- The S&P 500 broke below key resistance yesterday

- In the short term, inflation and interest rates will keep driving prices

- That, however, shouldn’t drive your decision-making, as earnings and dividend growth should remain critical factors in the long run

Markets have begun to retrace after rebounding from the June lows. The S&P 500’s 4160 area was a key resistance, overlapping static support with the 200-day Moving Average on the daily timeframe. From the chart below, we can see that yesterday’s breakout occurred at that level.

Now, it will be crucial to understand how prices will behave from now until Monday next week—especially since we have the Jackson Hole Symposium this week.

As always, we can follow the headlines, get scared and rush to sell everything in anticipation of the next crash, or we can (and I would say we must) stay rational and rely on fundamentals.

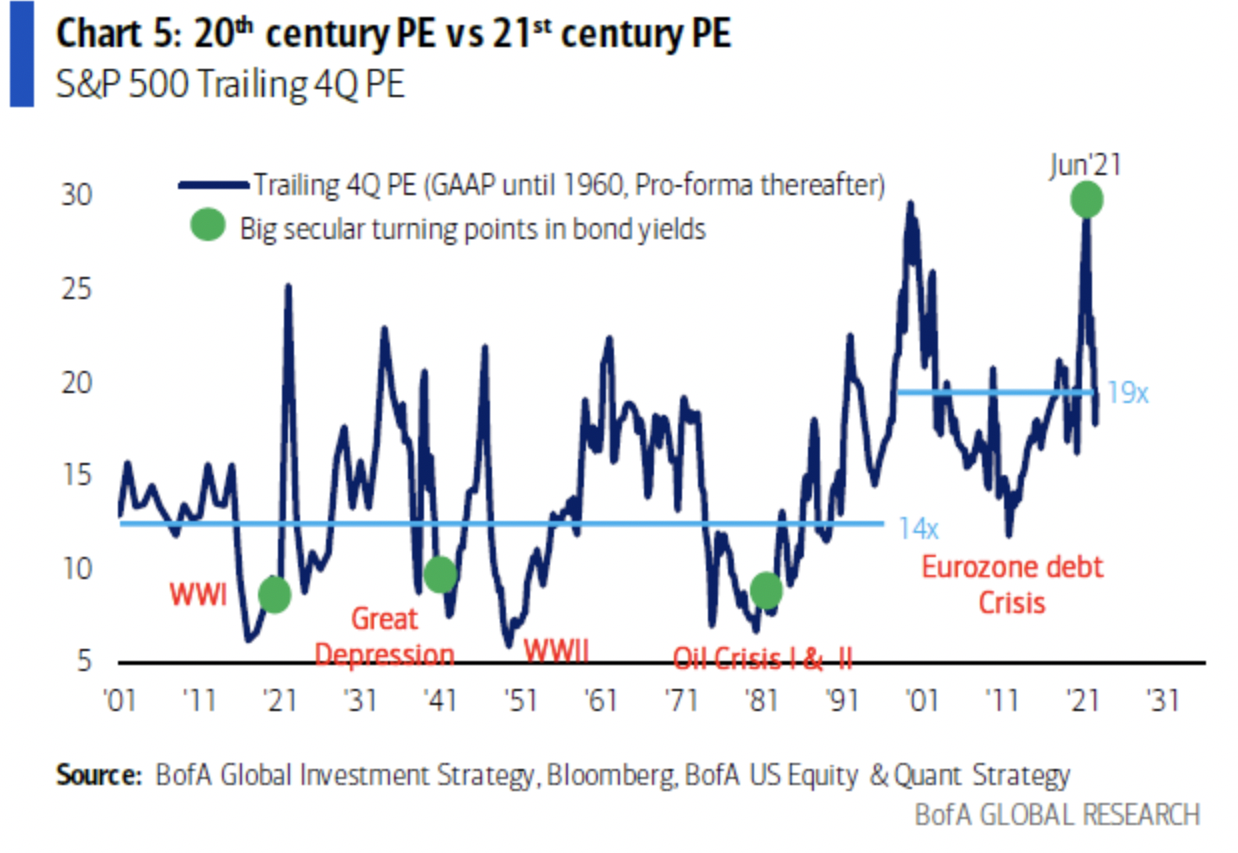

Source: BoFA

The image above shows that the historical trailing Price to Earnings (PE) ratio of the S&P 500 Index has been 19 since 2000—against 14 during the past century.

After the last earnings season, the S&P 500 compounded to an average Earnings Per Share of 220. If we multiply 220 by 19, we get 4180 points, which in theory should be a benchmark for the index today. Being at around 4130, I would say we are not far off.

Of course, countless factors may impact prices in the short run, yet, the two main factors in today’s market (for better or worse) are still inflation and interest rates.

However, in the medium to long term, there are only two factors that really matter:

- Earnings growth

- Dividend growth

That’s all we need, and history shows they are intrinsic drivers of the stock market.

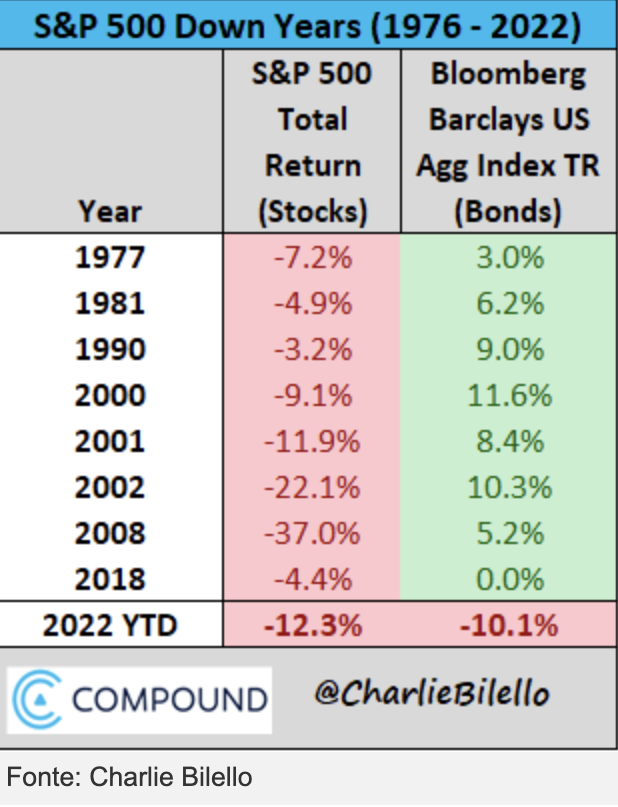

Source: Charlie Bilello

2022 has been somewhat abnormal, with stocks and bonds down 10-12% in the year’s first half. But, again, let’s think this through.

Howard Marks (value style investor and one of the best-known names on Wall Street) used to say that we have to think of markets as a pendulum, constantly swinging. Sometimes the swings are small, and sometimes they are strong. But in the pendulum, there is always an equilibrium point and a returning impulse.

What Marks means with that analogy is that, despite the oscillations, sooner or later, the market will return to the point of equilibrium. The fact is that it is good to have years like these every now and then. If there were no market declines and assets kept growing regardless of everything else, there would be no risk and, therefore, no return. That’s just how markets work.

That’s why I believe there is no point in figuring out whether the market will fall again or go back up in such a short timeframe. Instead, let’s do a portfolio check, plan to invest the remaining cash if the prices fall (and then we can buy at better prices), and check that the asset allocation is in line with our goals.

Unfortunately, I repeat, it is human nature to run after the markets. And since we are in the Internet age, that is even harder because we are constantly bombarded with messages.

I don’t particularly care for aphorisms or quotes, but in this case, I always think back to a phrase by Warren Buffett that fits the current backdrop:

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

Disclosure: The author is long on the S&P 500