The DXY consolidation continues:

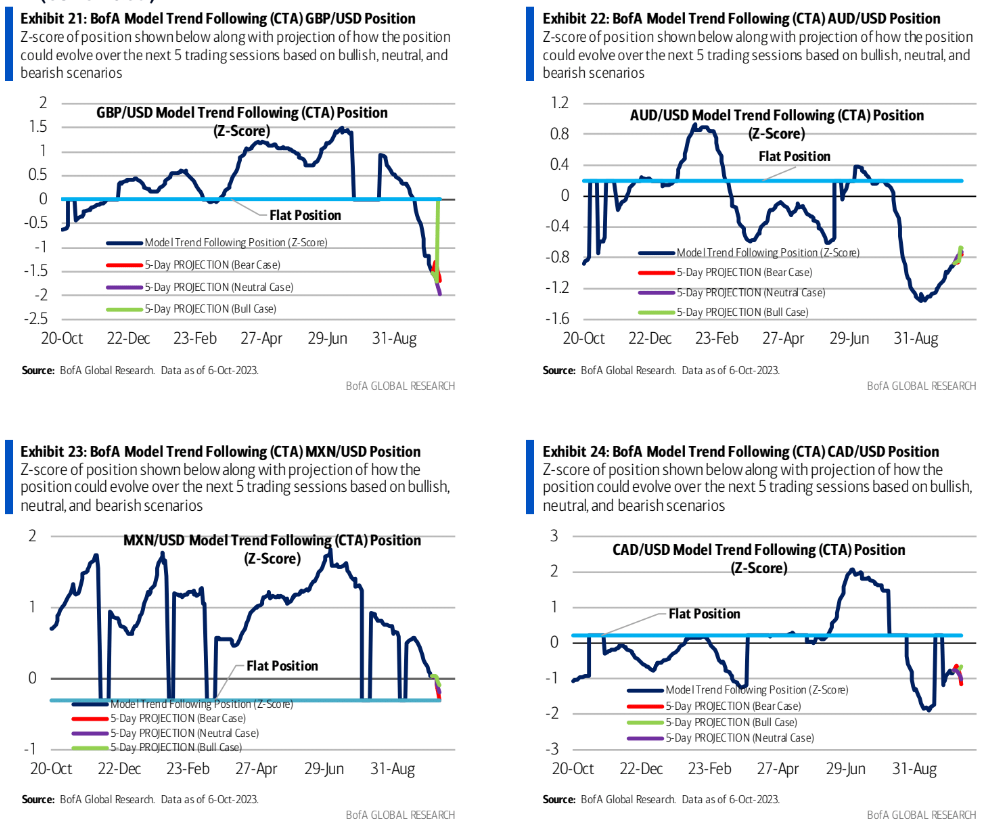

The AUD short is protecting the downside:

CNY is nailed to the floor:

Oil popped but it’s not making much sense!

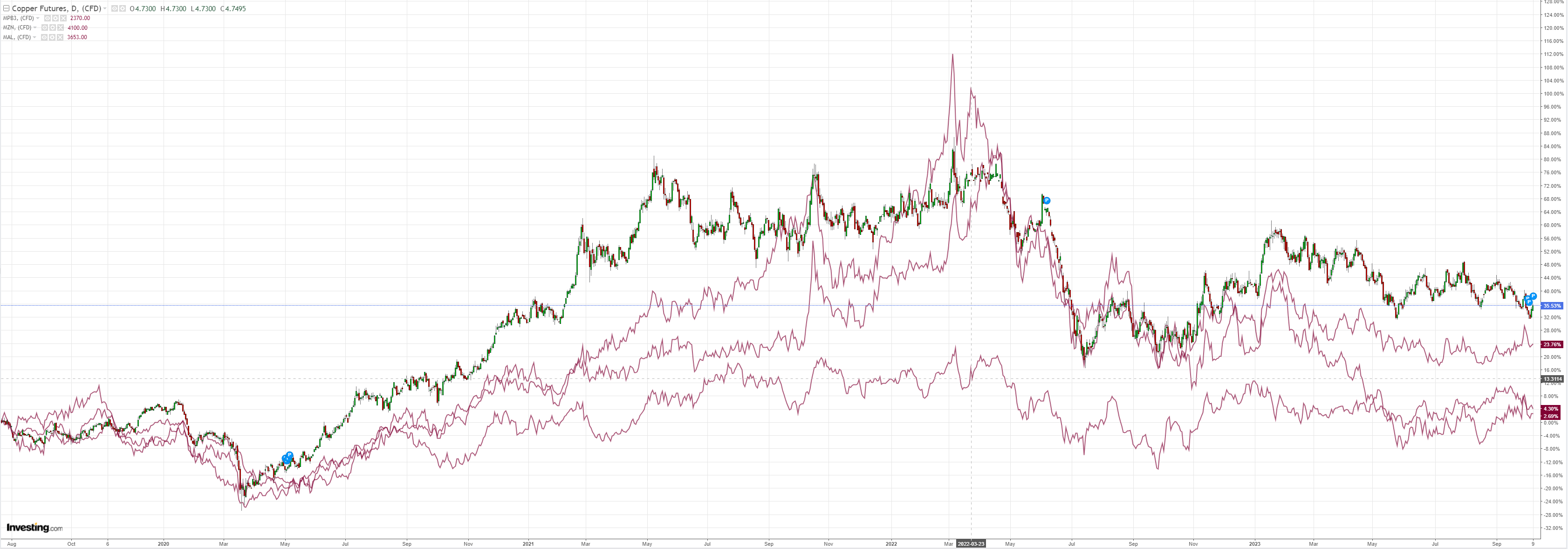

Copper bounced off support:

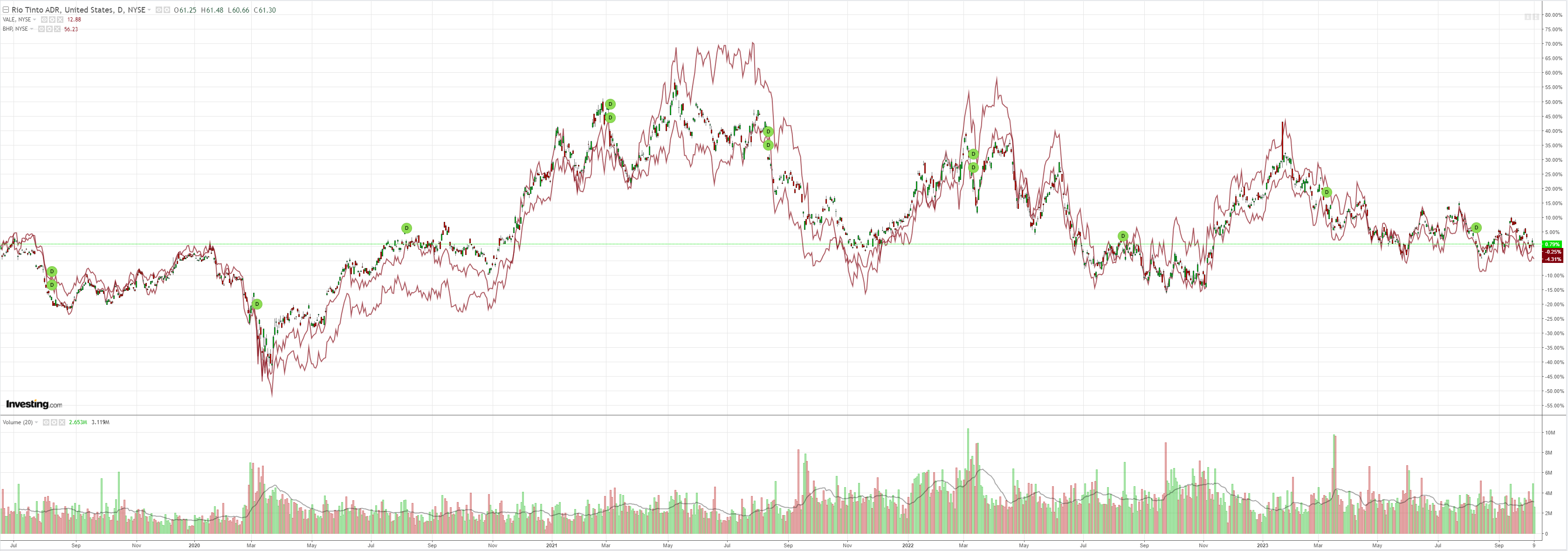

Miners sagged:

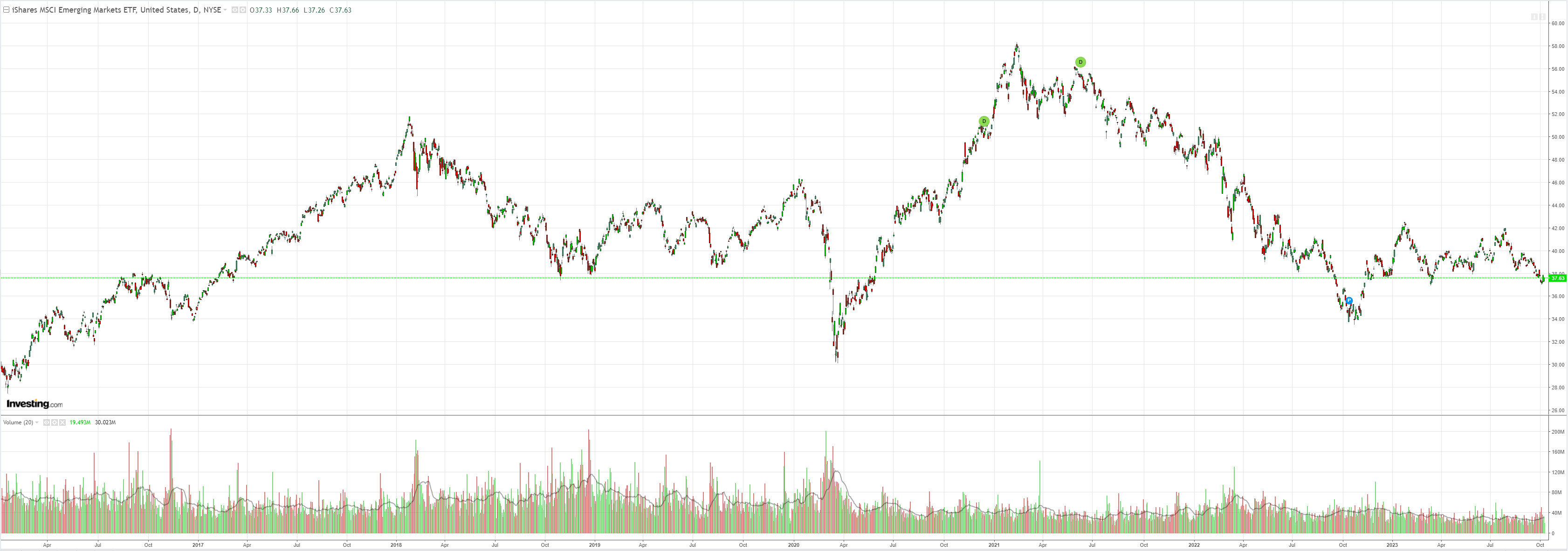

EM stocks are done:

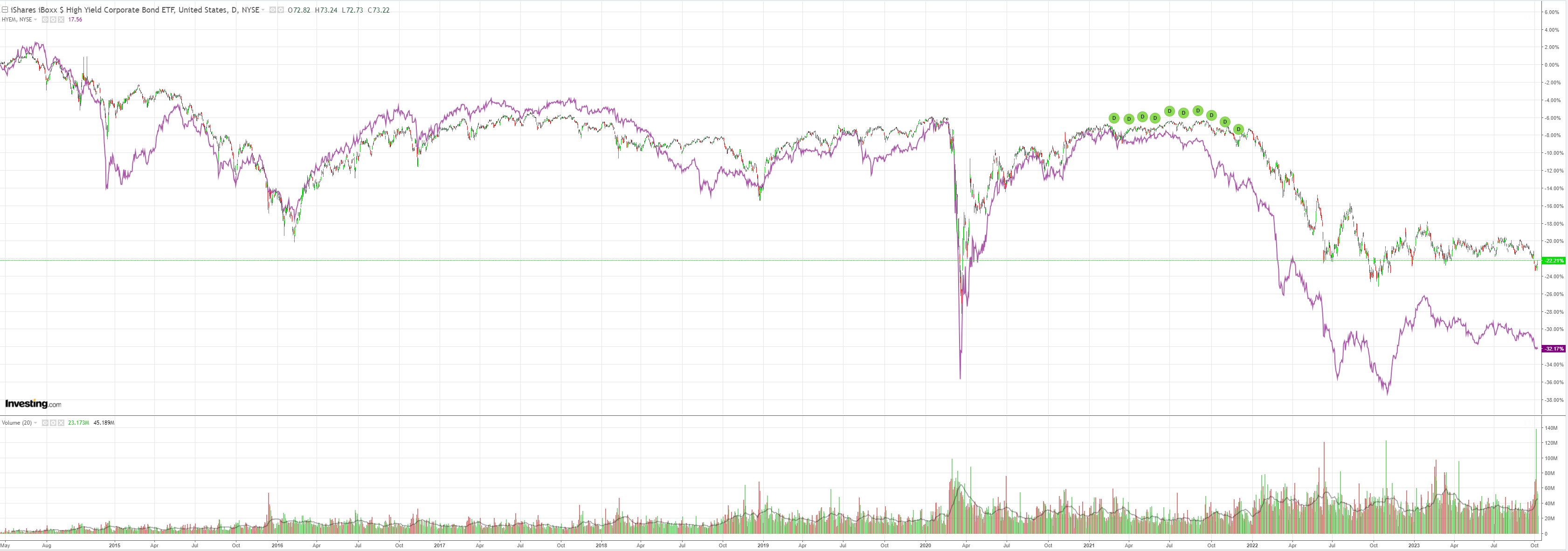

Junk is not well:

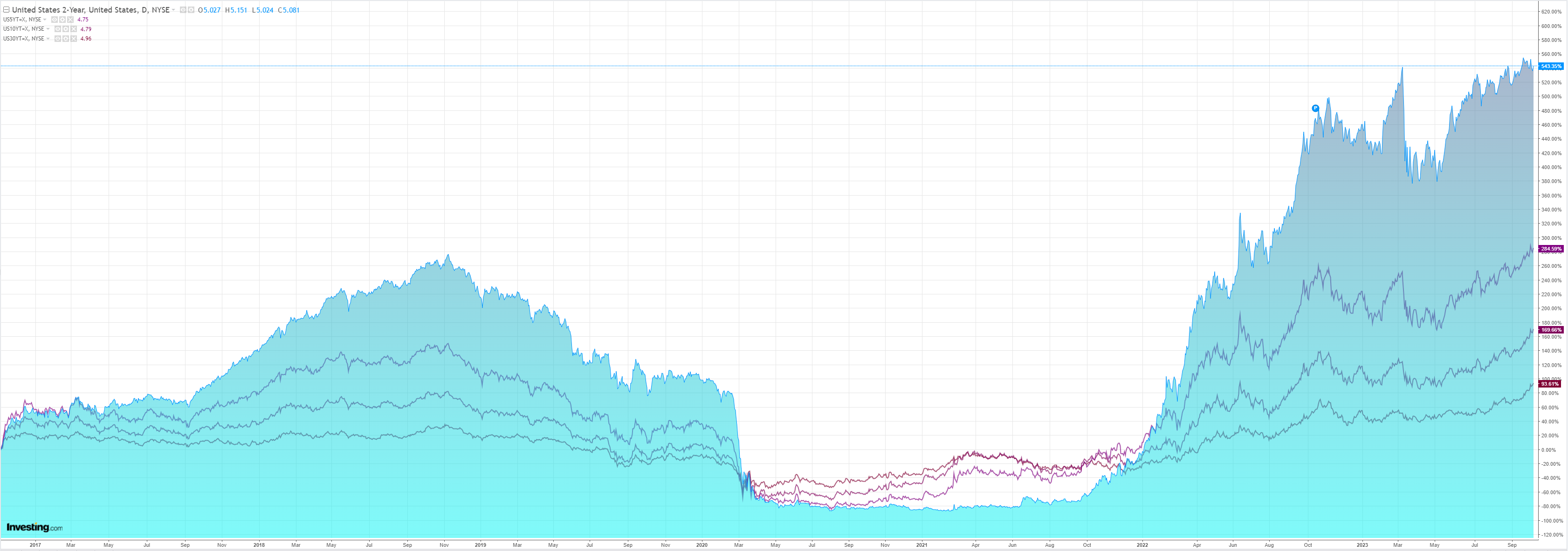

Yields fell (the chart is wrong):

As usual, stocks only trade positioning:

The safe haven bid into Treasuries is giving everything a chance to chop the wood of overbought and oversold conditions. That is all this is. If anything, global economic prospects just got worse, not better as a regional war and oil shock presented itself.

BofA has more on the CTAs. DXY is bigly overbought :

Eleven-week winning streak in USD comes to an end

Starting in FX this week, USD posted its first weekly decline since mid-July. Our CTA model implies that trend follower longs in USD remain stretched and correspondingly, acontinued pullback in USD could trigger a stop loss/full unwind. Positions that are most stretched in our model CTA are EUR, GBP, and JPY. But as well positions in AUD and CAD are significant. In Exhibit1 we list our model’s stop loss triggers, the closest of which are for EUR (1.0666) and GBP (1.2353). Outside stop loss risk, next week our model’s CAD short looks to increase in size.

I suspect this consolidation will run for now. At some point, we will refocus on fundamentals and my guess is there is another upleg in store for DXY as we enter the endgame of the business cycle.

Conversely, one more down leg for AUD.