- S&P 500 hits new highs amidst recession indicator concerns

- Yield curve and leading economic index raise recession fears, market sentiment remains bullish

- Tech stocks keep propelling index higher despite apparent overbought condition

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

Last week, the S&P 500 hit a new daily high of 5,261.10 points and a closing high of 5,241.53. It's up 9.7% since the start of the year and 46.3% from the lows of October 2022, when it fluctuated in the 3,577-point area.

For many investors, two of the most popular, and historically reliable, indicators of recession have topped out are the yield curve and the Leading Economic Index.

The former inverts when the long-term rate is lower than the short-term rate (e.g., when the 10-year yield is lower than the 2-year yield) and recessions have come rather early.

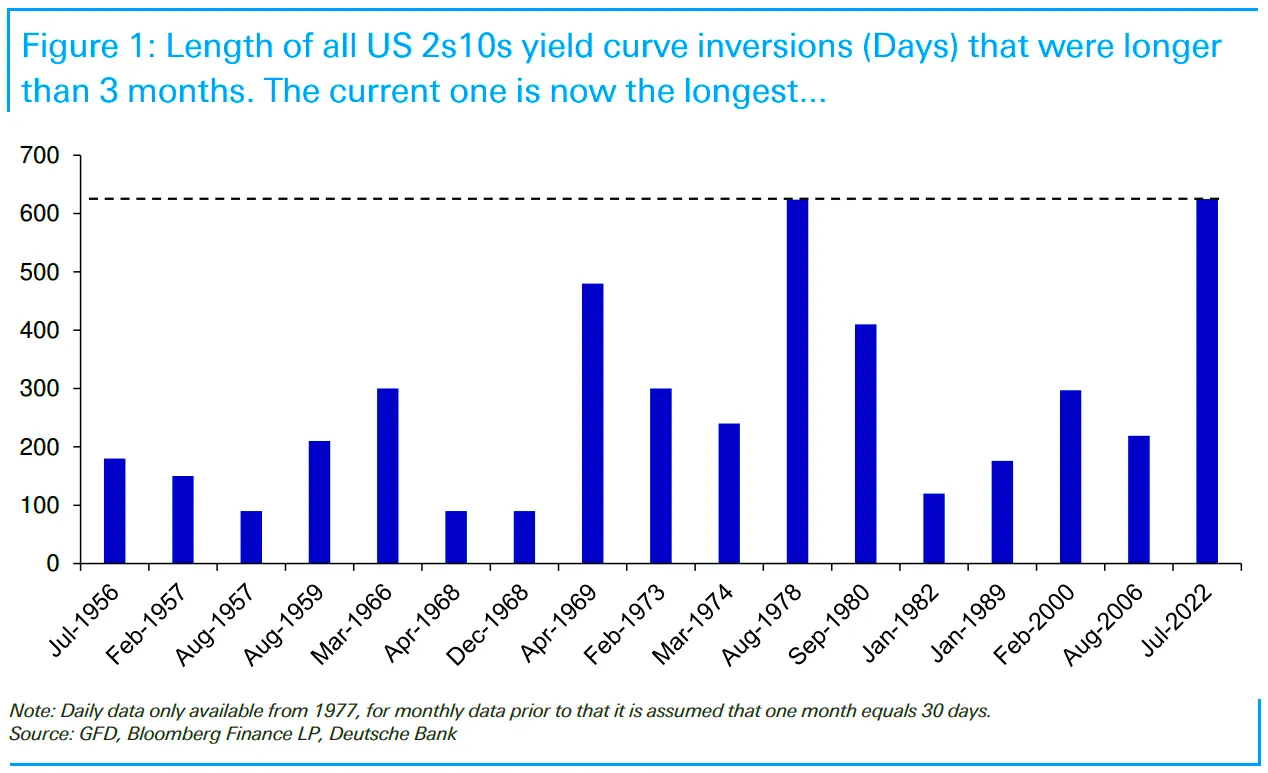

The yield curve inverted two years ago, sparking fears of an impending recession. Currently, it's experiencing the longest continuous inversion in history, starting 625 days ago in July 2022.

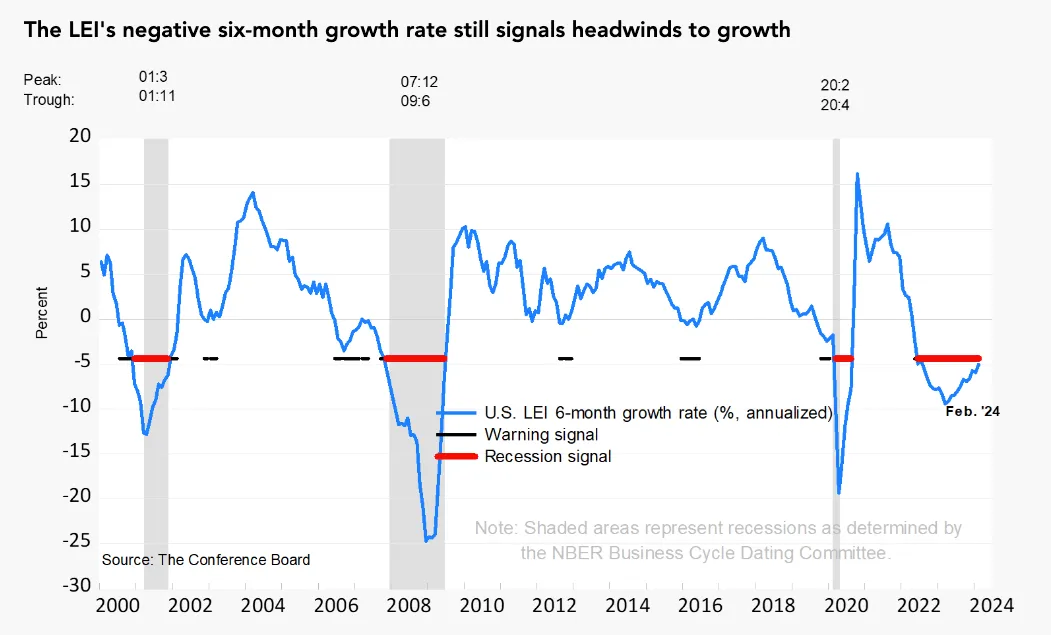

Turning to the Conference Board's Leading Economic Index (LEI), it has historically had a reputation for predicting recessions, particularly when its six-month average change turned negative. For the past two years, it has signaled a recession, but again it did not come.

The LEI index rose for the first time in February 2024, after 2 years. As a result, the index currently no longer signals an impending recession.

The data are all consistent with what is seen in a typical bullish market. Sentiment is bullish, investors who believe in it are on the bandwagon, and market volatility is still clearly down. But amidst all these positives, a new form of fragility could also arise: if a reason ever arises to doubt the bullish thesis, could sentiment shift?

The data are all consistent with what is seen in a typical bullish market. Sentiment is bullish, investors who are believing in it are on the bandwagon, and market volatility is still clearly down. However, amidst this positivity, a new form of fragility could emerge: a shift in sentiment if doubts about the bullish thesis arise.

When we look for excessively positive signals, one notable indicator is when everyone becomes overwhelmingly bullish or bearish.

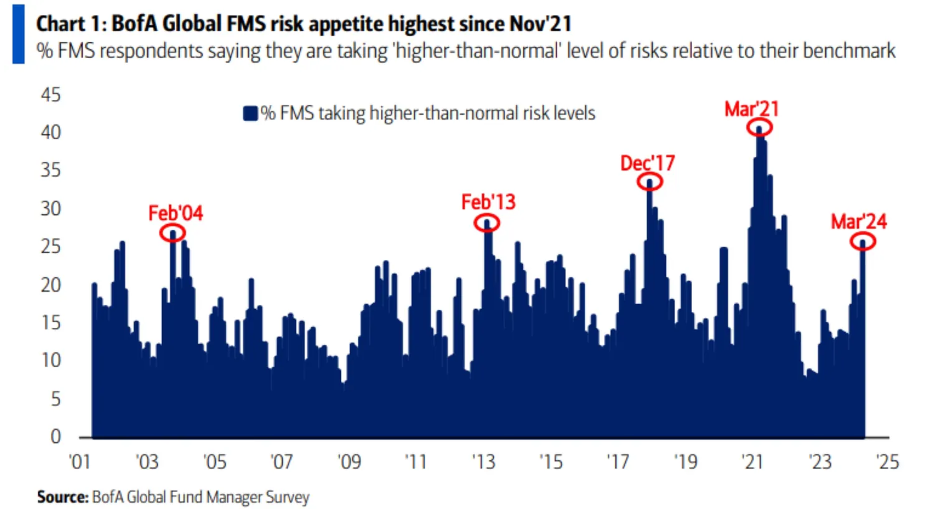

At present, sentiment seems unequivocally bullish, with the Fund Managers Survey indicating exceptionally high-risk appetite surpassing levels seen in November 2021. We're well aware of what followed in December 2021: the peak of the previous bullish market, which was then followed by the bearish market of 2022.

Could this be a good reason to reduce exposure?

From the chart above, it's evident that the S&P 500 performs positively when sentiment among fund managers is extreme, historically continuing its upward trend. This underscores the difficulty of trying to "time" the market.

Right now the trend is set, but we have to be aware that it cannot last forever.

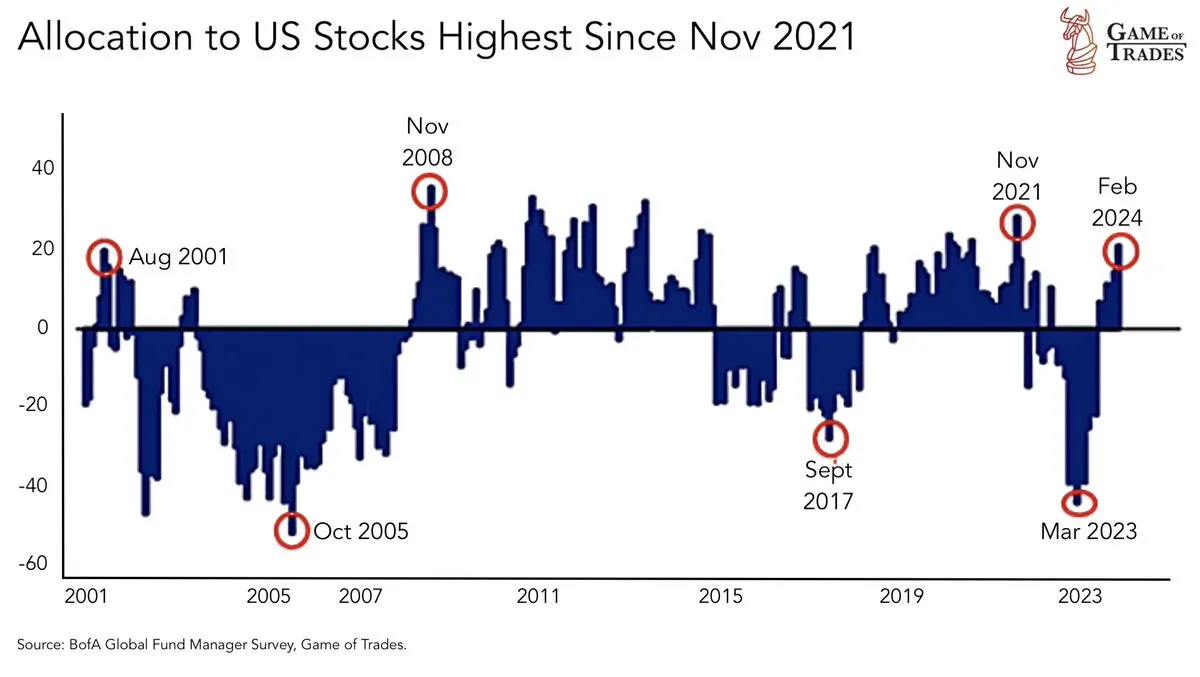

At present, large investors continue to follow the bullish trend, as evidenced by BofA's survey indicating higher U.S. equity allocation levels than November 2021. Moreover, they're closely mirroring the actions of small speculators in equities, who have reached their most bullish net position ever, in line with the ongoing trend.

And to think that things looked quite different for the market in general before the release of ChatGPT in November 2022. Nvidia (NASDAQ:NVDA) had plummeted 66% from its peak, while both Netflix (NASDAQ:NFLX) and Meta (NASDAQ:META) suffered losses of 75% from their highs. Amazon (NASDAQ:AMZN) saw a 50% decline, and Google (NASDAQ:GOOGL) experienced a precipitous drop in market capitalization to $1.08 trillion.

Has enthusiasm for AI saved the stock market?

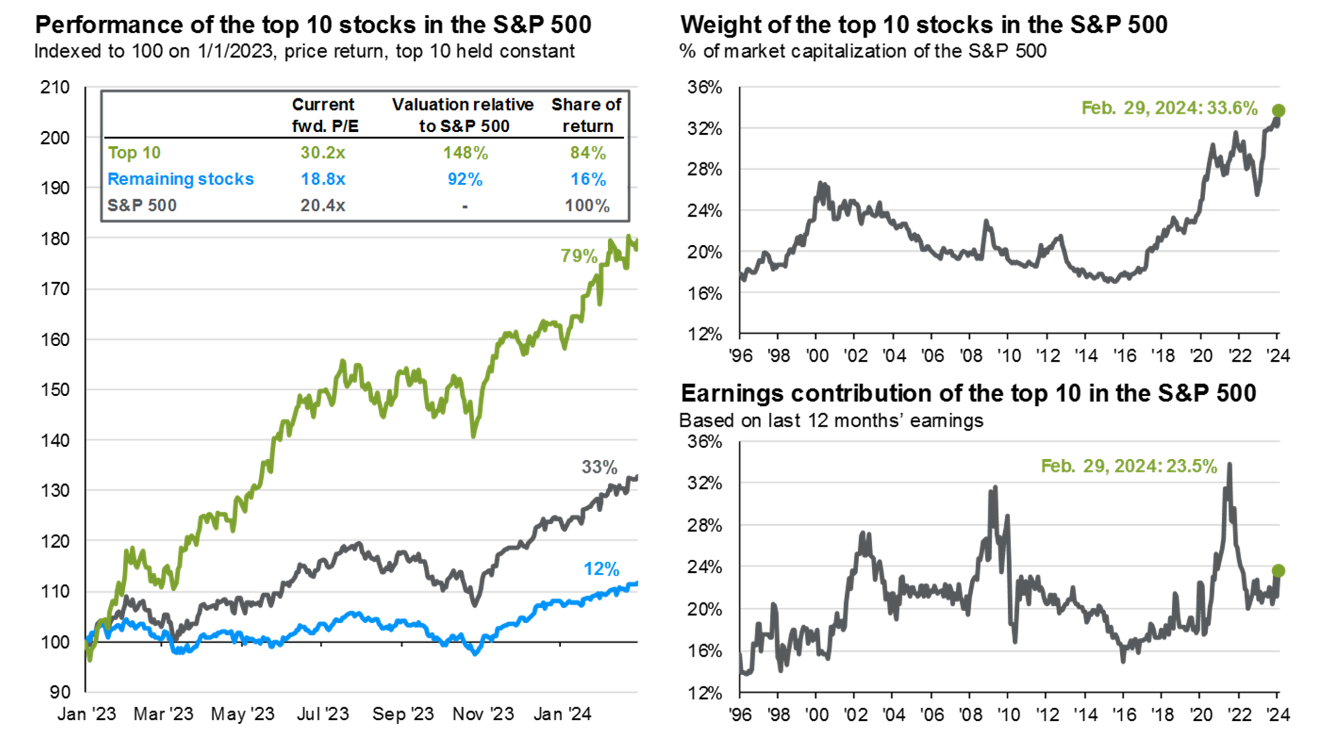

Tech stocks have had a huge impact on the performance and valuations of the S&P 500. According to JP Morgan's (NYSE:JPM) chart, it's apparent that the S&P 10 has a considerably higher valuation compared to the S&P 490, which demonstrates more reasonable levels.

Until next time!

DON'T forget to take advantage of the InvestingPro+ discount on the annual plan (click HERE), and you can find out which stocks are undervalued and which are overvalued thanks to a series of exclusive tools:

- ProPicks, stock portfolios managed by artificial intelligence and human expertise

- ProTips, simplified information and data

- Fair Value and Financial Health, 2 indicators that provide immediate insight into the potential and risk of each stock

- Stock screeners and

- Historical Financial Data on thousands of stocks, and many other services!

That's not all, here's a discount on the annual plan of InvestingPro! click HERE

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.