A shortened, slightly different Daily Market Update this morning as we ease down into the Holiday period. Enjoy the week and stay safe out there!

Key Notes:

* It would seem that Santa hasn’t got Mrs Claus to go long on her CFD account (to avoid any insider trading accusations of course) this December. Australian stocks are sliding early, with our SPI200 contract trying to catch up to the US market falls seen Friday night. The S&P 500 is acting as it should following an interest rate hike from the Fed and experiencing what I’d describe as a healthy pullback.

* Commodities prices continue to be in the headlines with the sliding oil price the big one. WTI hasn’t quite reached its swing lows again, while both gold and silver had uninspiring bounces from their most recent lows to end the week. Not something to get too carried away about just yet.

* Following the Fed’s interest rate hike, if you’re a pessimist (read: realist) like me, then you turn your attention to what markets will now start to worry about instead. Of course whether the economy was actually ready to withstand the beginning of an interest rate hiking cycle will be the main one, but remember Chinese growth worries, European QE and geopolitical risks gyrating through the Middle East? Yeah, me either…

* With the holidays period now officially having begun, be aware of the low liquidity type trading conditions that we are going to soon start to see. We’re either going to get wild swings or a 10 pip range, it’s hard to say. Wait and see, but be aware if you’re still here like I know a few of you are. Also please see our Christmas and New Years Holiday Market Hours if you are sticking it out.

———

———-

Chart of the Day:

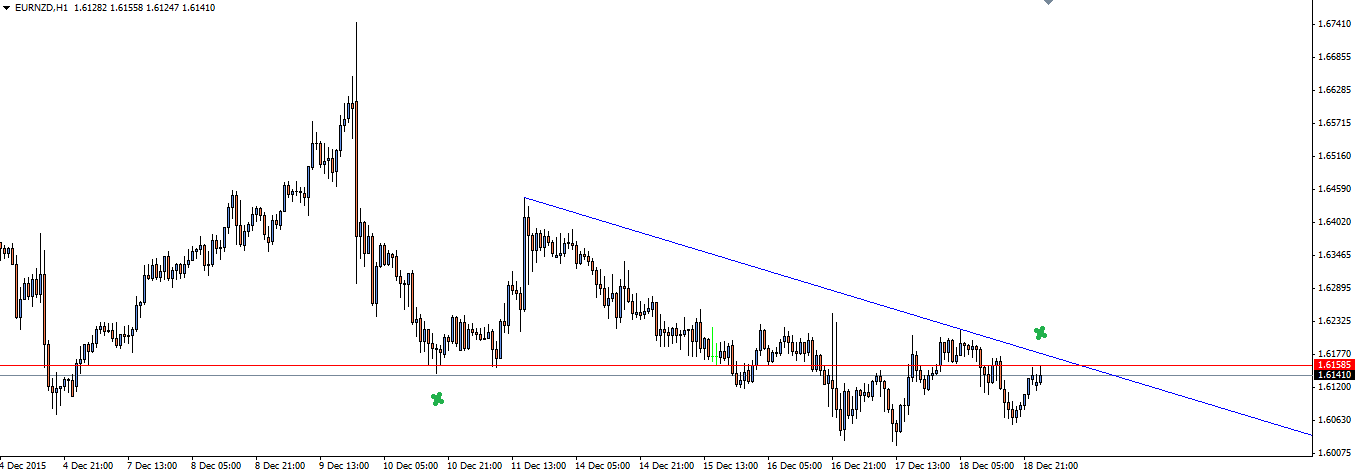

Sticking with the something different theme, today’s chart of the day looks at one of our exotic Forex pairs that not many other analysts regularly look at, EUR/NZD.

EUR/NZD 1 Hour:

Click on chart to see a larger view.

This nice area of confluence caught my eye as I was flicking through the far end of my Forex watch-list that doesn’t get the attention that some of the setups often deserve.

As you can see, the euro has continued to pull back following the Fed’s interest rate hike last week. With a bearish bias in mind for the euro, this pullback into this zone of marked resistance could be a good shorting opportunity.

Are you trading through this shortened Christmas week?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.