By Oliver Gray

Investing.com - Major mining companies are facing an increasingly volatile outlook amid easing inflation pressures and rising recession risks, while Rio Tinto Ltd (ASX:RIO) and BHP Group Ltd (ASX:BHP) are both making major acquisitions for the first time in over a decade as they seek to take advantage of increasing demand for metals required in renewable energy production.

Copper and nickel are among these metals that have seen a surge in demand due to decarbonisation efforts. These high commodity prices have encouraged both Rio Tinto and BHP to expand their commodities production and invest more in metals poised to benefit from decarbonisation instead of returning excess cash to shareholders.

What Does the Company Do?

Rio Tinto Group was founded in 1873 and is headquartered in London, the United Kingdom.

Engaging in worldwide exploration, mining and processing of resources, the company supplies markets with a range of minerals and metals, including Aluminum, diamonds, uranium, copper, gold and iron ore via its operations in Europe, Africa, Asia-Pacific, the Middle East and the Americas.

Data

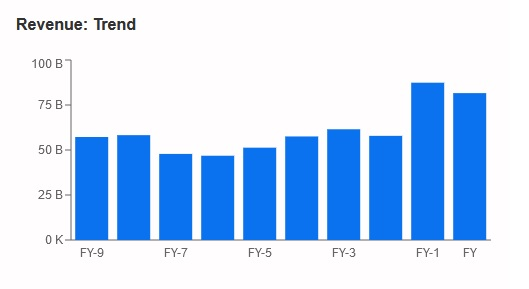

Source: Investing Pro

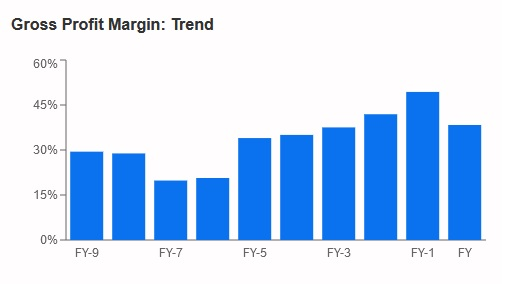

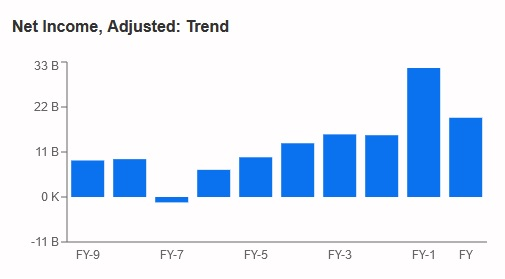

Rio Tinto’s revenues were blown out in the last two financial years as pandemic induced stimulus from many central banks across the world pushed inflation to near 35 year highs in the U.S. and boosted commodity prices. As such, Rio and many other Australian mining companies posted record profits over this period.

However, as inflation pressures cool and demand slows, iron ore, copper and lithium prices have fallen from their peak highs, with trends set to continue throughout 2023. In its stead, safe haven assets Gold and Silver have been surging to multi month highs as market participants brace for an incoming recession.

Source: Investing Pro

Source: Investing Pro

Valuations

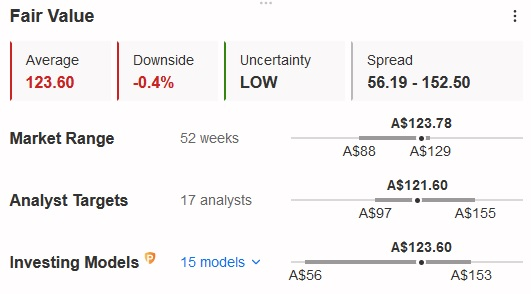

The stock is currently trading at a slight premium to the fair value of $123.6 per share (based on the average of 15 different models).

Source: Investing Pro

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any investment is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.