- Last hoorah for Q3 earnings with household-name retailers reporting

- Bouts of volatility with some of these stocks in 2022

- Take a cautious stance owning the group heading into year-end

Earnings season is not over yet. While 91% of S&P 500 companies have reported third-quarter results, more market-moving numbers will hit the tape this week in advance of the holiday season. I’m keeping my eyes on key reports from companies issuing profit numbers and guidance this morning through Thursday afternoon.

Key Reporters This Week

According to Wall Street Horizon, Walmart (NYSE:WMT) and Home Depot (NYSE:HD) give their quarterly updates this morning while other important retailers such as Lowe’s (NYSE:LOW), TJX Companies (NYSE:TJX), and Target (NYSE:TGT) report Q3 figures tomorrow.

This Week’s Earnings Calendar

Source: Wall Street Horizon

Warning Signs

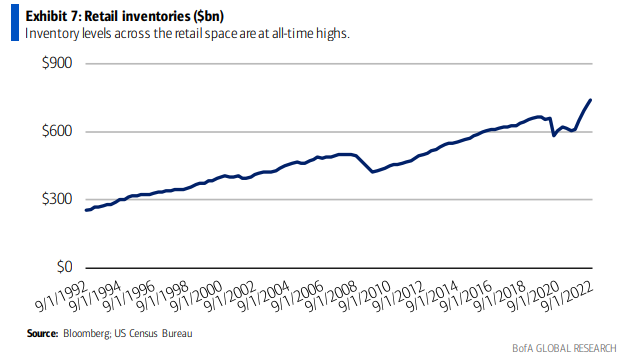

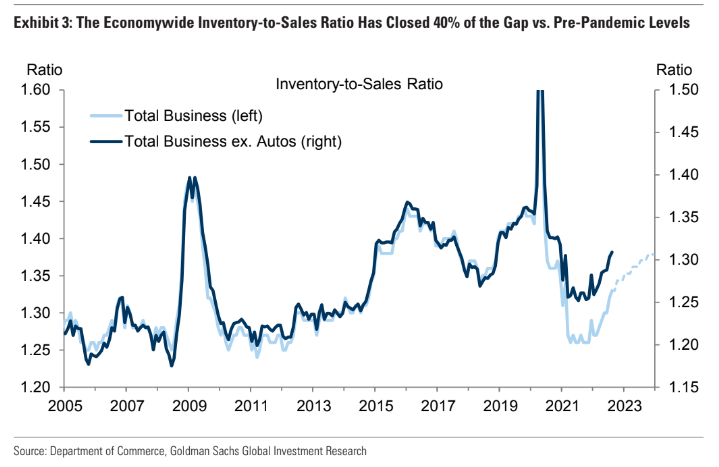

This is the final major week of earnings season, though we will still get other international companies and domestic small and mid-caps reports through month-end. Recall at times earlier this year when some of these consumer bellwether companies rocked Wall Street with disappointing sales, guidance, and, most impactfully, inventory levels. Ahead of the all-important holiday shopping weeks, it is critical that retailers manage their inventories well—and that could be challenging given a consumer who is quickly turning cautious.

Retail Inventories Surge to All-Time Highs

Source: BofA Global Research

Rising Inventories Relative to Sales

Source: Goldman Sachs Investment Research

Eyes on the Consumer

With less than six weeks until Santa’s big scene, what’s the expectation for the holiday spending season? According to the National Retail Federation, total sales are expected to be just 6% to 8% higher than a year ago. I say “just” since overall CPI inflation is 7.7%, so total real spending shows stagnant growth. Contrast that to the massive inflation-adjusted spending seen in 2021—on the order of +10%. What a difference a year makes.

Weak ‘Real’ Holiday Spending Expected

Source: National Retail Federation

Playing the Retailers

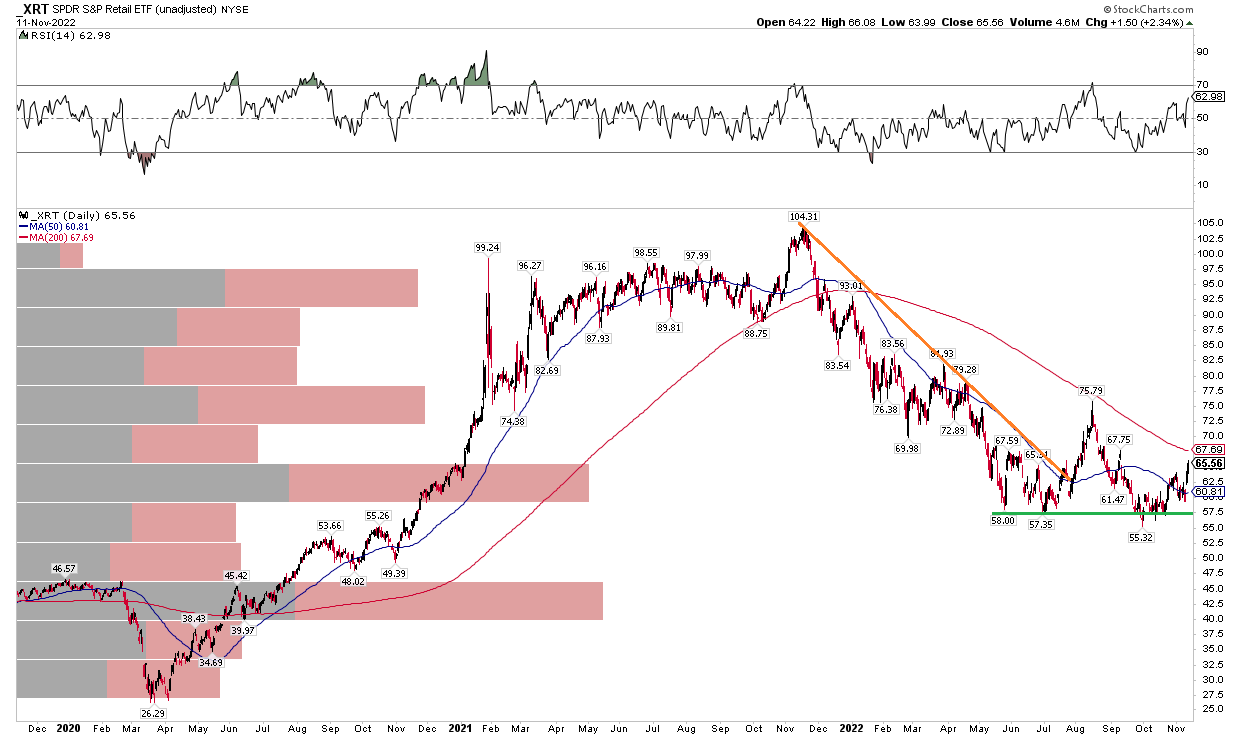

In terms of price action and the trade on retailers, I prefer to look at the SPDR S&P Retail ETF (NYSE:XRT). It is an equal-weighted fund holding dozens of major U.S. retail stocks.

Notice in the chart below that XRT has generally held the mid-$50s. It marginally made new cycle lows in October before the latest 20% advance. There could be a pause at its 200-day moving average as sellers emerged there in early 2022 and at the August peak. What’s encouraging, though, is that the XRT appears to be basing here, a bullish technical feature. A weekly close above the 200-day would support the bullish narrative.

XRT ETF: Trying to Bottom, But Some Resistance

Source: Stockcharts.com

There’s a value case to be made for retailers, too. XRT’s 97 holdings average out to a forward price-to-earnings ratio near 10 while 3-5 year EPS growth is seen near 8%, making for a good PEG ratio. The ETF pays a decent 2.6% dividend yield.

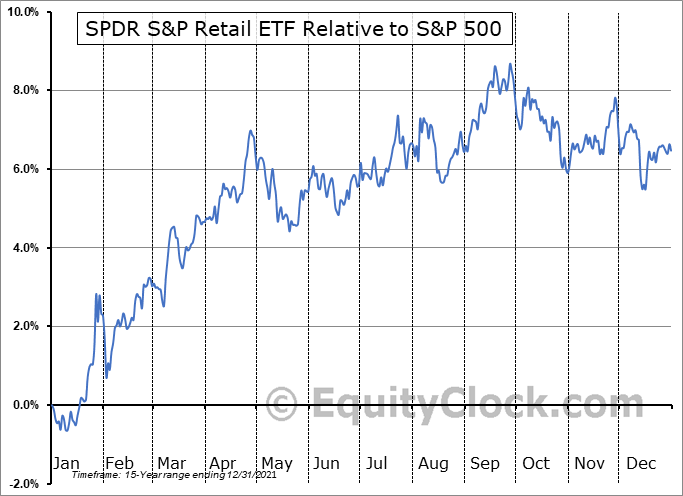

A Seasonality Check

One last chart I like to review with any ETF play is seasonality relative to the S&P 500. This is a cheery seasonal stretch for so many stocks, but active investors want to know what might provide alpha. November and December are not very strong periods for XRT versus the SPX. Ironically, it is after Christmas when retail equities really ring the register.

Q4 Not the Best Time for Retail Stocks

Source: EquityClock.com

The Bottom Line

I would shy away from going long the retailers during this busy week of earnings for the space. The chart, while looking good longer-term, might encroach on important resistance while seasonal trends are not particularly bullish for XRT.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.