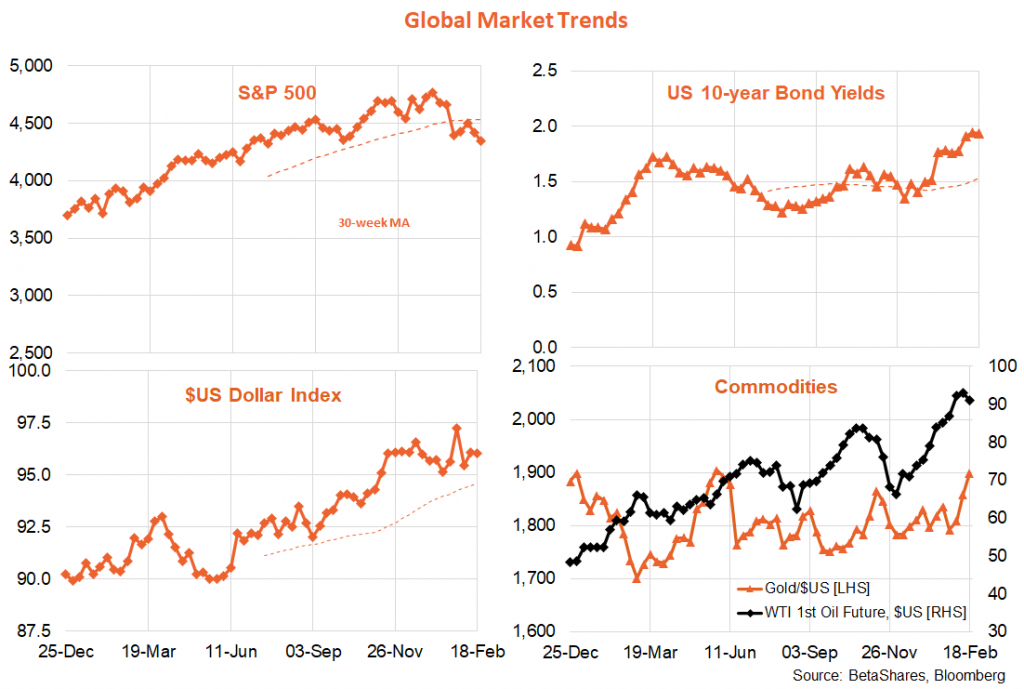

It was another rocky week for global equities, with war tensions in Europe and hot producer prices in the United States. Stocks got an early lift last week on reports that Russia might be scaling back its troop build-up - but those hopes were quickly dashed. The global equity rebound of a few weeks ago appears to be rolling over.

My sense remains that the U.S. is openly predicting a Russian invasion to undermine any attempt (however feeble) by Putin to engineer a pretext for attacking – such as an outbreak of trouble in regions with a lot of ethnic Russians. The whole world knows that a Russian attack will be an unprovoked act of aggression – and the repercussions in terms of sanctions could be severe. Maybe, just maybe, this is giving Putin grounds to reconsider? Either way, what is worse for markets is the lingering uncertainty – I suspect when and if Russia invades, markets would quickly stabilise within a few days.

Meanwhile, U.S. producer prices surged further in January, with the annual rate lifting to 9.7% (market expected 9.1%). If there’s any solace in that number, it’s that the annual rate at least was down on the 9.8% recorded in December. Better news came from the minutes to the January Fed meeting, which suggested the Fed (at that time at least) was not openly considering a 0.5% hike at the March meeting or any near-term sell down of its huge bond holdings.

Similar themes will dominate global markets next week – Ukraine tensions and the U.S. private consumption deflator (PCON) on Friday. PCON is the Fed’s preferred inflation measure, and it is expected to show core (i.e. excluding food and energy) annual inflation pushing up to 5.1% from 4.9%. Headline PCON is expected to hit 6%.

All up, I suspect global equities are likely to remain under downward pressure for some time yet – although a short-term bounce, especially if Russia pulls back, can’t be ruled out. Indeed, this first stage valuation-driven equity correction seems likely to last for as long as long-term bond yields are pushing higher – with the former likely to level out only once markets are convinced the worst in terms of Fed tightening is already priced in. Of course, all this assumes Fed tightening won’t be allowed to crush the economy or earnings – which in turns depends on how quickly currently hot wage and price pressures subside. If inflation pressures persist, and wage growth remains red hot, the Fed may have no other choice but to significantly slow the economy, which could see a second stage earnings-driven equity decline even if bonds yields stop rising.

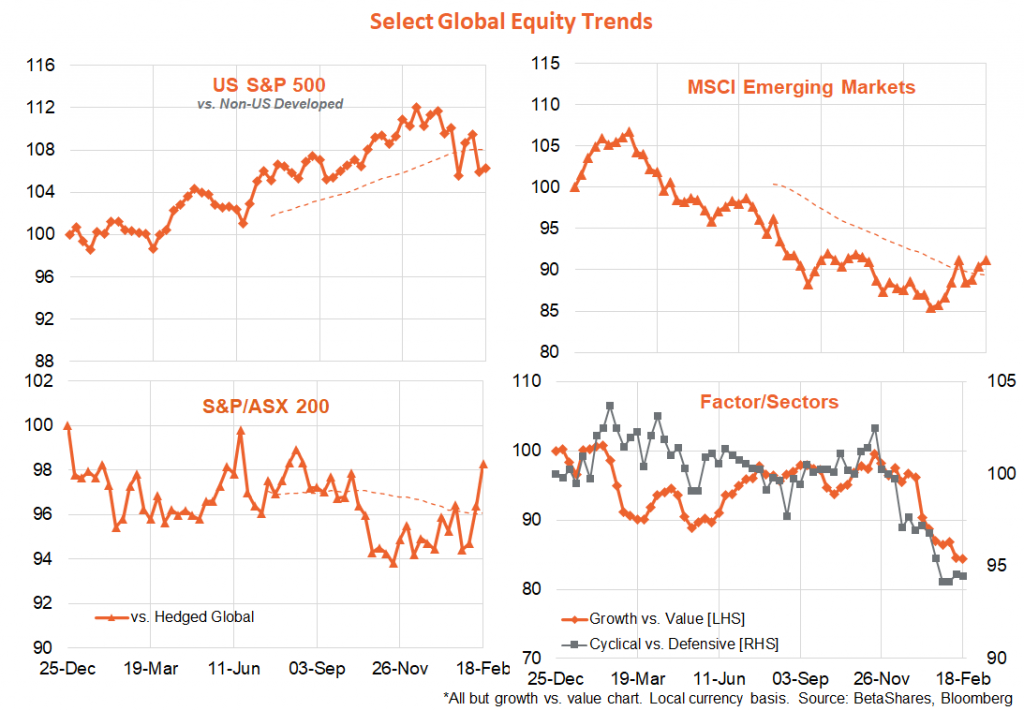

In terms of global equity themes, U.S. relative performance finally appears to be breaking down, with emerging markets getting a relative lift – Australia also appears to no longer be underperforming. Value and defensives are beating growth and cyclicals.

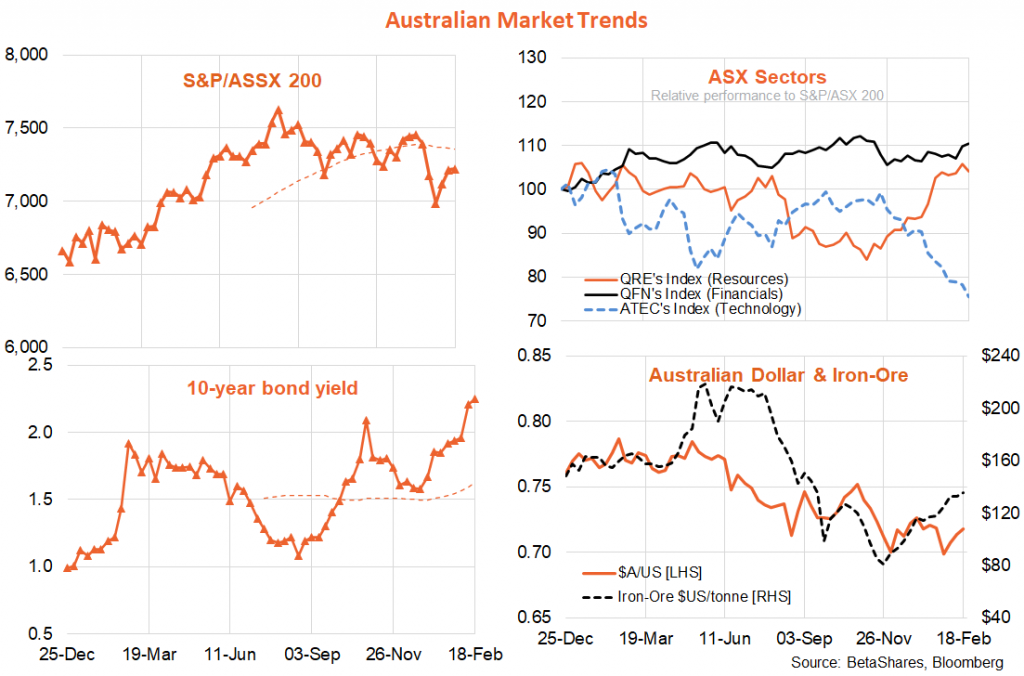

Australian market

Contrary to aggressive market tightening expectations, both RBA and Treasury commentary last week emphasised the word “patience”. Officials still seem of the view that they want to get the unemployment rate as low as possible until such time as wage growth suggests full employment has been reached. I sense they don’t want to risk any near-term rate rise getting in the way of this objective.

Last week’s labour market report suggested impressive employment flexibility in January – employment actually rose in the month despite Omicron disruptions, with the decline in labour demand coming via a large drop in hours worked. Through employer agreement or otherwise, many Australians took a lot more holidays and sick leave in January than is normally the case!

The critical wage price index for the December quarter is released on Wednesday. Notably, the market is expecting a rise of only 0.7%, which would take annual growth to only 2.3% from 2.2% in the September quarter. If so, that would be no smoking-gun for a rate rise any time soon. Of course, a larger than expected wage gain would be a different story – but I’m waiting for the data to prove me wrong, before pencilling in an RBA rate hike this year. As some have noted, wage growth in WA remains relatively benign even with a sub-4% unemployment rate.

Have a great week!