The S&P 500 fell by another roughly 75 bps on the day. The index fell below support at 5,600, creating an opportunity for a drop to 5,400. Of course, today will be a big test. No break of support is valid unless there is confirmation, and we will need to see a further move lower today.

The CPI report today makes things a bit more complicated, and the VIX 1-day closing at 30 also makes things more complex. I think it creates an opportunity for a volatility crush once the news comes out, but with all the noise in the background, it is impossible to determine how much of the CPI report is accounted for on the VIX 1 day.

More recently, the VIX 1-day has only dropped around 8 to 10 handles at the open daily, so a monster rally after the CPI report doesn’t seem likely.

I’m not even sure the CPI report matters much, given it is for February, and many things are changing rapidly on the fiscal policy side. I could imagine a scenario where the CPI comes in hotter than expected, really creating stress in the market because of stagflation fears. But as of tonight, I am seeing nothing from the swaps market that suggests a hot CPI report is in store for today. Swaps are priced at 2.9% y/y, which aligns with the analyst’s estimates. Swaps have been pricing at 2.9% now for what feels like weeks.

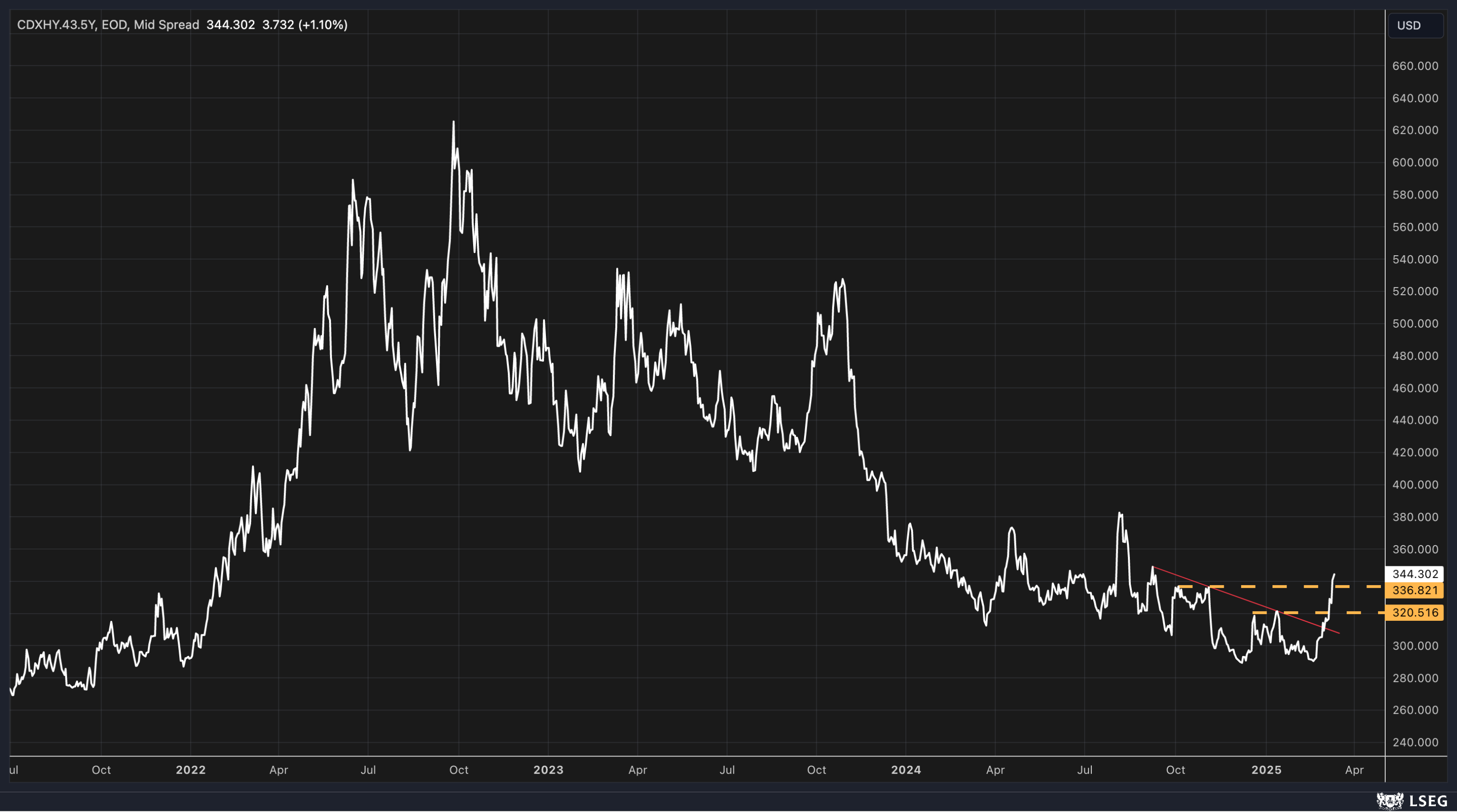

Widening Credit Spreads

Credit spreads are waking up and starting to move. Where this all goes is yet to be seen, but more importantly, it has broken above a down and two levels of resistance. If the breakouts are real, it would seem that the CDX 5-Year HY index could be heading to 400.

Right now, this is just a tough market, and I think, more importantly, the deleveraging process is still ongoing and could continue for some time longer.