Ten days ago, we warned that the S&P 500 (SPX) was approaching a local top:

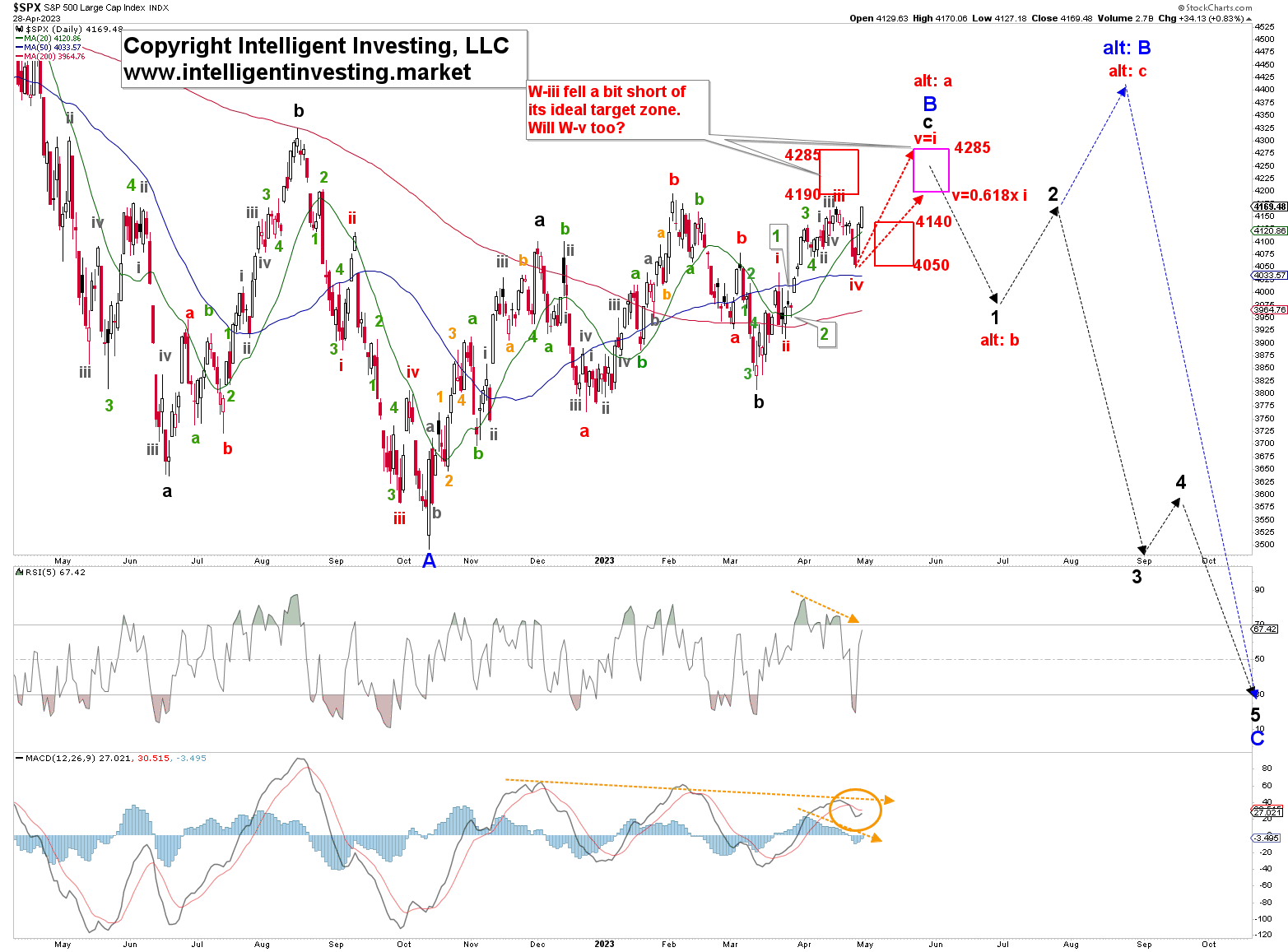

“The index has topped and bottomed where it should go for the grey W-ii, -iii, and -iv of the green W-5 of the red W-iii. It means that as long as the index can stay above $4112 and especially $4085, we should allow for a last push higher into the $4180-4190 zone, which matches with the lower end of the red W-iii target zone of $4190-4285 shown in Figure 1.

Once the red W-iii target zone is reached, we should expect the next more significant pullback, red W-iv?, to $4050-4140 before the last hurray, “red W-v?” gets underway. We now have our cut-off levels below, which we know the index has already topped. Those levels are our insurance policy to lock in profits, minimize losses, and outperform the market. Given the, in last week’s update shared, pre-election year seasonality peak in early May, the current EWP count matches well.”

Fast forward, and the index could not reach the ideal W-iii upper target zone, dropping below our “insurance policy level” of $4112 on April 25. Or as they say, “In Bear Markets Upside Disappoints.” It bottomed the next day at $4049 at the lower end of our red W-iv target zone. Since then, it has staged an impressive two-day rally, telling us that red W-v to ideally $4200-4285 (purple target zone) is underway. See the chart below.

Thus, the general path we have been sharing with you since April 12 is still on track, and as long as $4049 holds, we should be able to reach the (purple) upper target zone over the next few days. Please note the negative divergences starting to develop on the MACD and RSI (orange dotted arrows and circle) and remember that the (pre-election year) seasonality we have shared with you then has a significant peak in early May, after a low in late April. Thus the current EWP count continues to match well.

Once the red W-v tops, we should prepare for the blue W-C, subdivided into the five black waves 1, 2, 3, 4, and 5: black dotted path (exemplary only; not accurate in price nor time). The alternative options will be the red “alt: b, alt: c”: blue dotted path.

Both options will look for lower and higher prices: black W-1 vs. red “alt: b” and black W-2 vs. red “alt: c.” The nuance is that the red “alt: c” will make a higher high, and the black W-2 will be a lower high. For now, our focus is on completing the red W-v and getting ready for a more significant decline in May. Or, as they say, “Sell in May and Go Away.”