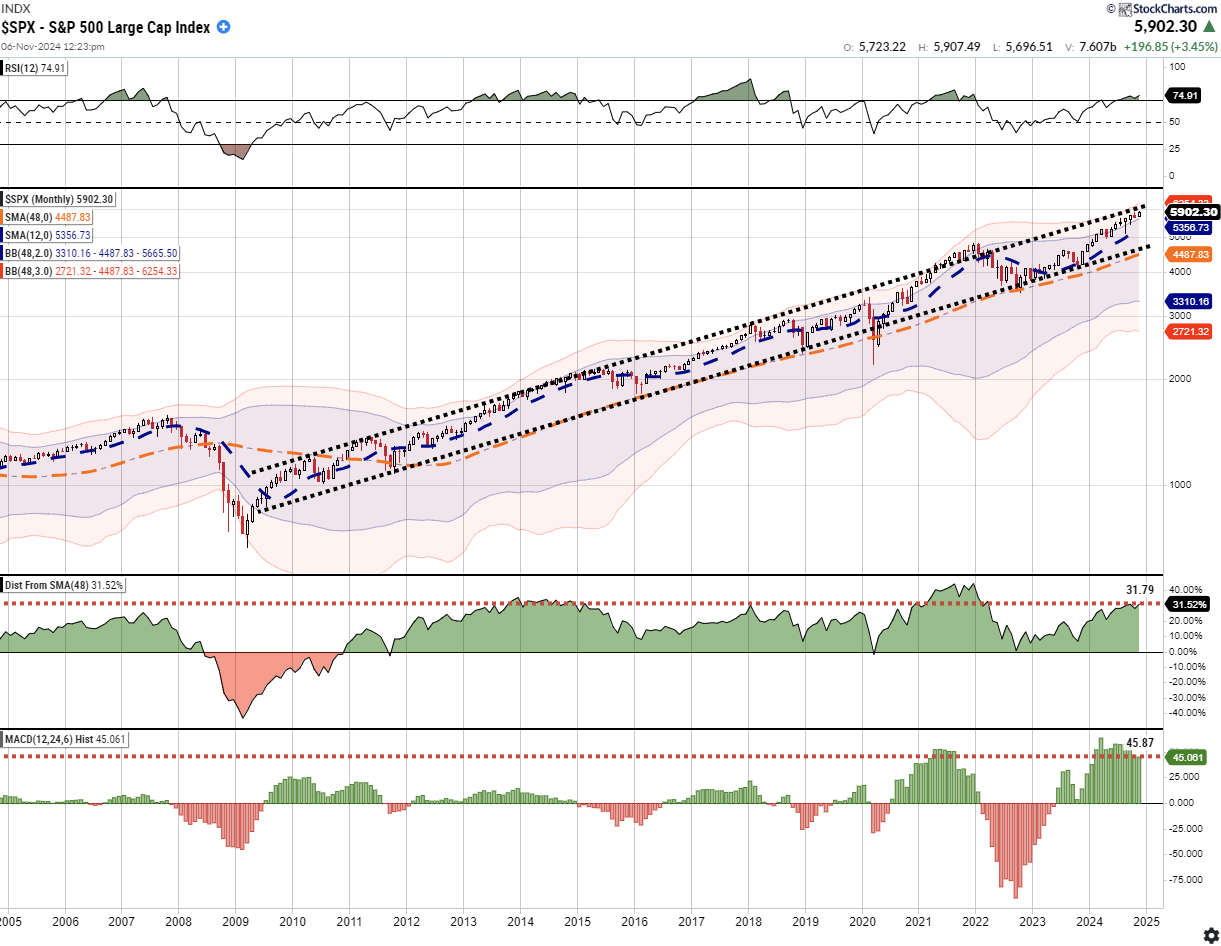

Technically, the market remains on solid bullish underpinnings with very high levels of expected earnings growth heading into 2025. The bullish trend remains intact, and as discussed, the seasonally strong period of the year has started. Notably, corporate share buybacks and year-end performance chasing will support the last two months of the year.

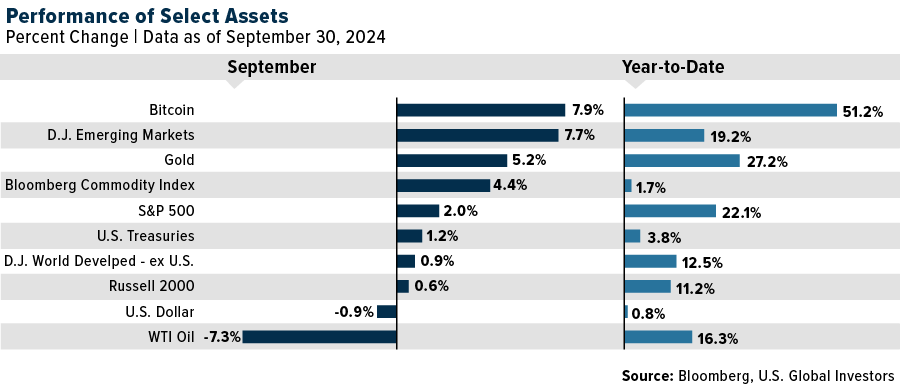

“According to Morningstar, during the first half of 2024, only18.2% of actively managed mutual and exchange-traded funds outperformed the cap-weighted S&P 500 index. There are several reasons for this, including the lack of allocation to the ‘Magnificent 7,’ dispersion in returns of holdings, and lack of allocation to non-traditional assets.

However, there are risks.

It’s Not All Roses

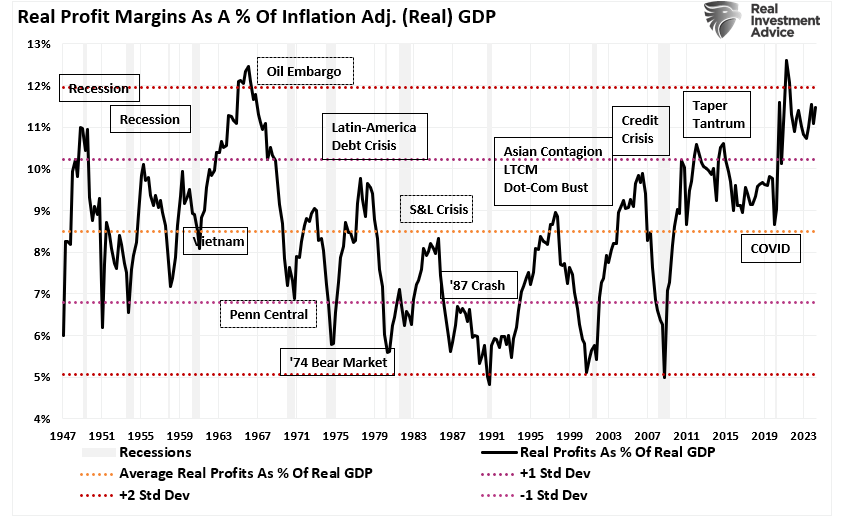

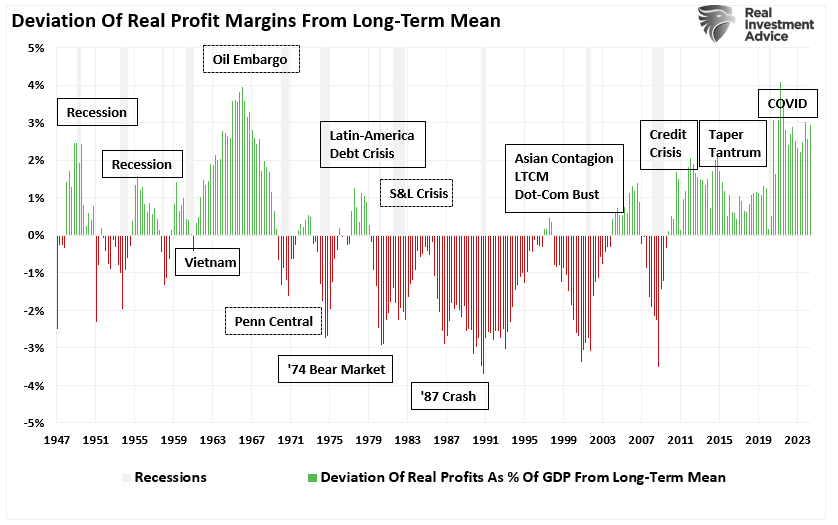

Downside Risks: It’s not all rosy. A Trump presidency also brings risk from protectionist trade policies, including higher tariffs on Chinese goods. Those tariffs can potentially disrupt supply chains and increase costs for consumers and companies. Furthermore, if there are deep cuts to Government employment or spending, such would also slow economic growth more than expected and could offset the benefit of the extension of tax cuts. However, while those risks are present, the most significant risk is a reversion of economic growth, negatively impacting corporate profitability. The risk of investor disappointment is elevated with corporate profits already significantly deviated from long-term means.

Bottom Line: Stocks might see an initial jump on business-friendly promises but could face challenges if tariffs or unpredictable governance introduce economic shocks that suppress corporate profitability.

Bond Markets

Reasons for Caution: The bond market sold off sharply following the announcement of a Trump presidency. Such was not unsurprising, as bonds typically react negatively to narratives that might lead to higher inflation and rising interest rates. The initial knee-jerk reaction in the bond market was the assumption that the administration would emphasize deficit-financed spending on infrastructure or defense. Such spending would certainly lead to stronger economic growth and higher wages, which would sustain a higher level of inflation than witnessed from 2008 to 2020. The Federal Reserve will maintain higher interest rates to align with stronger economic growth if stronger growth occurs. In such an environment, bond prices would fall to accommodate higher economic activity. Such an outcome would stabilize bond prices at a higher “terminal rate,” reducing the potential upside in owning bonds.

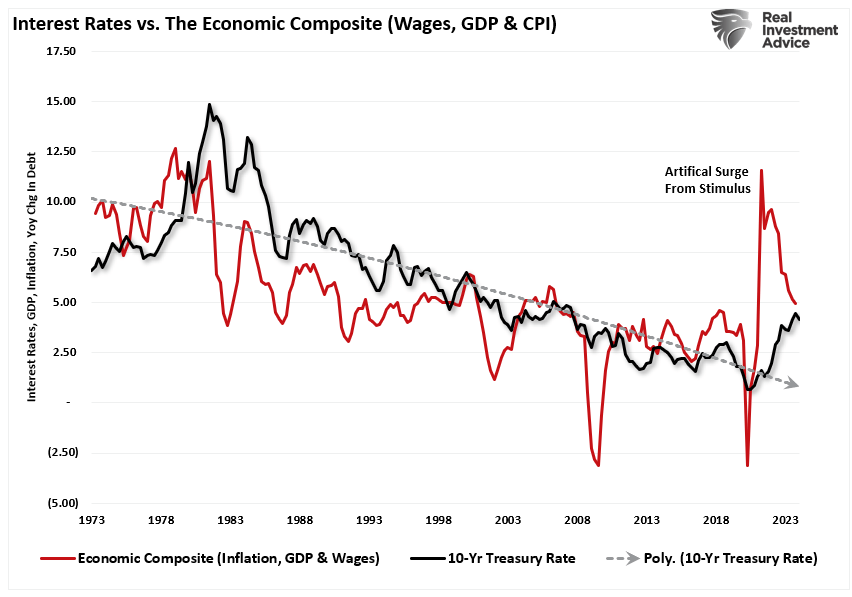

As discussed in “Rates Are Going Much Higher?” there is an important correlation between wages, economic growth, inflation, and interest rates. To wit:

“If we create a composite index of wages (which provides consumer purchasing power, aka demand), economic growth (the result of production and consumption), and inflation (the byproduct of increased demand from rising economic activity). We then compare that composite index to interest rates. Unsurprisingly, there is a high correlation between economic activity, inflation, and interest rates as rates respond to the drivers of inflation.”

Therefore, the bond market has a right to be concerned if a Trump presidency can foster a sustained level of higher economic growth and increased wages, creating a comparative inflation level. Such inflation would raise yields to align with those variables.

However, such will likely be harder to do than many think.

It’s The Economy

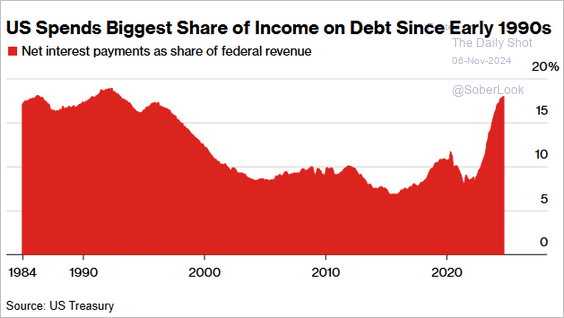

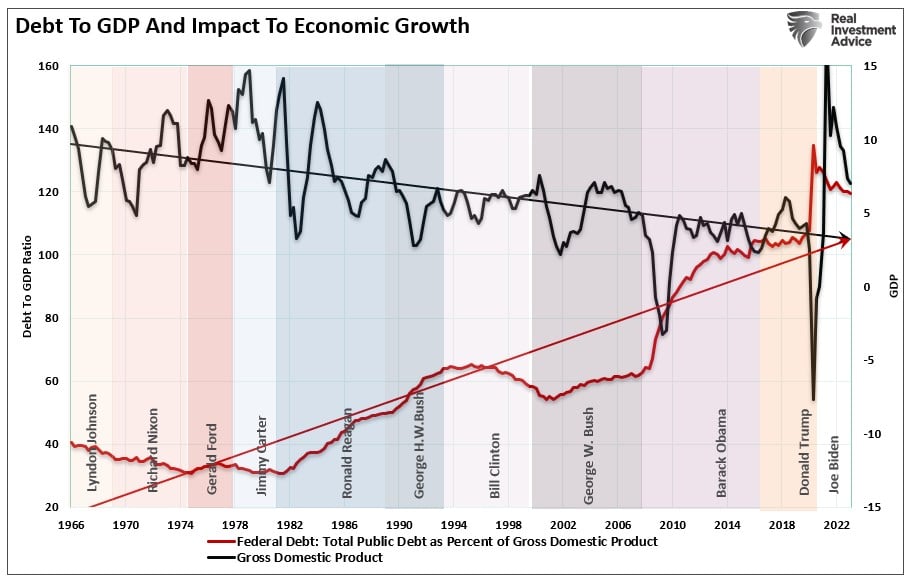

Potential Silver Linings: On the flip side, a Trump presidency must deal with high debt levels and a large fiscal deficit. Increases in the national debt were squandered on non-productive investments, and rising debt service results in a negative return on investment. Therefore, the larger the debt balance, the more economically destructive it is by diverting increasing amounts of US Dollar from productive assets to debt service. As interest rates increase, more federal tax revenue is diverted into servicing the national debt.

While many expect that Trump’s policies will lead to inflationary pressures, what should be evident is that increases in debt and deficits continue to divert more tax dollars away from productive investments into the service of debt and social welfare. The result is lower, not higher, economic growth, inflation, and, ultimately, interest rates.

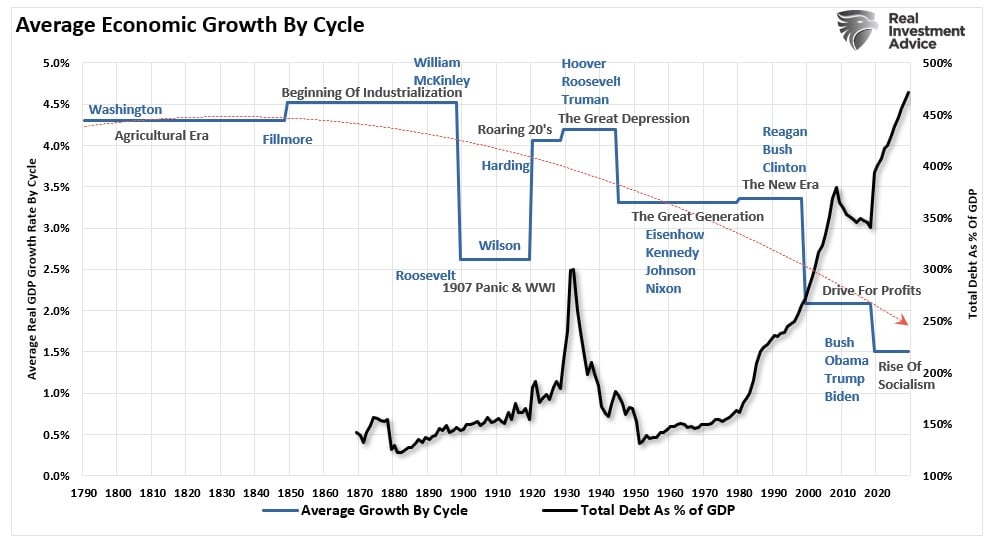

When put into perspective, one can understand the more significant problem plaguing economic growth. A long look at history clearly shows the negative impact of debt on economic growth.

Furthermore, changes in structural employment, demographics, and deflationary pressures derived from changes in productivity will magnify these problems. Trump or any other president cannot effectively resolve those particular issues.

Overall Takeaway

Under a Trump presidency, the outlook for the stock and bond markets presents a blend of opportunities and challenges. The outcomes for both are heavily dependent on which policies become realities.

The one big concern for us at RIA Advisors continues to be a market that has enjoyed outsized returns over the past two years and deviates from long-term means. With the markets being overbought monthly and trading at the top of its long-term trend channel, expectations of further market upside seem overly confident without some correction first. Since 2009, the market has retested the 4-year moving average numerous times. Such is a normal and healthy process for an ongoing bull market, and a mean reversion should be expected at some point in the future. However, such an event isn’t likely between now and year-end.

Furthermore, market predictions hinge on the balance between growth and inflation. While Trump has many policies on his wish list, those policies must be passed by a heavily bipartisan Congress. With only slim majorities to work with, there is a risk of defection on some bills, particularly by the “Freedom Caucus,” which would oppose large deficit spending bills.

Lastly, stocks could rally on tax cuts but might stumble if tariffs weigh heavily on global trade. Bonds could indeed face headwinds, but the “3-Ds” of debts, deficits, and demographics will continue to plague economic growth. While there was an initial surge in stocks and a sell-off in bonds on the announcement of a Trump presidency, there is still a very long road ahead that investors must navigate. Fed policy, economics, earnings and corporate profitability all pose risk to longer-term outlooks.

Investors should stay informed and consider a diversified approach, as the next presidency promises to bring both opportunities and risks across asset classes.