The ‘Front Page of the Internet’ is heading for a much-anticipated initial public offering (IPO). Under the ticker symbol RDDT on the New York Stock Exchange (NYSE), Reddit will likely gather $6.5 billion in valuation. According to insider sources relayed to Reuters, this would place RDDT shares within the $31 – $34 range per share.

Investors’ enthusiasm for the Reddit IPO would push it into ‘oversubscription’ territory. This means that for every share available, investors would apply to buy up to five shares. The Reddit IPO rumors popped up in December 2021, valued at $10 billion via a private fundraising round.

On February 22nd, 2024, the San Francisco-based social media company filed the S-1 registration form with the Securities and Exchange Commission (SEC) as the first step toward going public.

If materialized ending March 31st, would RDDT be a good long-term investment? Or will it suffer the volatile fate of meme stocks?

Reddit’s Fundamentals Explained

Before the emergence of Big Tech, people had to interact with each other across messengers and disjointed forums, each having specialized in specific topics, requiring individual accounts. In the 2010s, using Google (NASDAQ:GOOGL) or Facebook (NASDAQ:META) accounts as a login shortcut to such social media sites became common.

However, Reddit began streamlining the forum experience early on in 2005. Since then, the platform has grown to over 100,000 forums, dubbed subreddits, or communities, with over 267 million weekly active unique visitors. This made it the “Front Page of the Internet” as the natural evolution of content generation and exploration within a single platform.

Such was the success of Reddit that when its moderators went on a blackout on June 11th, 2023, protesting fees for third-party data access, Google search itself became crippled. In the S-1 filing, the company noted some of Reddit’s high points as a social catalyst and coordination vessel.

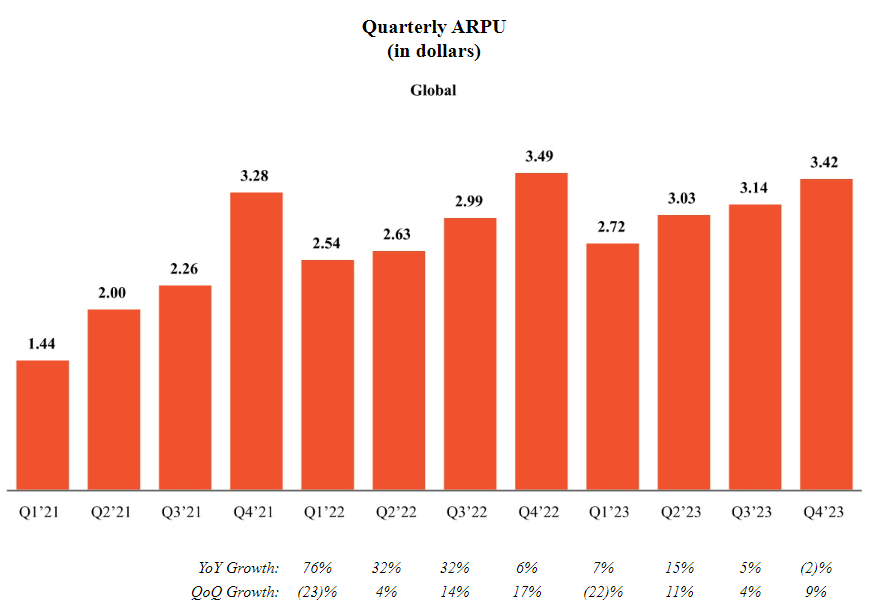

Looking to monetize this potential, Huffman is betting on a $1 trillion digital advertising market, poised to grow at $1.4 trillion in 2027 at a compound annual growth rate (CAGR) of 8%, per S&P Global Market Intelligence data.

Reddit’s Business Model Moving Forward

Despite efforts, Reddit has yet to turn in a profitable year. Although it increased its revenue to $800 million in 2023, a 20% year-over-year uptick, it still churned ~ out a $90.8 million loss. This was despite nearly doubling the research and development budget from $4.68 million to $8 million and increasing the sales and marketing budget from $1.76 million to $4.34 million.

Reddit crossed a monetization milestone with novel Community Points (CPs), exchangeable for karma and cryptocurrencies such as r/Cryptocurrency Moons (MOON). The token has risen 272% in the current bull market over one month.

However, Reddit’s main focus is the digital and search advertising market. With the rise of AI agents, Huffman believes that Reddit’s social congregation potential can be used to license data for large language model (LLM) training and refining.

Reddit is not yet involved in fee-charging for trading digital assets. This could change with “informal exchanges today of digital goods, services, and even physical goods.” Tapping into this user economy could expose Reddit to a $1.3 trillion market, which is expected to reach $2.1 trillion in 2027, at a CAGR of 12%, per the International Data Corporation (IDC) forecast.

Reddit’s Problematic Auto-Censorship Culture

Any user interacting with the platform likely encountered Reddit’s strict ideological barriers. Even outside of them, it is common for users to receive algorithmic auto-blocks on their content as it is posted or auto-removed shortly after.

This does not bode well for user retainment and growth, the primary capital driving RDDT stock value. Such is Reddit’s tarnished reputation, and X’s account under the moniker @reddit_lies has already accumulated over 328,000 followers. Huffman acknowledges that Reddit’s bottom line relies on a “strong brand and reputation.”

More importantly, there has yet to be a proof of concept for monetizing user data. Huffman, too, recognizes the risk of “timely and effectively scaling and adapting our existing technology and infrastructure.”

Some r/WallStreetBets users have already taken the mindset of shorting RDDT stock. However, to preempt the sentiment rising further, Reddit is allocating 8% of shares to moderators and the platform’s most active users. Going outside the norm, this indicates that the Reddit IPO is a unique market event for precarious social capital.

***

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.