Originally published by Guppytraders.com.au

Speculation about the imminent collapse of the S&P 500 continues. This speculation is based on a fear of heights. The speculation uses the same reasoning that forecast a collapse of the S&P when it was at 22250, and then at 2350. This is just based on fear of heights and has no relationship with the actual trend behaviour of the S&P.

The S&P will develop a correction in the trend and this will be a buying opportunity to join a continuation of the uptrend. The S&P shows steady, sustained and continued trend behaviour for all of 2017. These are the key features traders need to concentrate on. The trend is well defined using a Guppy Multiple Moving Average (GMMA) indicator. These are the features of trend strength.

The long term GMMA is well separated and has consistent degree of separation. This suggests that investors are very very confident about the trend continuing.

The short term GMMA is also well separated. When the index drops traders move in very quickly as buyers and stop the index from falling further. This is a very bullish environment. The S&P index has not moved below the lower edge of the short group of moving averages at any time since 2016 November. This shows an even stronger uptrend than the S&P trend between 20012 and 2015.

The degree of separation between the long term GMMA and the short term GMA has remained consistent for the past 6 months. This confirms trend stability and sustainability.

This strong uptrend will end sometime in the future, but there is no indication the trend will end soon. The most common end-of-uptrend patterns are:

-

Head and shoulder reversal pattern. This long term pattern takes months to develop.

-

A rounding top pattern. This is also a longer term pattern developing over several months

-

Significant and sudden compression in the long term group of averages in the Guppy Multiple Moving Averages indicator on a weekly chart.

-

A break below a long term up trend line that has been used as a support level. This is a very low probability on the S&P chart with this trend line around 130 index points below the current index value.

-

A blow-off top pattern. This is a buying climax with a dramatic increase in the index value and significantly higher volume.

-

A large increase in the CBOE Volatility Index which indicates the market is expecting a significant change in trend. This has not developed.

None of these patterns are seen on the S&P index chart.

Analysis of the S&P chart shows a very strong and stable uptrend with no end-of-trend patterns. However this does not rule out the potential for a retracement and consolidation. This behaviour is common in all uptrends and provides a good buying opportunity.

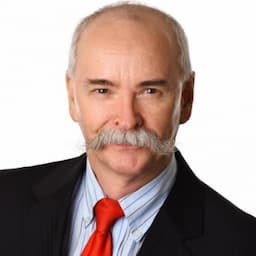

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.