- The S&P 500 is set to rise for the fifth month in a row, historically a bullish sign.

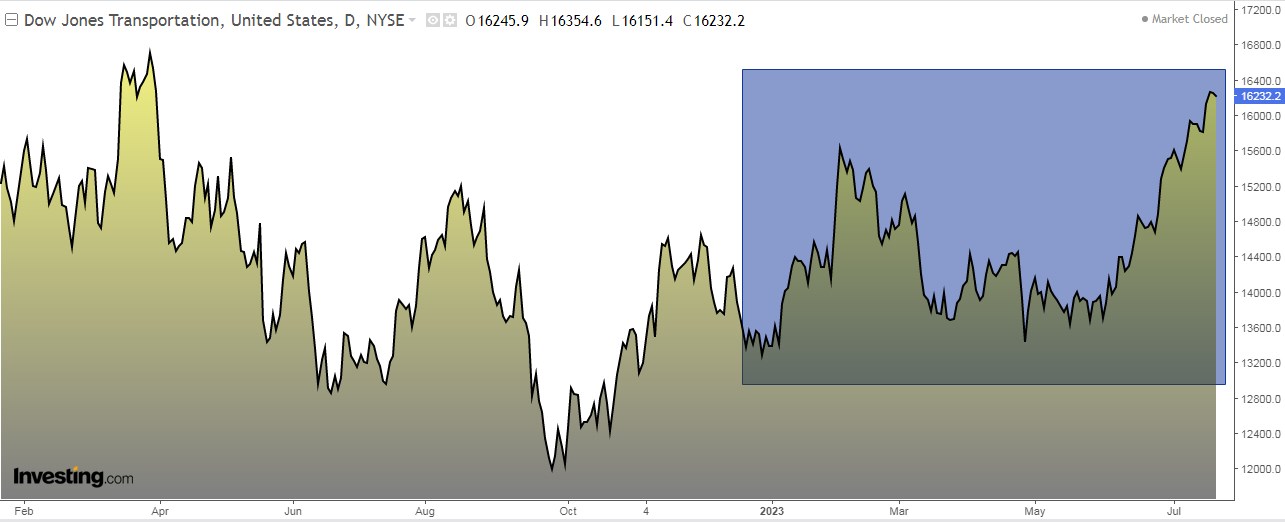

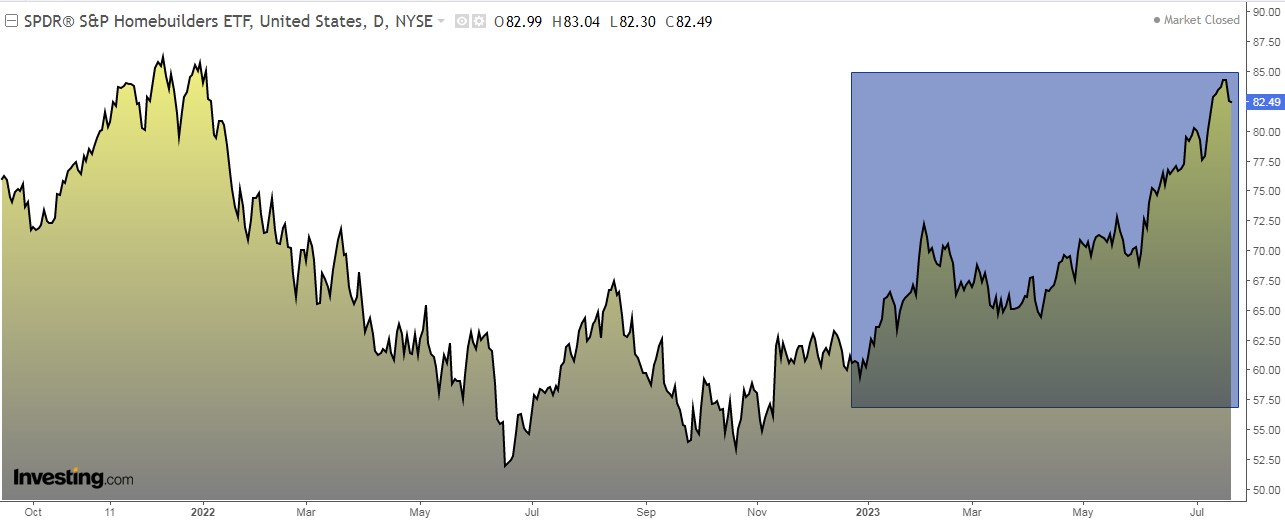

- Meanwhile, tech stocks are not the only ones thriving, as the Dow Jones Transportation and Homebuilders ETF have also hit 52-week highs.

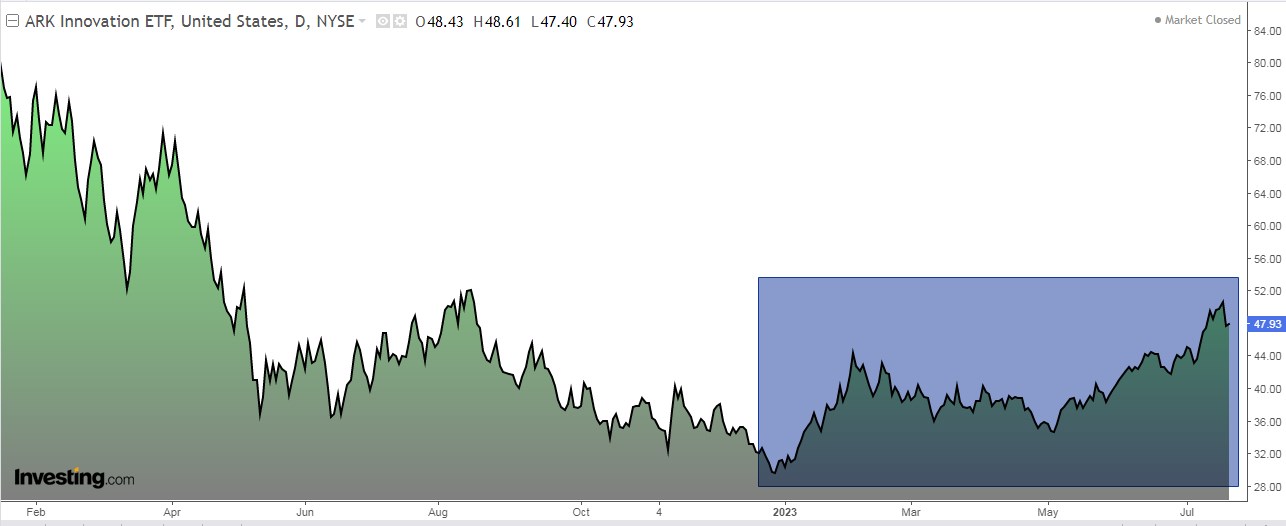

- And, investors betting against Cathie Wood through the AXS Short Innovation Daily ETF have lost big.

The S&P 500 appears set to rise for its fifth consecutive month, and that's exciting news. Looking back at the last 28 times this happened, it performed remarkably well:

- One year later, on 26 of those occasions, it went up, showing an impressive average gain of +12.5%.

- Six months later, it rose in 23 instances, averaging a solid +6.2% gain.

- Three months later, it recorded an average increase of +3%.

Now, remember, past performance doesn't guarantee future results, but it's definitely an interesting statistic worth considering.

Meanwhile, the sector rotation has brought more stocks into 52-weeks high territory. Technology mutual funds received a substantial $1.8 billion in inflows for the fourth consecutive week, showing significant momentum over the past eight weeks, while the Dow Jones Transportation hit a 52-week high on Thursday, boasting a remarkable year-to-date gain of +21%.

This index includes notable companies like American Airlines Group (NASDAQ:AAL), Avis Budget Group (NASDAQ:CAR), FedEx Corporation (NYSE:FDX), and Union Pacific Corporation (NYSE:UNP), among others.

The diverse strength across various sectors has helped the index.

Even the Homebuilders ETF (NYSE:XHB) recently touched a 52-week high.

The Cathie Wood Effect: The Cost of Bearish Bets

Cathie Wood's investment funds evoke strong emotions - you're either a fan or a skeptic, with little room for neutrality. Disliking her funds may lead you to avoid investing in them, but going against them can be an expensive proposition.

Enter the AXS Short Innovation Daily ETF (NASDAQ:SARK), designed to profit when ARK Innovation ETF (NYSE:ARKK) declines and suffer losses when ARKK rises. Unfortunately, for investors in SARK, this year has been brutal, as ARK is up an impressive +51% year-to-date.

Admittedly, last year ARK experienced a steep plunge of -67%, leading many to believe the decline would continue. But the tides have turned, and betting against Cathie Wood's funds has proven to be a costly decision in 2023.

In the current portfolio, 80% of the positions are showing gains, and an impressive 5 of them have surged by nearly or over 100% year-to-date. Notable winners include DraftKings (NASDAQ:DKNG), Coinbase (NASDAQ:COIN), Meta (NASDAQ:META), Palantir Technologies (NYSE:PLTR) and Tesla (NASDAQ:TSLA).

However, it's worth noting that there are also a few stocks in the portfolio that are experiencing losses this year. Examples of these decliners are 2U (NASDAQ:TWOU), Invitae (NYSE:NVTA), and Cerus (NASDAQ:CERS).

Investor sentiment (AAII)

- Bullish sentiment, i.e., expectations that stock prices will rise over the next six months, rose 10.4 percentage points to 51.4%. This is the seventh consecutive week in which bullish sentiment is above its historical average of 37.5%.

- Bearish sentiment, i.e., expectations that stock prices will fall over the next six months, declined 4.4 percentage points to 21.5%. It is at its lowest level since June 10, 2021 (20.7%).

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and, therefore, any investment decision and the associated risk remains with the investor.