Stocks finished lower yesterday as rates rose globally and the dollar strengthened. Many forces are at work, making for a potentially volatile situation for the stock market, especially as we head into earnings seasons.

yesterday, the VIX popped up above that 14.5 level as the VIX opex has now passed, and whether the VIX continues to move higher will largely depend on the macro factors in the market.

This will also depend on how the market adjusts to this idea that the Fed most likely won’t be cutting rates 6 or 7 times between now and January 2025.

Especially if the data continues to come in, like the CPI report, the jobs reports, and yesterday’s retail sales data, which was hotter than expected.

The timing of this may be just as important because this weekend, we will also enter the Fed’s blackout window; whatever taste the governors and board members have left in their mouths won’t be going away.

The market will get a heavy dose of Atlanta Fed Gov. Bostic and SF Fed Governor Daly; both see rate cuts later this year, and Bostic only sees 2.

They are both voting members this year as well. Their message will likely be similar to what we have heard regarding rate cuts for weeks.

Additionally, one could argue that even if the pace of inflation slows and the economy stays healthy, there may not even be the need to cut rates.

If the policy were truly restrictive, I would think that by now, we have seen the effects on the economy.

Either that, or inflation isn’t as low as the CPI report makes it seem, and the effects of falling oil prices have masked the higher inflation rates that persist in the economy.

S&P 500: Is the Index Reversing Trend?

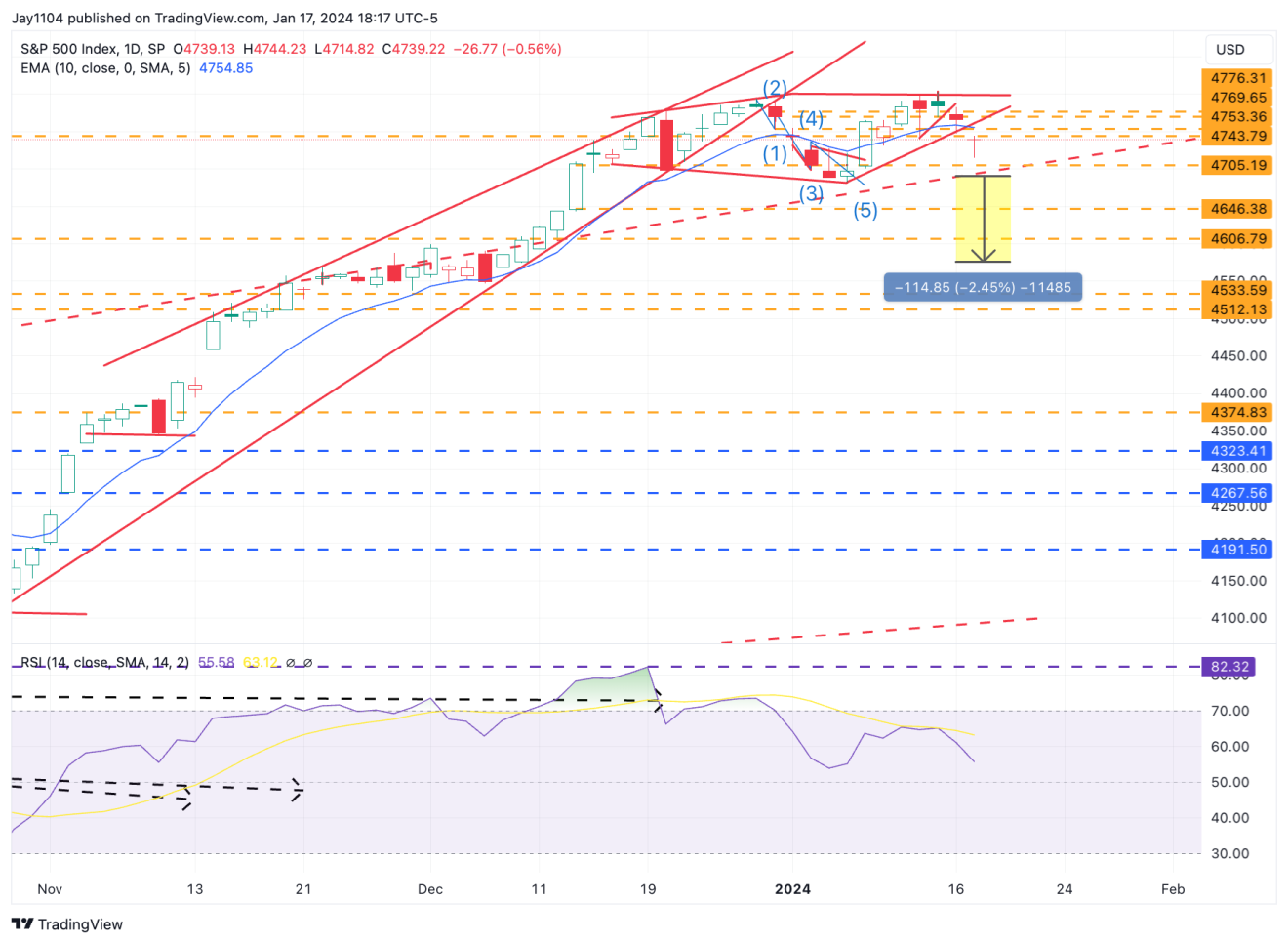

Yesterday, the S&P 500 finished below the 10-day exponential moving average.

While it is only one day, the fact that the index fell below it to start the year, moved back above it last week, and is now back below could be telling us that a change in trend is starting.

A big sign is if the 10-day EMA starts to act as a resistance level.

A break below 4,685 would confirm a short-term double top and project an initial decline to around 4,575, a big support region. A break below 4,575 likely opens the floodgates to much lower levels and a potential return to 4,100.

This is all still very far away, but again, the market dynamics are changing, and that is mostly due to the market beginning to price in fewer rate hikes, Treasury rates and the dollar rising.

This is also because of the supportive hedging flows from the options market diminishing as we approach OPEX and move past it.

In the meantime, we are seeing positive momentum building in the dollar index, with the RSI trending higher.

Right now, the dollar is stuck at resistance below 103.50, and if the dollar can get above that resistance level, then it could have further climb potential to around 104.40 or as high as 105.60.

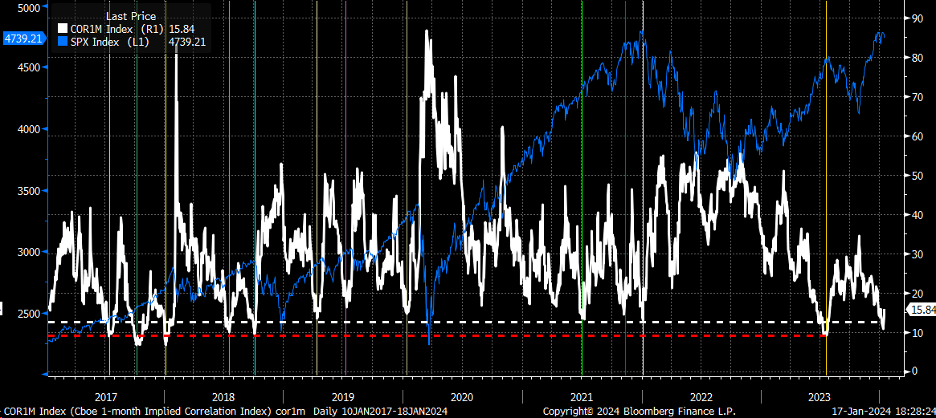

Also, we are seeing the 1-month implied correlation index moving higher, as that tells us that the implied vol of individual stocks and the S&P 500 are rising, which means that volatility dispersion isn’t working.

This is important to watch because it could tell us a lot about the direction of the VIX and, more importantly, the direction of the S&P 500.

Youtube Video: