- The biotech sector looks ripe for a rebound

- Vertex Pharmaceutical has been a strong outperformer since 2022

- Strategic advantages and strong financial health should allow VRTX to continue to outperform

The biotech sector had a challenging year in 2021, with losses deepening through mid-2022, reversing the stratospheric rise seen in the face of the outbreak of the COVID-19 pandemic in 2020.

The SPDR S&P Biotech ETF (NYSE:XBI), which includes the sector's largest companies, collapsed by nearly 65% between its all-time high in February 2021 at $174.79 and the low in May 2022 at $61.78.

However, biotech stocks then rebounded slightly in the summer of 2022 and have since been in a consolidation trend.

As the Fed has just signaled the prospect of a pause in rate hikes, the skies are clearing for biotech stocks.

We thought it is wise to take a closer look at this sector to identify the stocks best positioned to benefit from a recovery.

We used the InvestingPro screening tool to identify companies that deserve a closer look, and the Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) stock stood out.

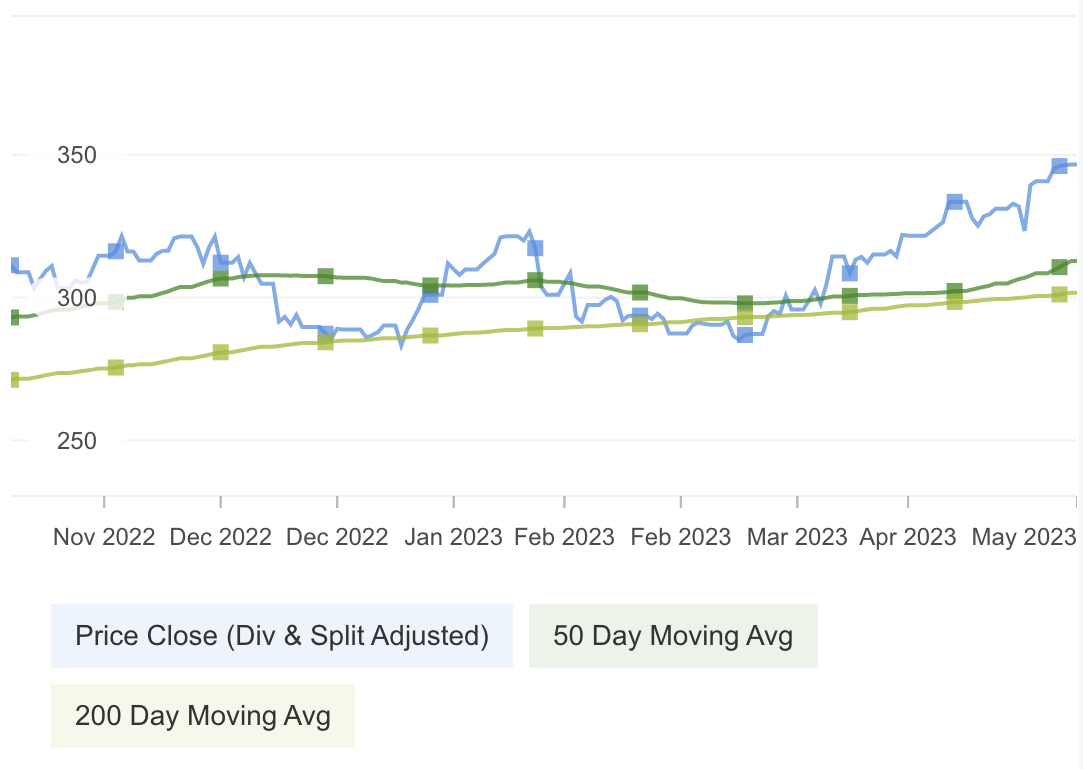

As seen in the chart below, the stock is currently in breakout mode, trading above its 50 and 200-day moving averages (MAs).

After +31.5% In 2022, Vertex Soars 20% In 2023

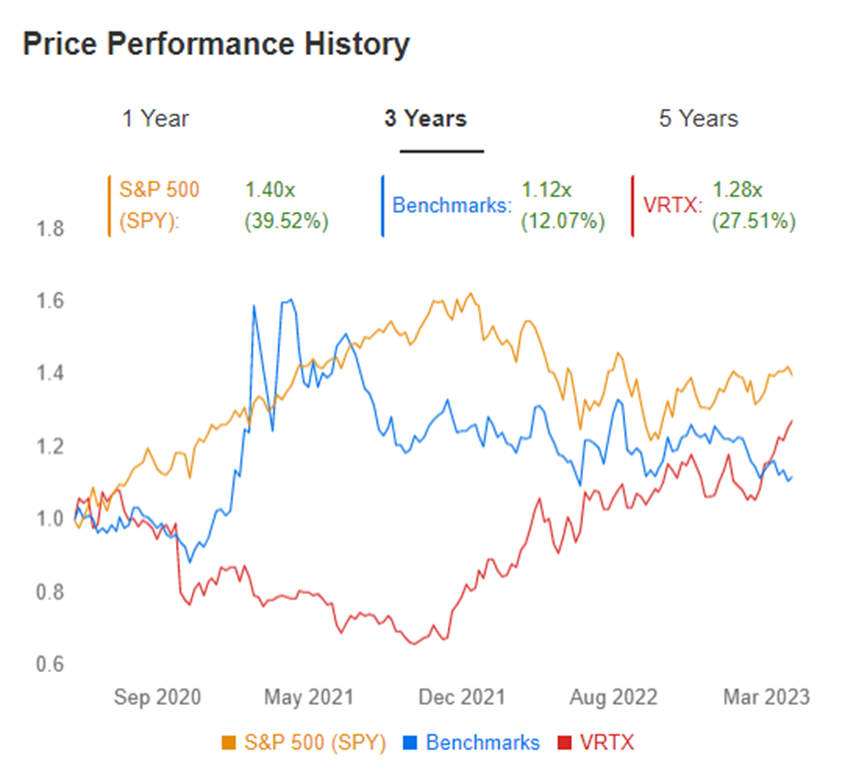

Vertex Pharmaceutical stock has primarily outperformed the biotech sector (as measured by the XBI) since 2022.

While XBI posted a meager rebound in the summer of 2022 and has since stabilized, Vertex shares posted a 31.5% gain in 2022 and are currently up 19.9% in 2023 based on the May 3 close at $346.36.

Source: InvestingPro

However, investors should note that Vertex's future performance relies on solid foundations, with a leading position in specific markets.

The company's development pipeline looks promising and has solid financial health, unlike many companies in the sector.

Vertex’s Monopoly and a Promising Pipeline

Vertex Pharmaceuticals' biggest strategic advantage currently is that it is the only company with approved therapies to treat the underlying cause of cystic fibrosis while its competitors are still in trials.

The company's leadership in this area should provide some protection against an economic downturn.

Moreover, the company does not intend to stop there, as it has a rich pipeline with several promising projects.

In particular, Vertex plans to launch a vanzacaftor-based triple therapy that could help patients who have given up on the company's other drugs due to their side effects.

Vertex is also awaiting regulatory approval for its gene-editing treatment for sickle cell disease and transfusion-dependent beta-thalassemia, which is expected to become its next multi-billion dollar product.

The company is also developing the promising opioid-free pain drug VX-548 and three programs focused on curing type 1 diabetes. Finally, Vertex and CRISPR Therapeutics are collaborating on a gene-editing program that will not require immunosuppressants.

In other words, Vertex's diverse pipeline allows it to potentially claim leadership in several therapeutic areas besides cystic fibrosis.

Confidence-Building Fundamentals

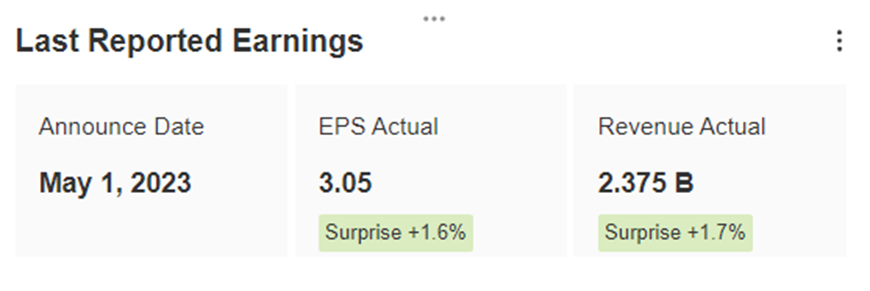

Vertex's Q1 2023 results released on Monday exceeded expectations. EPS reached $3.05, 1.6% ahead of consensus, while revenues reached $3.375 billion, beating expectations by 1.7%.

Source: InvestingPro

In addition, InvestingPro data also shows that analysts expect EPS and revenue to rise further in the current quarter, forecasting EPS of $3.88 and revenue of $2.42 billion in the next release due on August 3.

Source: InvestingPro

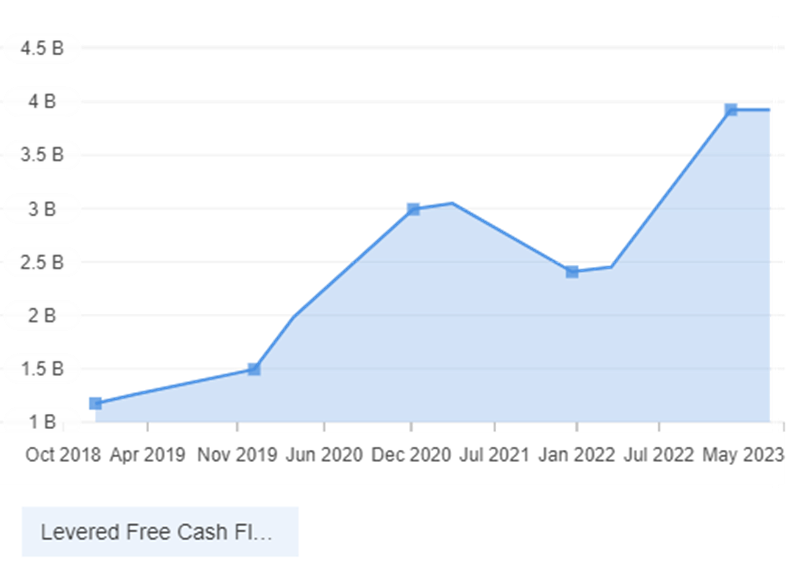

A closer look at the financials also shows that Vertex Pharmaceutical has seen a solid increase in free cash flow in recent years, currently at $3.925 billion.

Source: InvestingPro

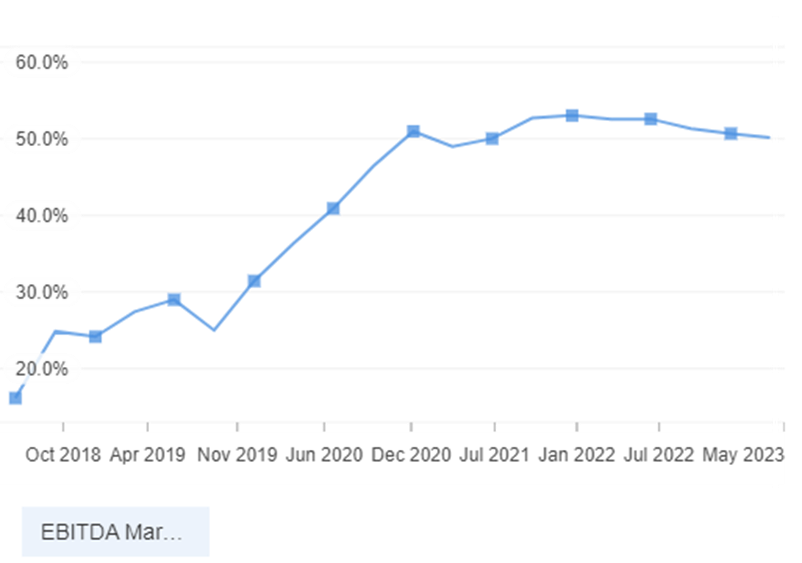

The EBITDA margins are also very strong, stabilizing at over 50% in recent years after a strong increase between 2018 and 2020.

Source: InvestingPro

Vertex's strong profitability and ability to generate cash are advantages that set the company apart from others in the biotech sector and make it a stock to consider for a long-term investment.

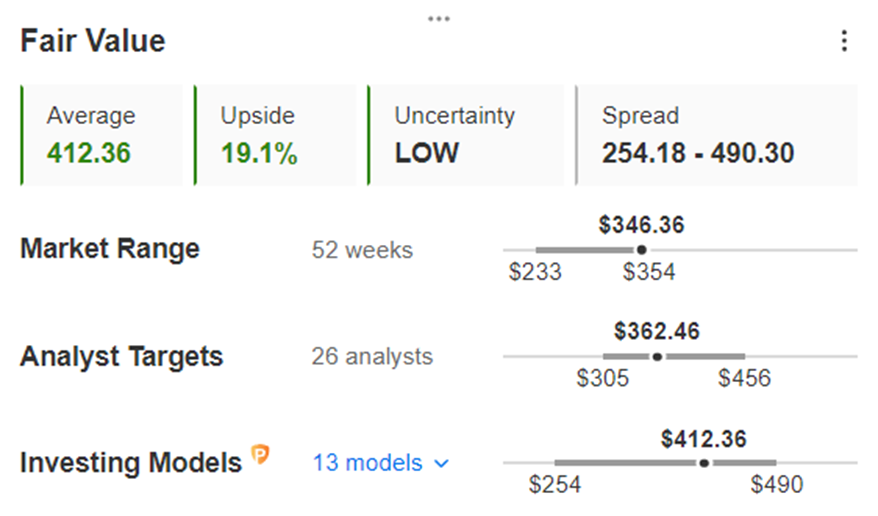

Finally, it is worth noting that the InvestingPro Fair Value of Vertex Pharmaceuticals shares, based on 13 recognized financial models, also suggests a buying opportunity.

Source: InvestingPro

Indeed, the Fair Value stands at $412.36, or more than 19% above Wednesday night's closing price.

However, the 26 analysts who follow Vertex stock are sending a more cautious message, with an average 12-month target of $362.46, or a more limited upside potential of 4.6% based on the May 3 closing price.

Conclusion

In conclusion, Vertex Pharmaceuticals stock has a clear long-term uptrend, which is justified by its leading market position.

And despite the share's sharp rise since the beginning of 2022, the company's financial health and promising pipeline should allow it to continue outperforming the biotech sector and stock markets in general between now and the end of the year.

If you’re looking for actionable trade ideas and investments to navigate the current market volatility, the InvestingPro tool enables you to identify winning stocks at any given time.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Disclosure: The author does not own any of the securities mentioned.