Global Markets

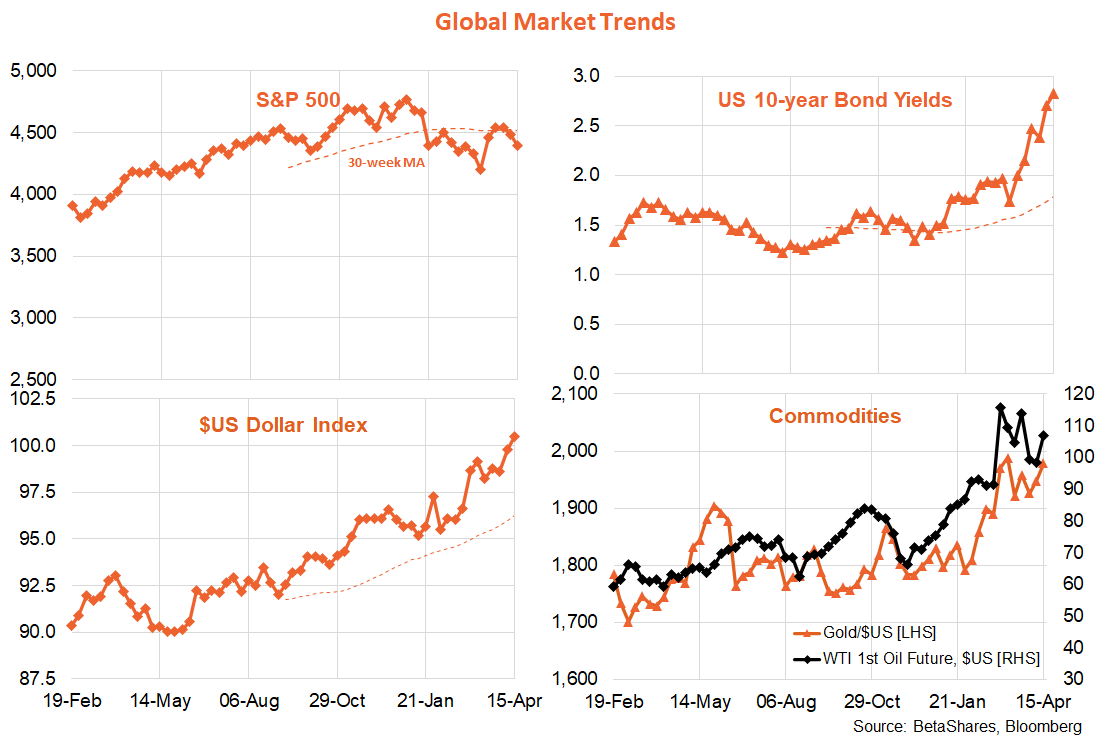

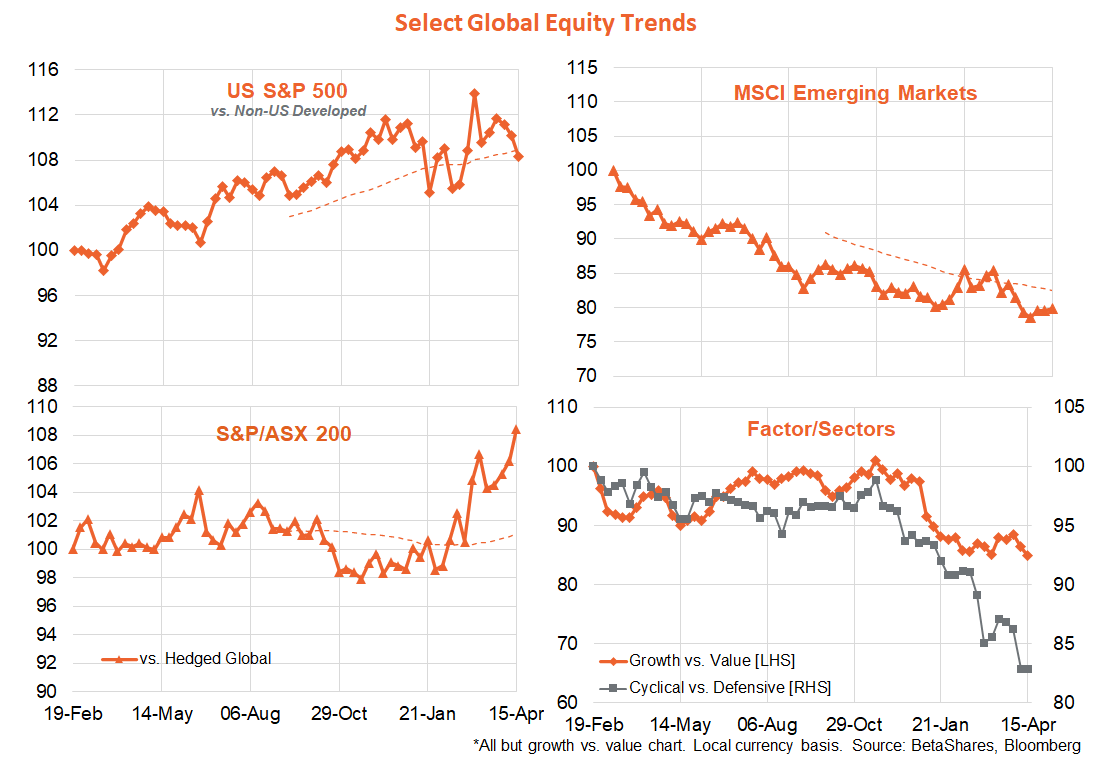

Higher bond yields and Oil prices caused global equities to remain on the defensive last week, with further hawkish talk from the Federal Reserve, OPEC stubbornness, ongoing Russia-Ukraine hostilities and uncomfortably high US inflation. One glimmer of hope was talk that U.S. inflation may at least have “peaked”.

Chicago Fed President Charles Evans joined the chorus of Fed speakers strongly hinting at a 0.5% U.S. rate hike next month, while OPEC’s refusal to consider a larger increase in output – along with emerging fears of an eventual EU ban on Russian oil – saw oil prices push back above $US100/barrel. U.S. 10-Year bond yields surged further, with the much watched U.S. 10-year vs 2-year yield spread now firmly back in positive territory.

The March U.S. CPI report was mixed news for the market. Headline and core inflation was broadly as bad as the market feared, with annual gains of 8.5% and 6.5% respectively – with the former obviously not helped by the surge in petrol prices. But a further decline in used car prices – which helped hold down core inflation – has sparked talk that U.S. annual inflation has at least likely “peaked”.

Of course, while inflation may well have peaked, it remains to be seen how quickly it will fall – and it is likely to stay high enough for long enough to justify aggressive Fed tightening at least over the next few meetings, and still most likely the remainder of the year. Indeed, it’s worth noting that wage inflation remains very high and past house price increases are starting to feed through into higher rents.

Also of note globally last week, both the Bank of Canada and the Reserve Bank of New Zealand hiked rates by an aggressive 0.5%.

In terms of the week ahead, a key mid-week speech by Fed Chair Powell is likely to be the highlight – though I suspect markets are now well prepared for further likely hawkish talk, with hints of a 0.5% move next month and impending balance sheet rundown. The U.S. Q1 earnings reporting season also intensifies this week, with key reports from the likes of Tesla Inc (NASDAQ:TSLA) and Netflix Inc (NASDAQ:NFLX). So far at least (with 7% of S&P 500 companies having reported), earnings beats are in line with their long-run average, suggesting only modest moderation in performance so far compared to the very buoyant above-average earnings beats last year.

Perhaps of most market concern, however, will be the Russia-Ukraine conflict, with the former seemingly preparing for a major new assault on the eastern Donbas region – which could see oil prices move higher and/or talk of even tougher sanctions.

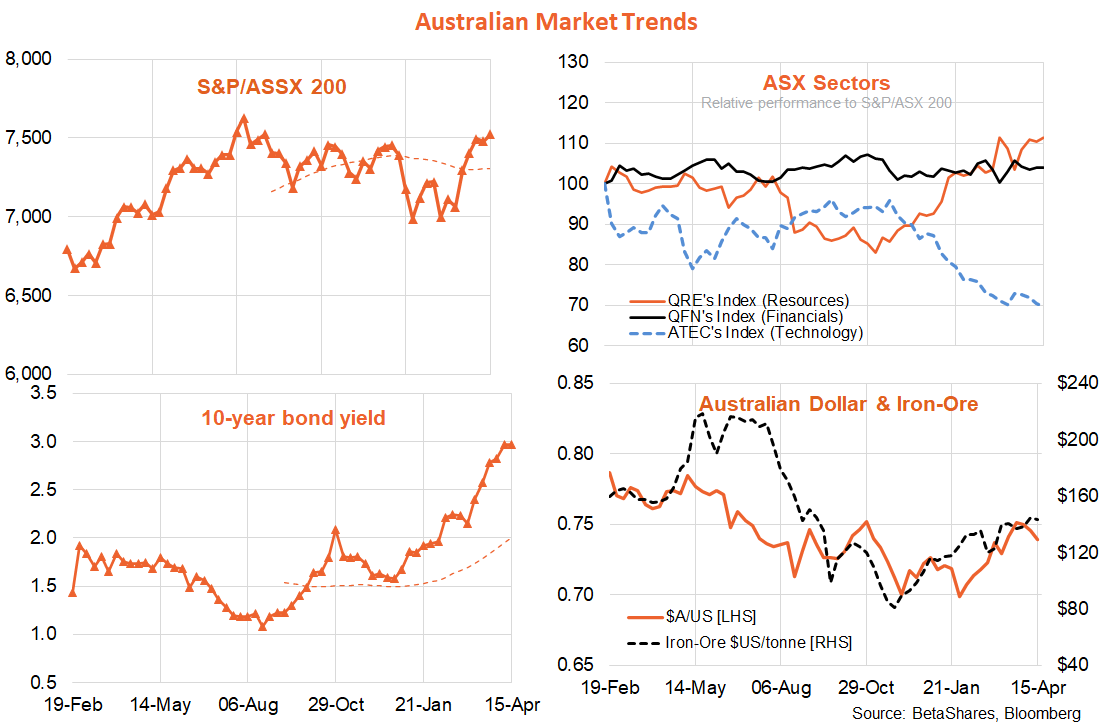

Australian Market

Last week’s local highlights were further robust readings on business conditions and employment, even though consumers appear somewhat beset by worries. The NAB index of business conditions rose solidly in March with the economy bouncing back from recent COVID restrictions, while a further 18k jobs were created in the month with the unemployment rate holding steady at 4.0%.

Despite all this good news, the Westpac survey of consumer confidence dipped further, reflecting concerns over rising petrol prices and the prospect of higher interest rates. So far at least, however, consumer concerns have not led to much of a slowdown in consumer spending – with the March retail spending report on Thursday expected to show another solid 1% gain. A stronger $U.S. and a flattening off in iron-ore prices has seen the $A’s ascent stall somewhat last week.

Apart from retail sales, minutes to last month’s RBA meeting are released on Tuesday. These are likely to add further insight behind the RBA’s hawkish shift in its post-meeting policy statement, which now has many economists (including yours truly) anticipating a June rate hike.