That re-escalated quickly. DXY blasted back to the highs:

AUD was massacred back to the lows:

Oil is trying to break higher, which will end the cycle at a brick wall if it happens. I still think it will crash sooner rather than later:

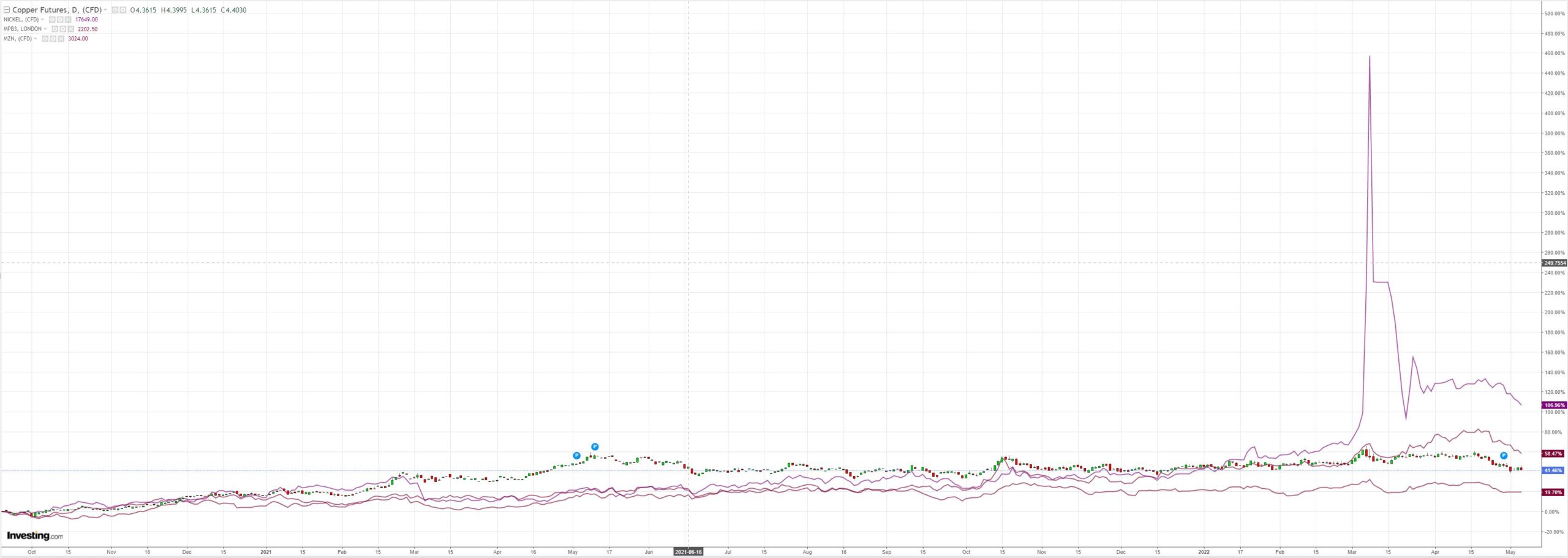

Metals have begun to deflate:

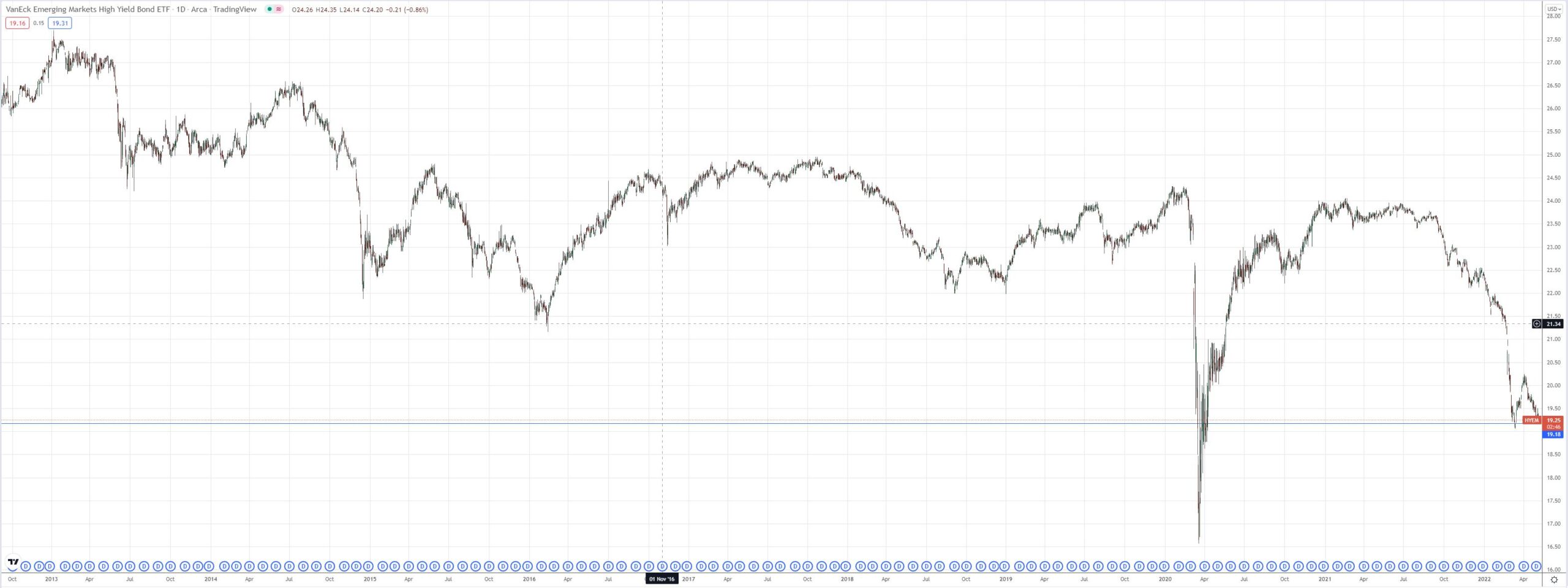

Big miners (LON:GLEN) were smashed. EM junk back at the cliff’s edge:

Treasuries were flogged and the curve steepened. Stocks were put to the sword with Nasdaq -5.4% and S&P500 -4% (sorry charts have stopped working).

Westpac has the wrap:

Event Wrap

US non-farm productivity in Q1 fell 7.5% (est. -5.3%, prior +6.3%), reflecting a large rise in hours worked. Productivity may now be reversing some of the acceleration seen during the pandemic, as low-wage workers return to the labour pool Unit labour costs in Q1 rose 11.6% (est. +10.0%, prior +1.0%). Weekly initial jobless claims rose to 200k (est. +180k, prior +181k), while continuing claims fell to at 1384k (est. 1400k, prior 1403k) – a 52-year low.

BoE hiked by 25bp to 1.0%, as was widely expected. The decision brings the policy rate to the highest since 2009, although the 6-3 vote and warnings of a sharp slowdown in growth and a contraction in activity for most of next year indicate that there is now more caution on the policy outlook. Indeed, while the statement reads that “most members of the Committee judge that some degree of further tightening in monetary policy may still be appropriate in coming months”, it added that “there are risks on both sides of that judgement and a range of views among these members on the balance of risks”.

Norges Bank (Norway’s central bank) kept its policy rate on hold, as was widely expected, but said that the policy rate will most likely be raised in June, with some risk that “the policy rate may be raised more quickly than indicated by the policy rate forecast in the March report”. The statement noted that “the upswing in the Norwegian economy continued through winter, the labour market is tight, and unemployment is lower than projected…rising wage growth and imported goods inflation are expected to push up underlying inflation ahead.”

Event Outlook

Aust: The RBA Statement on Monetary Policy will deliver an update to its forecasts and provide more detail surrounding the RBA’s views on the risks to the economic outlook.

US: Nonfarm payrolls are expected to continue reflecting healthy gains in employment growth in March (Westpac f/c: 425k; market f/c: 380k) keeping the unemployment rate near its lows (Westpac f/c: 3.6%; market f/c: 3.5%). The historically tight labour market should continue to support average hourly earnings (Westpac f/c: 0.4%). The FOMC’s Williams, Kashkari and Bostic are all due to speak at different events.

In other words, sanity was restored. Global recession and AUD lower ahead.