The Reserve Bank of Australia (RBA) announced its November decision for monetary policy with a very familiar template. The most important part of the statement came at the end where the RBA made it clear rate cuts are on its collective mind (emphasis mine):

“At today’s meeting the Board judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate at this meeting. Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand. The Board will continue to assess the outlook, and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target.”

The RBA used similar language in the months leading up to the last cycle of rate cuts. This statement confirms the policy divergence between Australia and the U.S. This is a divergence that the RBA surely wants to leverage to further weaken the Australian dollar (Guggenheim CurrencyShares Australian Dollar (N:FXA)).

“The Federal Reserve is expected to start increasing its policy rate over the period ahead, but some other major central banks are continuing to ease monetary policy. Volatility in financial markets has abated somewhat for the moment. While credit costs for some emerging market countries remain higher than a year ago, global financial conditions overall remain very accommodative.”

In this global landscape of diverging policy, Australia definitely wants to stay on the side of accomodation:

“Inflation is low and should remain so, with the economy likely to have a degree of spare capacity for some time yet. Inflation is forecast to be consistent with the target over the next one to two years, but a little lower than earlier expected.

In such circumstances, monetary policy needs to be accommodative. Low interest rates are acting to support borrowing and spending.”

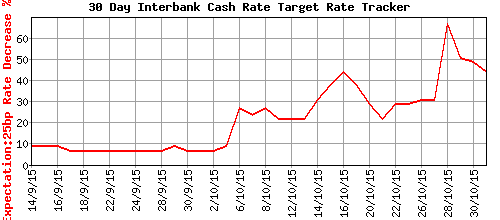

Markets were on alert for a rate cut in this meeting. In particular, the odds for a rate cut soared briefly in the wake of soft inflation data. Clearly, the RBA was all too happy to seize upon the inflation data as an excuse for setting up a new set of rate cuts.

The odds of a rate cut peaked briefly at 67% going into the November decision on monetary policy

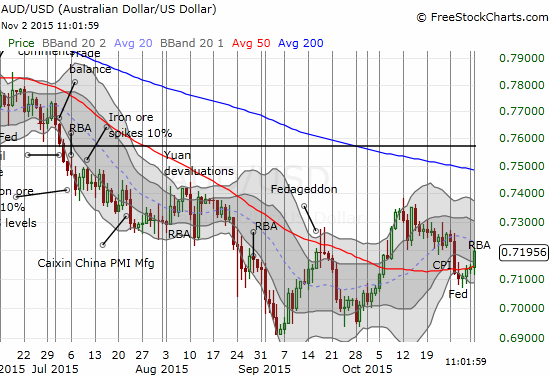

Given the RBA abstained from cutting this time around, I am not surprised to see the Australian dollar firming up a bit. This move is very likely temporary. In due time, the weakness in the currency, especially versus the US dollar, should resume. A complete reversal of the post-inflation loss would mark a reasonable spot to start/refresh short positions on AUD/USD. That spot happens to coincide with a declining 20-day moving average (DMA). The 50DMA is providing technical support for now.

The Australian dollar jumps post-RBA for now

Be careful out there!

Full disclosure: net short the Australian dollar