Originally published by guppytraders.com

We start with basic analysis of the first chart. On the first chart there is a clear support level shown as line A. The trend line B breakout is more clearly defined. Bullish traders look at this chart and project the upside target near Line C. The probability of a break below support level A is very low.

Remember this analysis and conclusion.

The second chart is the S&P 500 index. It has encountered serious resistance near 2810. On the daily chart this resistance resembles a triple top pattern. Its not technically a triple top because the S&P peak is near 2940. However, this consistent testing a retreat from 2810 makes this a significant resistance level having been tested three times since October 2018.

The current reaction away from this resistance level is also a break below the trend line that defined the uptrend that commenced from the pivot low in December 2018.

The trend line that defines the trend does not start from December 2018. The trend line starts from January 2019 because this line most accurately captures the subsequent S&P trend development with four trend line anchor points. The break below the line is substantial so it has to be treated as a downtrend break.

The target support level for the retreat is near 2630. This is not well-defined support level. The index has clustered around this level several times, but it has not historically provided a sound support feature. This suggests some vulnerability in the S&P. Its good for short-side traders because it suggests this may be a minimum target. It’s not good for long-side traders because entering a long-side trade on a rebound from near 2630 has a lower probability of success because the support level is weak.

Traders have traded the S&P rebound starting December 2018 first as a rally, then in recent weeks as a fast uptrend. Now traders must switch to the potential for rally and retreat trading within a weakly defined trading band between 2630 and 2810. Traders will wait for proven rebound from 2630 support before entering long-side positions.

Its difficult to acknowledge weakness in such a strong and rapid uptrend rally. However, chart 1 is simply an inverted S&P 500 chart. The rules for using inverted charts are simple. If its bullish analysis on the inverted chart, then it must be bearish analysis on the chart shown the correct way up. Using an inverted chart is a good way to verify your analysis and discount any unconscious bias.

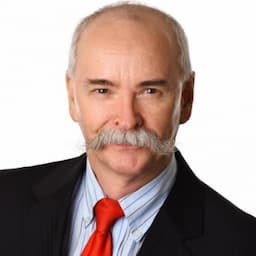

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.