-

The Q3 2024 reporting season was, by one measure, the best in three years

-

Optimism abounds across Wall Street research desks as year-end 2025 S&P 500® forecasts make their rounds

-

Investors should heed macro and company-specific risks looming as the year draws to a close

The S&P 500 earnings growth rate will likely come in just below the 6% mark for the third quarter. That’s rather solid considering that analysts were expecting the Q3 EPS rate of increase to be under 5% when the reporting season began. Looking ahead, the bulls will have something to cheer about if the consensus current quarter’s profit forecast verifies.

According to FactSet, the street sees a Q4 EPS growth acceleration, rising to 12%. That trajectory is then expected to persist through 2025; the per-share operating earnings growth pace for the S&P 500 is currently seen at 15%.

Strategists’ Eyes All Aglow

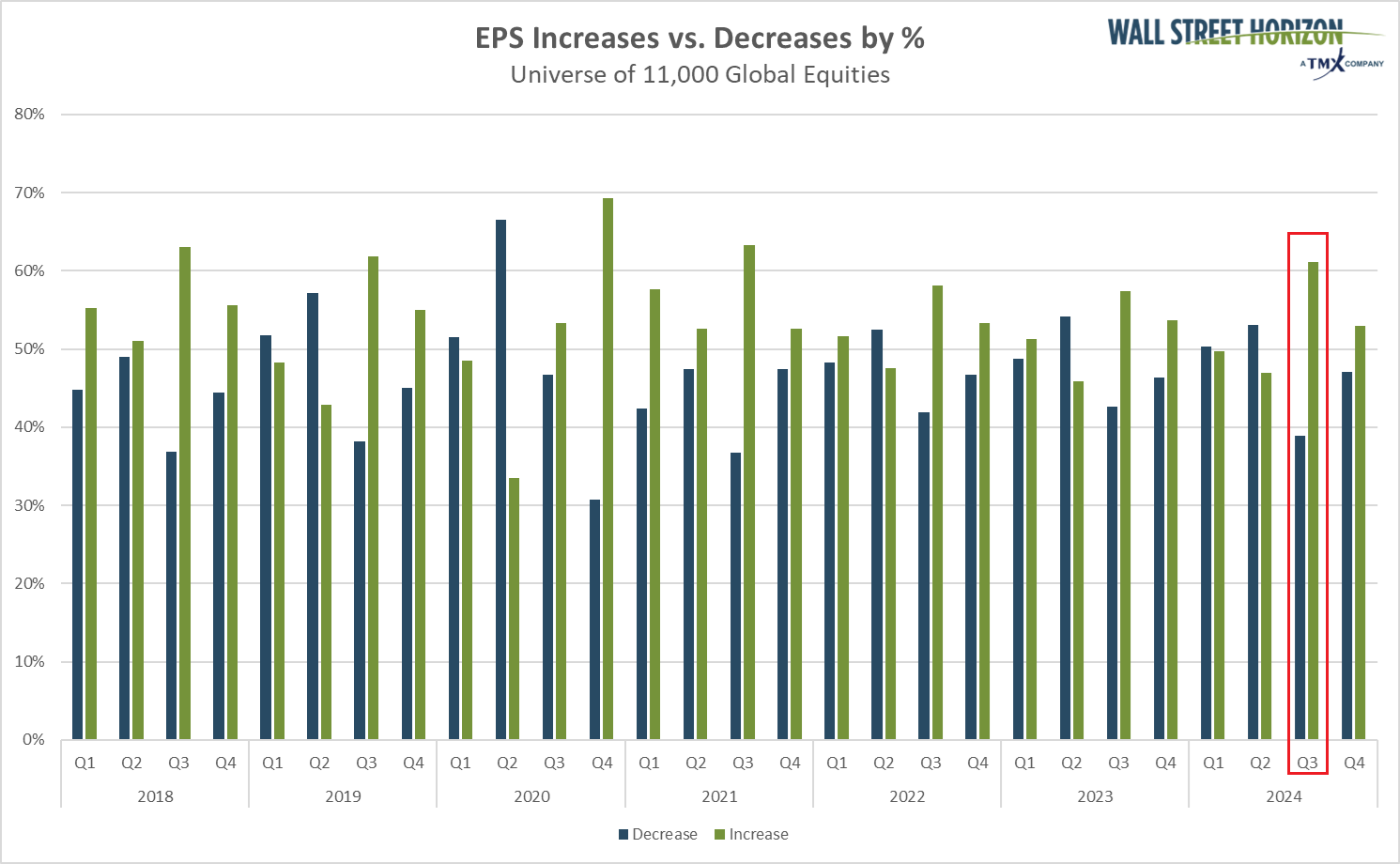

Some pundits claim that a mid-teens EPS growth rate is a high bar, and while historical trends point to earnings estimates generally declining through the first half of a calendar year, companies around the world are showing investors the money, so to speak. Our data reveal that a net 22% of firms reported higher earnings figures in Q3 compared to the same period a year earlier. That’s the highest net-increase percentage since the third quarter of 2021, back when interest rates were extremely low and speculation ran rampant across global markets.

In fact, on a rolling four-quarter basis, the percentage of EPS increases versus decreases has hit 5.6%, the best in three years.

The Most Net EPS Increases Last Quarter Since Q3 2021

For investors, determining whether these trends are signal or noise is the big conundrum. Consider that when companies report better earnings, it could be a sign of too much optimism. After all, stocks tend to discount news, particularly backward-looking trends like a previous period’s earnings profile. It seems fair to say, however, that Wall Street has increased confidence in what may lie ahead over the next 13 months.

Stockings Stuffed with Positive Predictions

Sellside S&P 500 price targets have come in left and right since mid-November. To get a flavor of the numbers, Goldman Sachs (NYSE:GS) predicts the S&P 500 to end 2025 at 6500, up about 9% from current levels. Wells Fargo (NYSE:WFC) has a 6600 forecast. Deutsche Bank (ETR:DBKGn) even tossed out a 7-handle (7000).

Even the best strategists concede that it’s a bit like throwing darts, but gauging year-end price forecasts at least offers a sense of sentiment. Moreover, the commentary around such estimates provides context of where macroconditions stand heading into the often-quiet holiday season across financial markets.

A Reversal from Previous Years’ Frosty Forecasts

A sanguine sellside is a change from generally sour outlooks this time a year ago and in late 2022. Year-end 2024 S&P 500 targets implied a low-single-digit price gain for the US large-cap index. They will likely turn out to be wrong; through late November, the S&P 500 was up more than 25% year to date. As for 2023, right after the 2022 bear market ended, strategists were historically bearish, cumulatively predicting an S&P 500 down year for the first time in decades. The S&P 500 returned better than 20% in 2023.

So, maybe bulled-up forecasts today are cause for caution. Consider the potential headwinds – the US Dollar Index notched two-year highs before Turkey Day and The Conference Board’s investor sentiment turned downright giddy midway through November, all while the Economic Uncertainty Index hit its highest mark in about four years.

Unwrapping Business Trends in the Weeks Ahead

Indeed, corporate America has its work cut out for them if they are to continue navigating macro unease well over the next handful of quarters. It’s important to point out that though we are in the last month of the year, December is busy when it comes to corporate events, including conferences.

This week and next feature a host of major events before we call it a wrap on 2024. Now would seem to be the ideal time for executives to, like Wall Street pros, provide their outlook on macro and micro trends impacting their earnings power.

Counting on the Consumer

Ultimately, it might simply come down to the health of the labor market as to whether we get a lump of stock-market coal next year or if the good-tidings train keeps chugging. Workers have enjoyed positive inflation-adjusted wage growth each month since the middle of 2023.

Comments from Walmart’s (WMT) chief executive officer underscored consumer resiliency, although Target (NYSE:TGT) reported a disappointing quarter. In aggregate, the tone among retailers was decent, and that’s perhaps reflected best in the SPDR® S&P® Retail ETF (XRT) hitting its highest price since January 2022 last week.

Bundle Up, Or Will a Warm Economy Endure?

Arguably the biggest X-factor in the past few years, the Fed, has been absent thus far in this week’s update. Wouldn’t it be nice if monetary policy became a secondary or tertiary variable in 2025? Focusing more on corporate profit potential and risks, and not dissecting what the FOMC’s words may mean for markets, would be a welcome change.

As it stands, rate traders anticipate perhaps a few more rate cuts between now through December 2025, down from upwards of 10 total quarter-point eases when the Fed’s cutting campaign began in September.

A less accommodating Fed would seem to be a risk, but it may just reflect more economic optimism about the year ahead. Also, European companies could benefit from more aggressive cuts by the European Central Bank (ECB), as the Eurozone combats more sluggish growth compared to healthy economic expansion trends in the US.

The Bottom Line

‘Tis the season for Wall Street prognostications. S&P 500 year-end 2025 price targets point to a merry and bright next 13 months, but there are plenty of risks for both investors and corporate executives to weigh.An active conference circuit should help paint the picture for next year before the Q4 earnings season begins in mid-January.