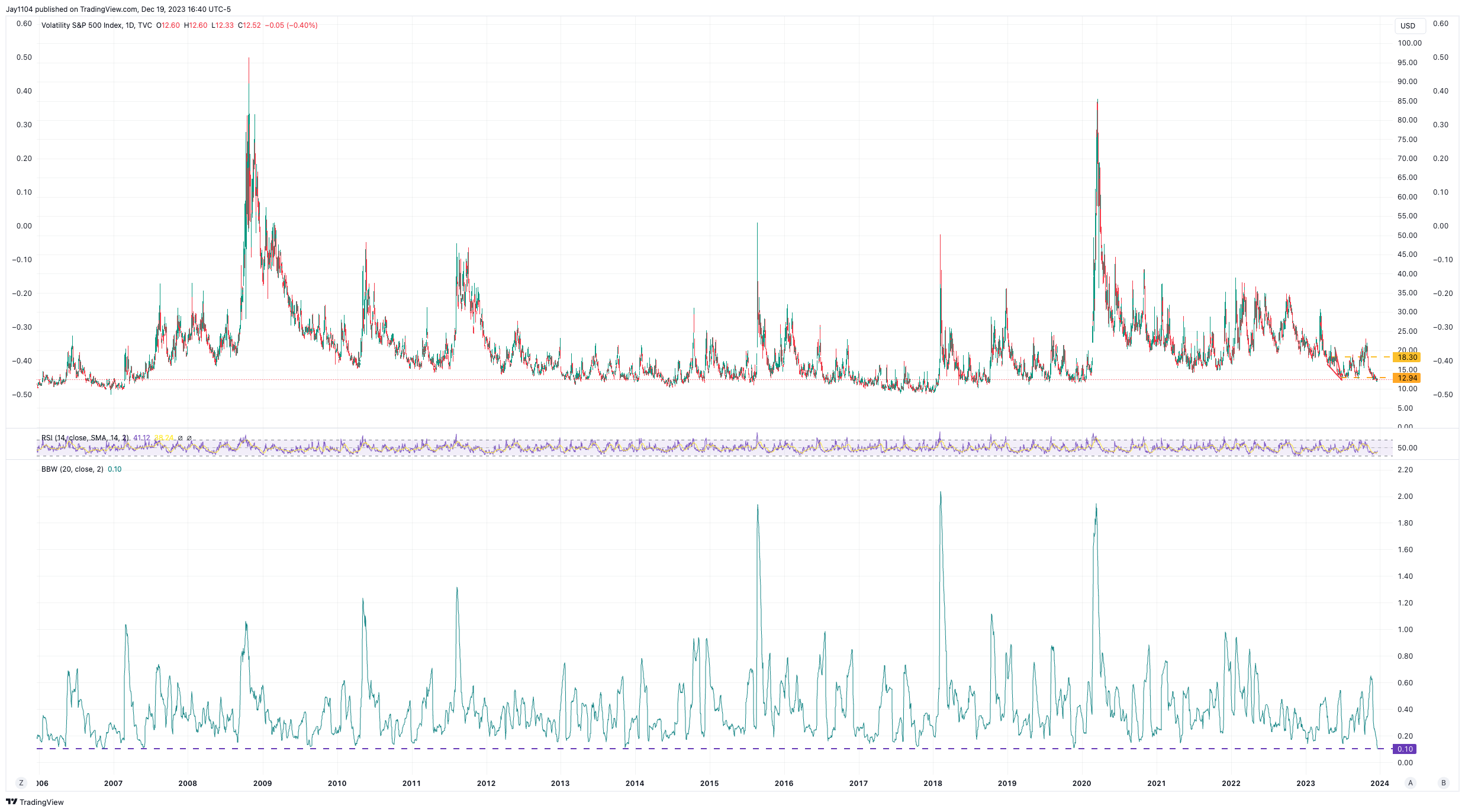

Stocks rallied again, achieving even more extended levels, with the S&P 500 RSI rising to just shy of 82 while remaining above the oper Bollinger band.

Again, this is reaching extreme overbought and stretched levels, and the best opportunity to pop this will come tomorrow, with VIX expiration.

The way the calendar worked out let this whole thing drag on further than it should have, but we have no control over time or the calendar.

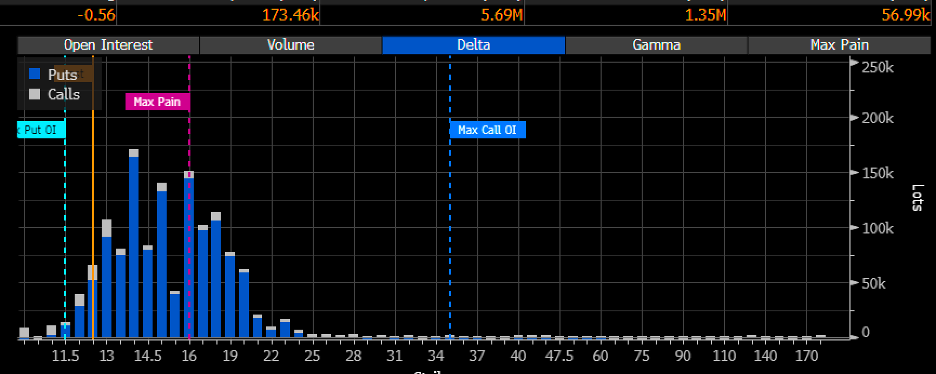

A lot of deltas are due to expire, and perhaps that will relieve some of the pinning and pressure on the market.

At this point, the reflexive nature of the VIX flows has also been a factor in the rally, and once this comes off, the reset in the options market will be complete.

Meanwhile, the VIX Bollinger bandwidth has narrowed to 0.1 at historically low levels. It tells us that the realized volatility of the VIX is very low and tight, and I don’t think it would take much at this point to reverse this trend in the VIX.

I already showed you the chart yesterday of the S&P 500, and today’s chart is more stretched than yesterday’s.

Oil Bulls Show Signs of Life

Meanwhile, oil is showing some signs of breaking out, and given the events in the world, it seems pretty surprising to me it is this low to begin with.

But as we can see, oil was very oversold with an RSI below 30 while trading below the lower Bollinger band.

Now, oil has broken out above the 20-day moving average and, more importantly, can be heading to the upper band around $79.

While rising oil prices won’t be felt in December’s inflation data points, it would likely be felt in the January data points.

If oil rises, the whole cycle with rates will start again because this was exactly what we saw take place in the summer.

As oil prices climbed, rates rose, and I think that is exactly what we are likely to see start all over again because oil and the 10-year have been linked at the hip.

Why shouldn’t rates and oil rise? As measured by the CDX High yield spread, financial conditions have collapsed, as I noted it would if the Fed didn’t push back against the market’s pricing of rate cuts.

US Dollar Could Strengthen With Rates

But more importantly, rising rates will come with a strong dollar, which means tightening financial conditions may be ahead.

Additionally, with the prospects of fourth-quarter GDPNow estimates now at 2.7%, why shouldn’t the dollar strengthen? The US is still the strongest of the economies around the globe.

A stronger dollar and tighter financial conditions can lead to higher implied volatility.

This brings us back full circle and exactly to the point that Powell made about financial conditions and why he isn’t going to fight with the market because, in the end, he is right; financial conditions will get to be where they have to be.

It just means that inflation will linger, and the odds of another rate hike will begin to rise again.

YouTube Video: