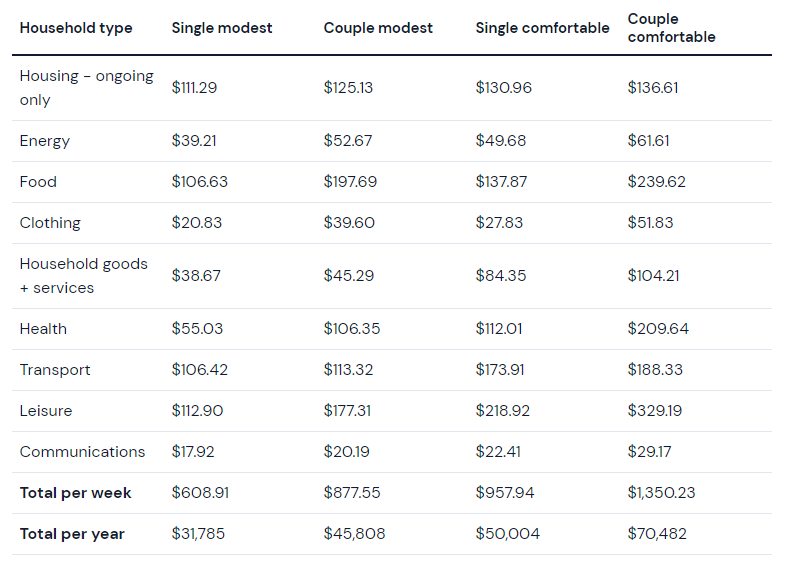

According to the Association of Superannuation Funds of Australia (ASFA), the annual budget for a comfortable retirement is a record $70,482 for a couple aged 65 and $50,004 for a single.

- Comfortable retirement costs have outpaced inflation rising 7.7% over the last 12 months compared to 7%.

- To live a comfortable retirement, couples need $70,482 per year and singles need just over $50,000.

- Seniors have had to fork out extra annual costs for electricity, leisure activities, and food.

It says a “modest” retirement costs $45,808 for a couple and $31,785 for singles – which can be largely covered by the age pension.

Retirees continue to face significant upward pressure on their household budgets with the cost increase reporting higher than Australia’s CPI inflation, which rose 7% for the 12 months to March.

Seniors have been hit by large annual increases in electricity costs (+15.5%), leisure activities such as holidays and restaurant meals (+14%), and food (+8%).

In the March quarter, medical and hospital services costs rose 4.2%, the price of pharmaceutical products rose by 4.5% and insurance costs were up a further 3.5%.

ASFA CEO Dr Martin Fahy said retirees are having to fork out more money on basic staples.

“Retiree budgets have been under substantial pressure for over 18 months due to the higher cost of essential goods and services, namely food, fuel and electricity, with the latter up 15% over the year,” said Dr Fahy.

“Self-funded retirees will not be eligible for Federal Budget measures aimed at relieving cost-of-living pressures, and despite recent adjustments to the Age Pension, payments continue to lag inflation.

“Fortunately, we are seeing a turnaround in term deposit income, and critically, the 1 July increase in the Super Guarantee (SG) rate to 11% will put a greater number of Australians on track to achieve the dignified retirements they deserve.”

According to ASFA, the lump sum now required to retire comfortably at 65 years is $690,000 combined for couples, and $595,000 for singles.

See Also: The gender super gap: what is it and how can women safeguard their superannuation?

Cost of living pressures see some seniors skip health visits

According to consumer group Core Data, cost of living pressures are seeing many older Australians cut back on their healthcare spending.

An Australian seniors survey of 1,200 Australians aged 50 or older found nearly half (45%) have been forced to cut back on their medical spending.

The average respondent estimated their annual out of pocket healthcare costs were $1,586, and many have been forced into sacrificing some expenses.

This includes skipping or reducing dental check ups, 23%; GP visits, 14%; and specialist appointments, 11%.

"Rising retirement costs outpace inflation" was originally published on Savings.com.au and was republished with permission.