Due to a shortage of rental stock and high demand for houses, Australia's rental prices have increased 'dramatically' according to CoreLogic's latest rental review.

Despite quarterly growth rates starting to ease, the price of renting has risen across the country, particularly in regional areas according to CoreLogic's latest release.

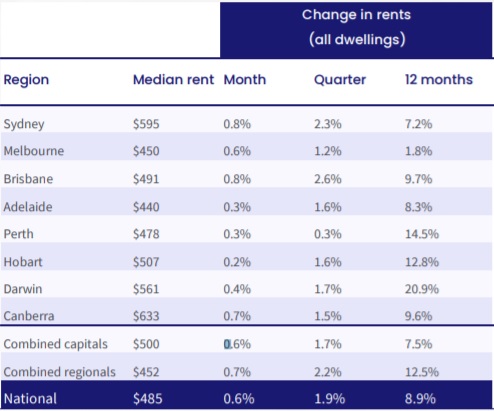

The national rental index increased 1.9% in the September quarter, slowing down slightly compared to the 2.1% rise in the June quarter.

The national rental rates are 8.9% higher year-on-year, which is the highest annual growth rate in dwelling rents since July 2008.

Regional dwellings rose at a faster pace than capital city dwelling rents over the September quarter, rising 2.2% and 1.7% respectively.

Regional rent prices have risen at the fastest annual rate since 2005, while combined capital cities have risen at the fastest rate since January 2009.

CoreLogic's Research Director Tim Lawless said that several factors, including a desire for detached housing and lack of supply, were influencing rental price growth.

"Renters are clearly looking for lower density housing options, with house rents rising at more than double the pace of units rents over the past year, however this trend is starting to narrow, with national house and unit rents rising at the same rate over the September quarter - 1.9%," Mr Lawless said.

"Another factor that may be contributing to rental demand is that more renters are working from home, which could be driving a trend towards smaller rental households as tenants look to maximise their space and working environment during COVID."

The strongest quarterly rental capital city growth was recorded in Brisbane (2.6%) and Sydney (2.3%).

Despite this, there were still suburbs in Sydney and Brisbane that escaped rental inflation, which has been attributed to high levels of development by Domain.

On the other hand, Perth has slowed down since rental prices surged earlier this year, with rental prices increasing 0.3% this quarter.

Which capital city is most affordable for renters?

Adelaide is still Australia's cheapest capital city for rentals, whereas Canberra is the most expensive.

The average cost to rent in Adelaide is $440 per week, compared to the $633 per week needed to rent a property in Canberra.

The second most affordable city is Melbourne, with the typical dwelling costing $450 per week.

"Relative to household incomes, based on data to March, Melbourne was actually the most affordable capital city to rent, with households, on average, dedicating 26% of their gross annual household income to rent a dwelling compared with the national average of 28.7%," Mr Lawless said.

"With Melbourne showing the largest exposure to overseas migration, at least historically, once international borders open we could see a more substantial boost to rental demand than other cities."

Domain research puts Melbourne ahead of Adelaide in terms of affordability, and shows Brisbane overtook Melbourne for average rent prices at the start of the year.

Both CoreLogic and Domain attribute the strong downward pressure on rents in Melbourne due to bottoming CBD demand, lack of international students, interstate migration, and ongoing Covid lockdowns.

Declining rental yield a 'continuing trend' this year

Despite rental prices rising this quarter, dwelling values increased by 4.8%, which resulted in declining gross rental yields.

According to CoreLogic, this is a trend that has continued on a monthly basis this year.

Gross rental yields have fallen by 48 basis points nationally in the past 12 months, from 3.77% to 3.29%.

The highest gross rental yield is in Darwin at 6.17%, followed by Perth (4.33%), Adelaide (4.06%), Brisbane (3.93%), Canberra (3.92%), and Hobart (3.89%).

The lowest gross rental yields are in Sydney (2.45%) and Melbourne (2.76%).

Mr Lawless expects rents nationally to rise for the 'foreseeable future', but with little increase in household incomes, meaning rental affordability will eventually become a problem.

"Data to March shows renters were spending an average of 28.7% of their household income on rental payments, which is slightly above the decade average of 28.1%," he said.

"Rental affordability has deteriorated further from there, which is likely to see more renters looking towards higher density rental options where renting tends to be more affordable."

"Rents rise at fastest annual pace since 2008: CoreLogic" was originally published on Savings.com.au and was republished with permission.