This article was written exclusively for Investing.com

- New highs in coffee futures

- Dry conditions in Brazil

- The Brazilian real rises

- Forward curve remains bullish

- Levels to watch

Soft commodities can be highly volatile. It is not unusual for prices to double, triple or half over short horizons. Coffee futures trade on the Intercontinental Exchange and is a leading member of the soft commodity sector. The world’s leading producer and exporter of Arabica coffee beans is Brazil.

In April 2019, nearby ICE coffee futures traded to the lowest price since July 2005 when they reached 86.35 cents per pound. Since then, the soft commodity has made higher lows and higher highs. Last week, the price traded to over the $1.60 per pound level for the first time since 2016.

Coffee is now approaching a critical technical resistance level at the November 2016, $1.76 per pound peak. In 2011, the price traded to over $3 per pound. Rising inflationary pressures, weather conditions, and a developing trend in the currency market have created a potent, bullish path for coffee futures. A break above the November 2016 high could send coffee percolating over $2 and perhaps $3 per pound over the coming months.

From 2008 through 2012, a sector-wide rally in commodities sent coffee from $1.0170 to $3.0625 per pound. Central banks and governments stimulated the global economy with monetary and fiscal stimulus following the 2008 global financial crisis, leading to inflationary pressures. Commodity prices rallied and reached highs in 2011 and 2012.

The 2020 worldwide pandemic is far different than the 2008 crisis, but the monetary and fiscal policy tools are the same. The only difference is the levels are far more substantial today than they were back then. Rising inflationary pressures could continue to push raw material prices higher, and coffee is no exception. The rally in coffee could just be getting underway as the price approaches a crucial technical level at $1.76 per pound.

New highs in coffee futures

July coffee futures have been making higher highs and higher lows over the past months. Last week, they hit the highest price since November 2016, when they traded to a peak of $1.6315 and settled at $1.6235 on May 28.

Source: CQG

The chart highlights the bullish trading pattern in the coffee futures market. After a dip in late March took the price to a low of $1.2250 per pound, the price made a series of higher highs, culminating in last week’s multi-year peak.

Open interest, the total number of open long and short positions in the ICE coffee futures market, has also been making higher lows and higher highs throughout 2021. The metric stood at 259,120 contracts on Dec. 31, 2020 and was at the 287,557 level at the end of last week. July futures were at the $1.3125 level at the end of last year.

Rising open interest and an increasing price tend to be a technical validation of bullish price action in a futures market.

Dry conditions in Brazil

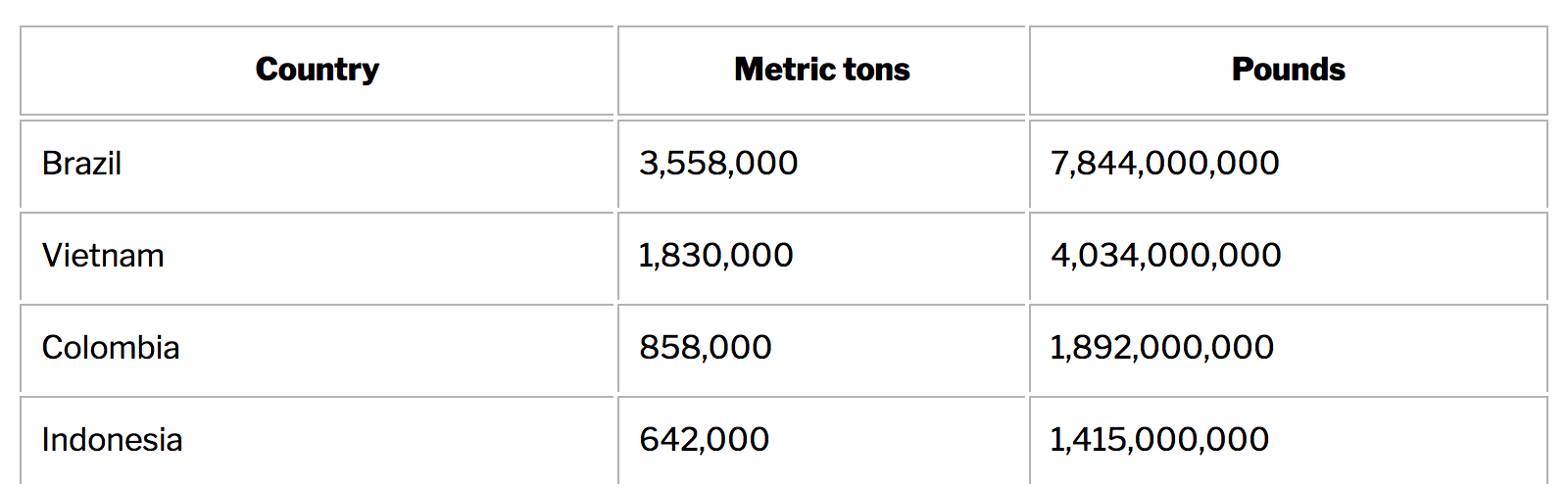

Brazil is the 800-pound gorilla in the coffee market. The South American nation is, by far, the world’s leading producer and exporter of beans.

Source: elevencoffees.com

Brazil’s output is nearly double that of second-place Vietnam. Moreover, Brazil produces more coffee than Vietnam, Colombia, and Indonesia combined.

The weather in Brazil has been dry, which is a problem for coffee production. Drought conditions have supported the price over the past weeks. Meanwhile, as COVID-19 continues to rage in Brazil, supply chain issues have also pushed the price of coffee higher.

The Brazilian real rises

As the leading producer of coffee beans, local Brazilian output costs are in the nation’s local currency, the real. The dollar is the world’s reserve currency and the benchmark pricing mechanism for the coffee futures market and many physical transactions.

When the value of the real rises, it makes producing a pound of coffee more expensive and puts upward pressure on the soft commodity’s price. Since March, the real has appreciated against the US dollar.

Source: CQG

The chart above, of the Brazilian real versus the US dollar exchange rate, shows the rise from $0.17105 on Mar. 8 to the most recent high of $0.19165 on Mar. 28. The over 12% move has increased the cost of production as the agricultural commodity is labor-intensive.

Forward curve remains bullish

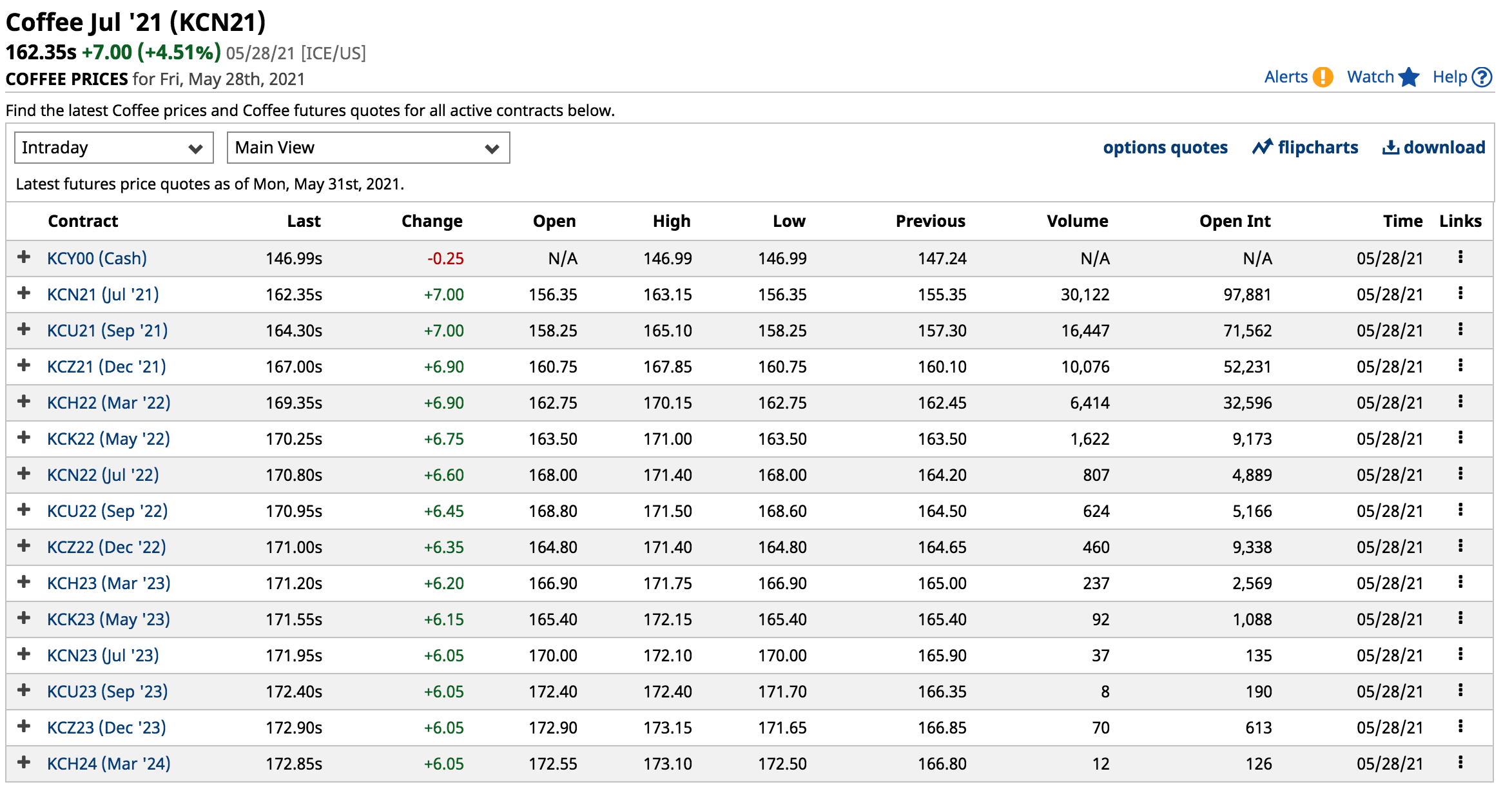

Term structure refers to the price differentials for delivery for different periods.

Source: Barchart

The chart above illustrates that coffee is in a steady contango from July 2021 through December 2023. Prices are progressively higher, indicating that the market is in supply-demand equilibrium, and traders, producers, consumers, and speculators expect them to remain firm.

While coffee for July delivery moved about the $1.60 level for the first time in half a decade last week, the price is already north of the $1.70 level for delivery in the first half of 2022 through early 2024. Coffee’s term structure is a bullish sign for the soft commodity.

Levels to watch

Coffee has nearly doubled from the April 2019 86.35 low. However, the bullish percolation may be just beginning. The next critical test is at the November 2016, $1.76 high.

Source: CQG

The quarterly chart shows that above $1.76, the next upside targets are the 2014, $2.2550 peak and the 2011, $3.0625 high. Quarterly price momentum and relative strength indicators are trending higher and remain bullish but have not entered overbought conditions above the $1.60 level.

Rising inflationary pressures, drought conditions in Brazil, and a rising Brazilian real versus the US dollar are a potent bullish combination for the coffee market. The rally in coffee could have a long way to run before it finds a top.

Bull markets rarely move in a straight line. Corrections can be sudden and severe. Looking to buy coffee futures or the iPath® Bloomberg Coffee Subindex Total Return(SM) ETN (NYSE:JO) on dips could be the optimal approach to the coffee market over the coming months.