Originally published by guppytraders.com

The NYMEX oil price pulled back to the long term uptrend line and then developed a strong rebound rally. This behaviour is consistent with a continuation of the long term trend. It suggests that the recent pullback in the oil price is not an opportunity to go short in anticipation of a trend change. I

The price has pulled back from $74 to around $70 This pullback takes place within the environment of a well established uptrend. Investors watch for the opportunity to add to long positions as the price rebounds from any of the three support features on the oil price chart. The upside target for the trend continuation is $76..

The first support feature is the long term support level near $65. This level was the support base for the most recent strong rebound rally.

Oil has a well established pattern of moving in trading bands. The first trading band starts with the strong support level near $43 and resistance near $54. This makes the trading band around $11 wide. Applying the same trade band projection methods gives a long term target near $76.

The second feature is the location of the uptrend line. It was tested successfully in 2018 June and acted as a base for the recent rally rebound. The current trend line value is around $68.

The third feature is shown with the Guppy Multiple Moving Average (GMMA) indicator.

The long term group of averages is well separated and this shows strong and consistent investor support for a rising trend. When price retreats, investors come into the market as buyers. This is the most consistent trend support behaviour shown in the GMMA indicator on the oil chart in nearly a decade.

The degree of separation between the long term and short term GMMA is also steady. This consistent degree of separation is a characteristic seen with stable trends. This again suggests that the current retreat is temporary rather than the beginning of a trend change..

The short term group of averages which reflects the way traders are thinking shows a low level of volatility. This group is not characterised by rapid compression and expansion. This shows that traders are buyers whenever the price falls. This tells us that traders are also confident that the up trend will continue.

These support features and the trend strength features all suggest that the oil price is experiencing a temporary retreat. The longer term trading band target is near $76 and potentially higher. It is higher because the $76 level has no history of providing strong support or resistance.

We use the ANTSYSS trade method to extract good returns from this trend behavior.

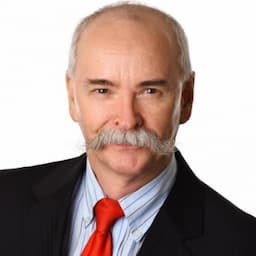

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.