Let me start today's update with a Wall Street adage, "Tops are a process, bottoms are an event." From an Elliott Wave Principle (EWP) perspective, the S&P500, is wrapping up its last 4th and 5th waves when topping and starting a new 1st wave when bottoming. Last week we then found,

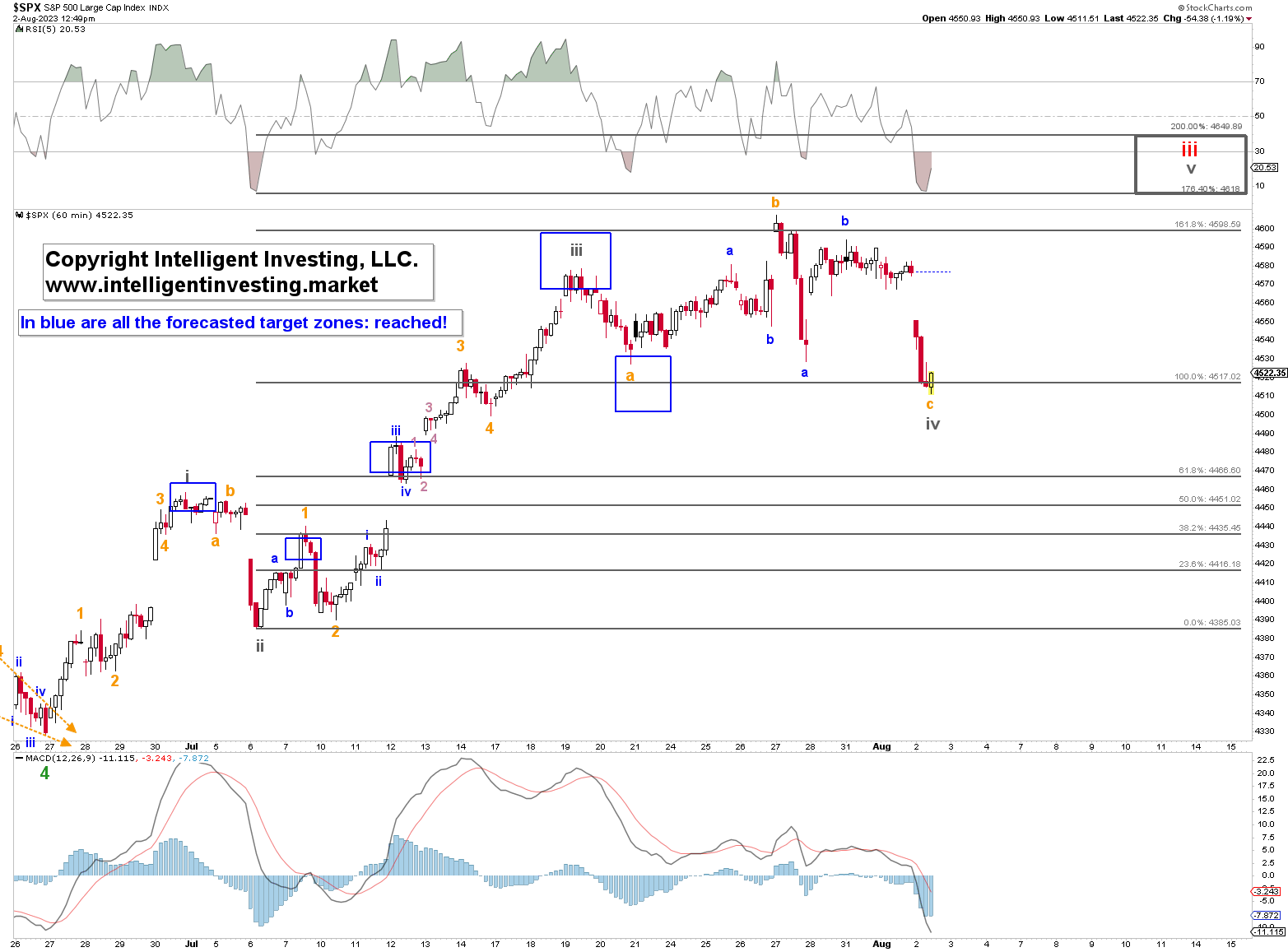

"[The] high at SPX4578 was most likely grey W-iii, and last Thursday's low at SPX4527 was grey W-iv. The index should now be in grey W-v to ideally the SPX4620-50 target zone (upper grey box). That should then complete an extended red W-iii, alternatively blue W-B. The S&P 500 will have to drop below last Thursday's low, followed by a move below the grey W-i high (06/30 high at $4458) to tell us the more extensive correction is already underway, and $4600+ will not be reached."

Two days after our article was posted, the index reached $4607, dropped to $4528 the same day, and rallied back to $4590 the next. Then it went sideways for a day, and today it is back at the crime scene: $4510s: quite the wild ride and a great example of why tops take time. See the price action in the orange box in Figure 1.

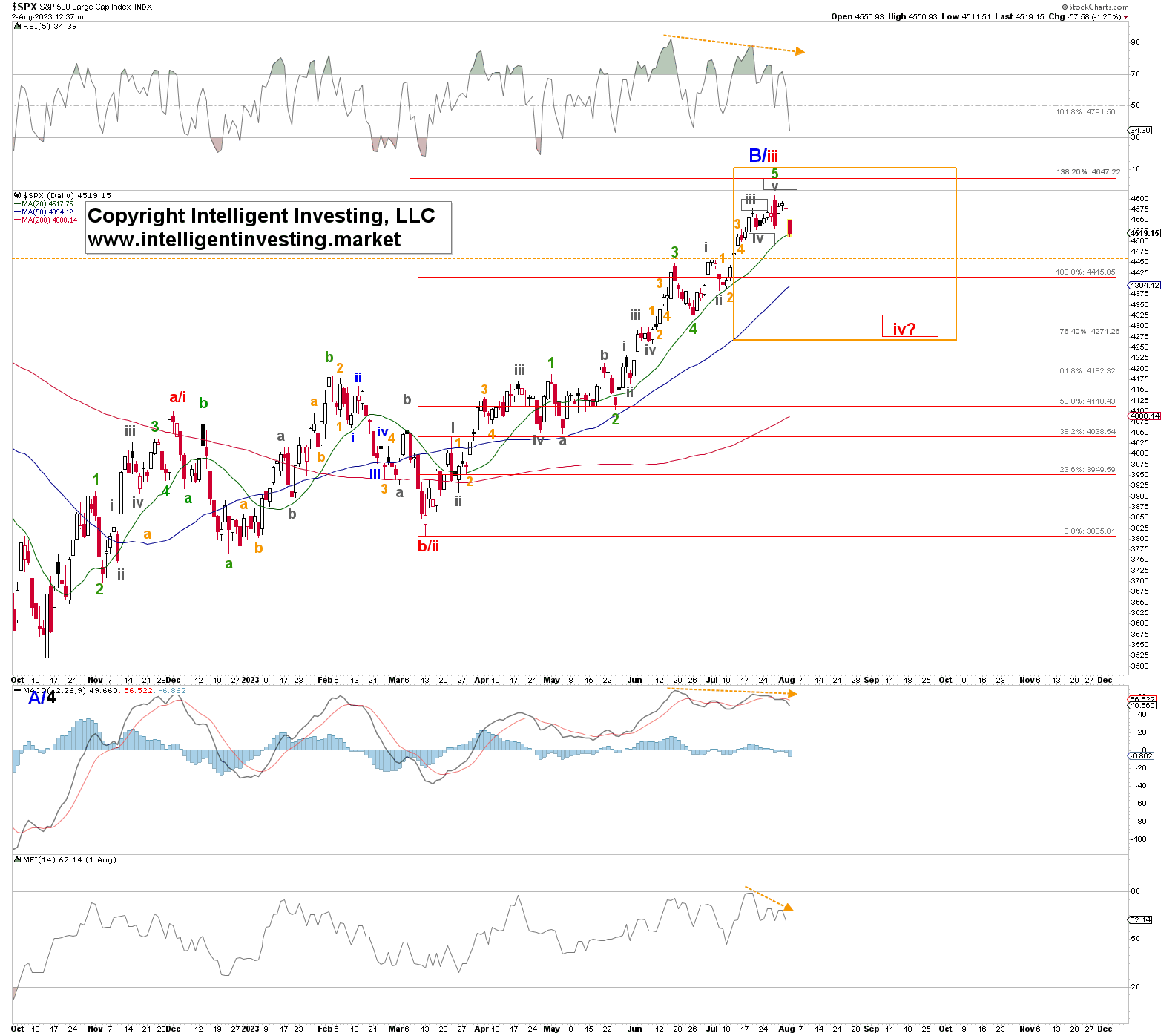

Thus, although the index has not dropped below the critical $4458 level, dotted horizontal line, it made a higher high at $4707 on July 27, which is only 0.24% below its ideal target zone, and thus grey W-v can have been completed. Therefore, we must now be mindful that either the red W-iv to ideally $4300+/-25 is underway, or the blue W-B counter-trend rally has ended, and the index is working lower to $2700-2900. Please note the upside levels have been on our radar since October last year. See here when we were looking for the index to reach SPX4350-4650.

In trading, one must always have a contingency plan to prevent havoc on one's portfolio, called the "alternate count" in the EWP. Namely, the S&P 500 can carve out a rather complex grey W-iv; see Figure 2 below. In this case, it is called an "irregular expanded flat." Fourth waves are often flats comprising an (orange) W-a, -b- and -c. The word "irregular" refers to the W-b making a new uptrend high, and "expanded" means the W-c moves below the end of W-a.