With less than a week until the unofficial start of Wall Street's second-quarter earnings season, investors are bracing for what may be the first earnings recession since 2016.

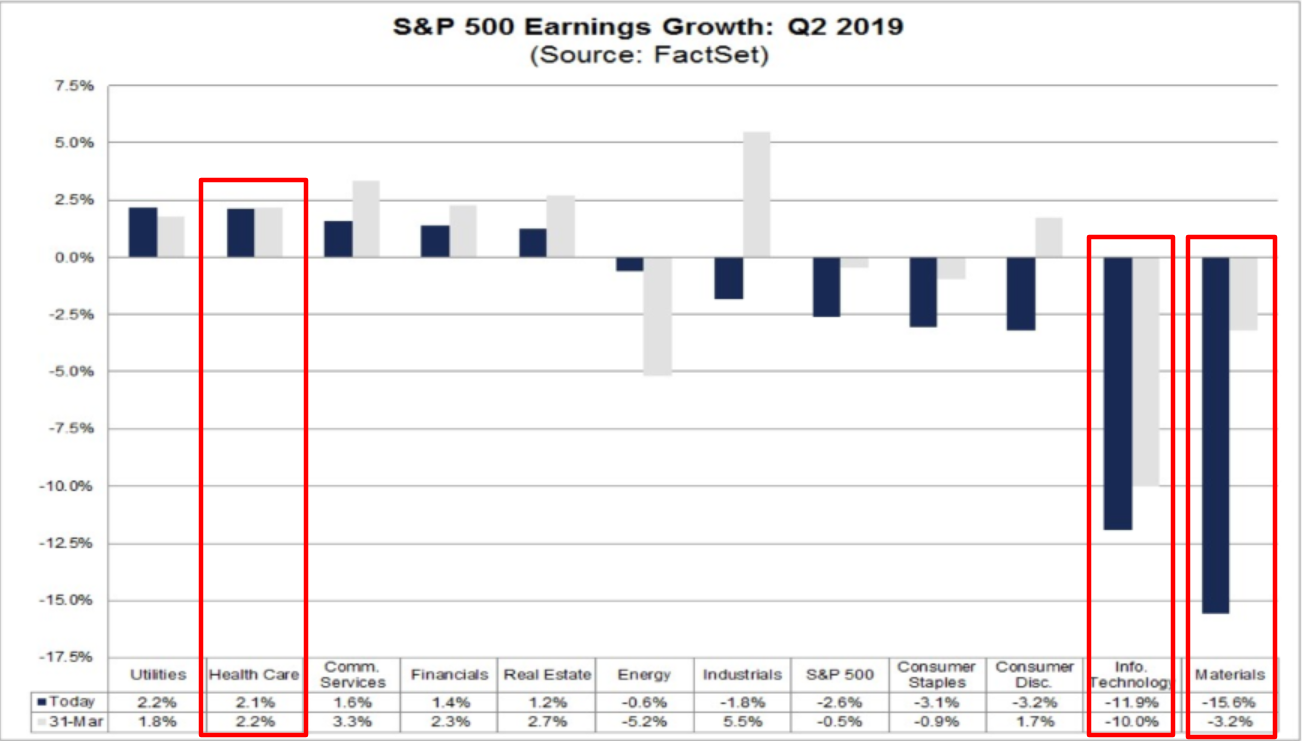

After earnings per share (EPS) contracted 0.3% in the first quarter, FactSet data show analysts expect second quarter S&P 500 earnings to fall by 2.6% on a year-over-year (Y-o-Y) basis. If confirmed, it would also represent the largest annualized drop in earnings reported by the index since Q2 2016, when it fell 3.2% FactSet notes.

Relative to recent quarters, a larger percentage of S&P 500 companies have lowered the bar for earnings for the April-June period. Of the 114 companies that have issued Q2 EPS guidance, 88, or 77%, released negative forecasts. The only time the number was higher was in the first quarter of 2016, which saw 92 companies issue negative guidance.

At the sector level, six are projected to report a decline in Y-o-Y earnings, led by Materials and Information Technology. On the other hand, Utilities and Health Care are the strongest of the five sectors predicted to report annualized earnings growth.

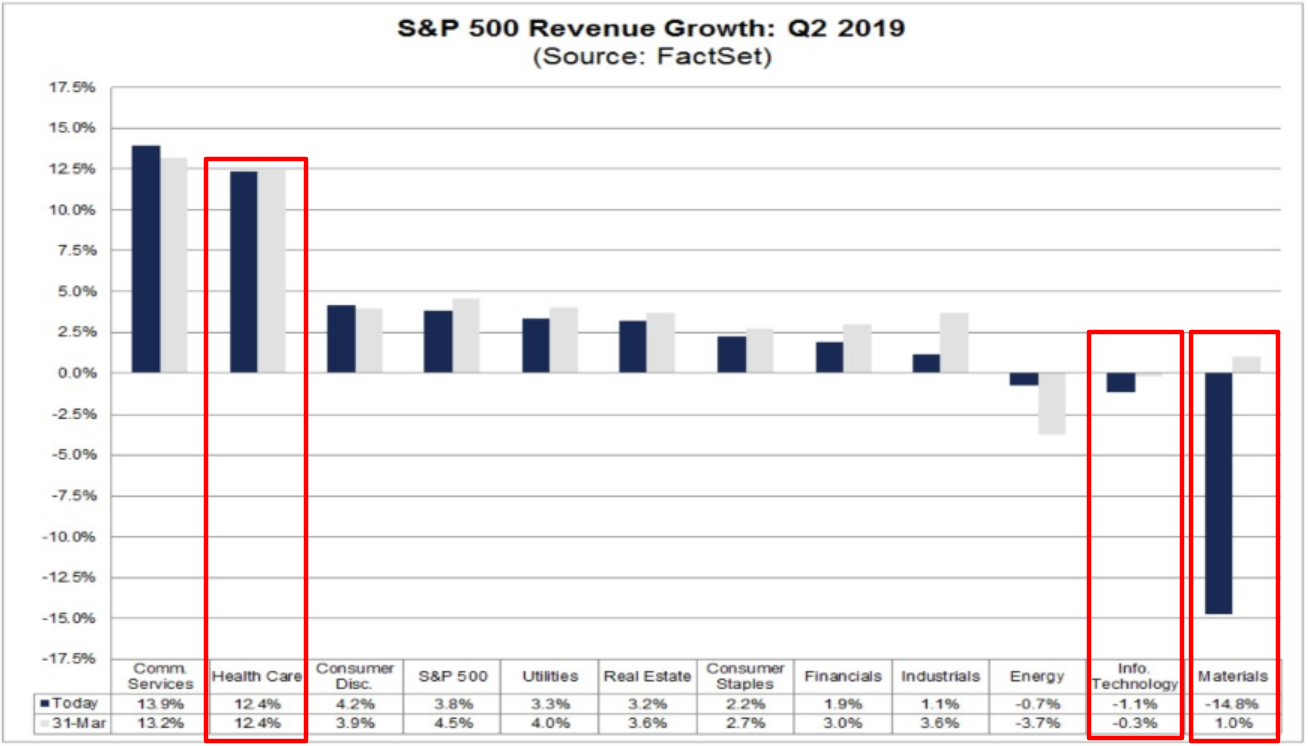

Revenue growth expectations of 3.8% Y-o-Y are just as worrying. If confirmed, Q2 would mark the index’s lowest revenue growth rate since the third quarter of 2016. Three of the eleven sectors are predicted to report a Y-o-Y drop in revenue, driven lower once again by the Materials and Information Technology sectors. Meanwhile, eight sectors are projected to report Y-o-Y revenue growth, propelled by the Communication Services and Health Care sectors.

Q2 Earnings Season: 2 Sectors To Avoid

1. Materials: Sliding Commodity Prices

The Materials sector is expected to report the largest Y-o-Y earnings decline of all eleven sectors, -15.6%, as the price of commodities like oil and copper slide. The sector is also projected to post the highest Y-o-Y decline in revenue at -14.8%.

It is anticipated that three of the four sub-industries will report a decline in earnings for the quarter, with Metals & Mining forecast to drop the most at a whopping -60%. While the anticipated declines in earnings from Chemicals and Containers & Packaging are -8% and -7% respectively.

Overall, 20 of the 28 companies (71%) in the Materials sector have seen a decrease in their mean EPS estimate, led by Freeport-McMoran (NYSE:FCX) (to $0.02 from $0.13), DuPont (NYSE:DD) (to $0.97 from $1.87) and Mosaic (NYSE:MOS) (to $0.33 from $0.58).

2. Information Technology: U.S.-China Trade War

The second largest Y-o-Y earnings drop is expected to come from the Information Technology sector at -11.9%. The sector is also forecast to suffer the second-largest Y-o-Y drop in revenue at -1.1%, with the impact of the U.S.-China trade war taking a toll.

The Information Technology sector witnessed an unusually high number of companies issuing negative guidance for the quarter. Overall, 26 companies in the sector have warned that earnings may miss, which is above the 5-year average of 20.

Two of the six sub-industries in the sector are expected to report a decline in earnings for the quarter. Indeed, both are estimated to report double-digit earnings declines: Semiconductors & Semiconductor Equipment (-31%) and Technology Hardware & Equipment (-22%).

At the company level, Micron Technology (NASDAQ:MU) is predicted to be the largest contributor to the decline in earnings for the sector. The Idaho-based memory and storage company reported EPS of $1.05 for Q2 2019 on June 25, down 39% from EPS of $3.15 in the same quarter a year-earlier. Revenue totaled $4.79 billion, down from $7.80 billion in the year-ago period.

Q2 Earnings Season: 1 Sector To Buy

1. Health Care: Rising Spending

The Health Care sector is expected to report the second-highest Y-o-Y earnings growth of all eleven sectors at +2.1%. With health care spending rising, revenue is projected to enjoy the second-biggest Y-o-Y increase at +12.4%.

At the sub-industry level, five of the six sub-industries in this sector are forecast to report growth in EPS, led by the Health Care Providers & Services industry (15%). Growth in sales for the quarter is also expected from five of the sub-industries with Health Care Providers & Services anticipating a double-digit increase (+18%).

At the company level, Cigna (NYSE:CI) and CVS Healthcare (NYSE:CVS) predicted to be the largest contributors to revenue growth.