Originally published by guppytraders.com

The NYMEX oil chart has three technical features. They signal a continuation of the uptrend with a target near $87. However movement towards this target is hindered by several resistance features which tend to slow the trend momentum

The first technical observation of the behaviour of the Guppy Multiple Moving Average (GMMA) indicator. The long term group of averages is consistently well separated. This shows strong investors support for the uptrend. When price drops, investors come into the market as buyers, supporting the trend.

There is no current evidence of compression in the long term GMMA. Compression shows that some investors are joining in the selling activity and signals the development of a bearish outlook. Price consistently rebounds from the upper edge of the long term GMMA and this shows continued support for the uptrend.

The second technical observation is the role of the uptrend line. From June 2017 until August 2018 the uptrend line acted as a support level. This confirmed trend strength. In August 2018 the price fell below the trend line and this is indicative of some trend weakness.

Now the uptrend line acts as a resistance features. Price trends to move towards the value of the trend line and then retreat away from it. This shows some trend weakness, but it is not, by itself, and indication of an end of the uptrend.

The third technical feature is the consistent behaviour of the oil price as it moves in trading bands. Oil has a well established pattern of moving in trading bands around $11 wide. Applying trade band projection methods gave a target near $76. This has been achieved and the pullback from $76 is an expected part of the trading band pattern. A breakout above the $76 level gives an upside target near $87.

A strong bullish trend continuation is shown when price is able to move above resistance near $76 and also move above the value of the trend line. This would signal that the trend line is again acting as a support feature.

These support features and the trend strength features all continue to suggest that the oil price is experiencing a temporary retreat. The longer term trading band target is near $87 so traders will buy in anticipation of trend continuation..

We use the ANTSYSS trade method to extract good returns from this trend behavior.

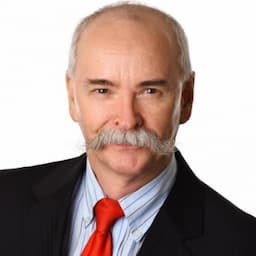

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.