The full implications of OPEC’s failure to cut production have been coming to bear on the oil price and energy stocks. The dramatic selloff in the energy sector seen in the S&P 500 overnight seems to have crystallised concern over the future of the energy market.

Currently, this fall in energy prices has developed its own momentum - like inertial motion - and it’s difficult to see what will stop it. The weekly EIA release due Wednesday and the Baker Hughes (N:BHI) drill rig count due Friday could bring welcome news. But the bloodbath we are seeing in energy stocks seems to imply that the market is looking for defaults. It wants to see companies going out of business before the short positions are ready to start coming out of the market.

Japan

The final number for Q3 GDP in Japan was even better than many were expecting, expanding 0.3% quarter-on-quarter (QoQ). Furthermore, GDP in Q2 was revised up to -0.1%. This is not only significantly better than the initial technical recession that Japan was thought to have entered in Q3, but details of the data are indicating a budding turnaround in the fortunes of the Japanese economy.

Last week’s very strong Q3 capex spending number was pointing to a pickup in business spending by Japanese corporates. Business investment increased 0.6% QoQ, indicating Japan may be at a turning point as Japanese corporates are feeling sufficiently confident about the economic outlook that they are prepared to start spending money again.

In the near term this probably marks the end of speculation that the Bank of Japan (BoJ) will step up its monetary easing. The mantle now falls to the government in following through on its promises to lower corporate taxes and improve Japan’s business environment.

The general global market selloff had far more bearing on the Japanese markets with a good final GDP number already priced in, but going forward these supportive domestic improvements should help drive a number of stocks up over the coming months.

China

China’s record trade balance did fall back to US$54.1 billion in November, driven by a pickup in imports. Imports still contracted 8.7% YoY. However, this was noticeably higher than the past three months and they increased 9.5% MoM as the temporary effects of the National Week in October looked to dissipate from the data.

Key for Australia was the 21.9% YoY increase in the volume of iron ore imports, and the third-highest monthly total for iron ore imported this year. Given net exports contributed 1.5% to Australia’s relatively decent Q3 GDP number concerns are high that this may be a fleeting contribution, particularly with fears over China’s slowing economy particularly high. However, with October and November China’s trade data in iron ore imports are clearly not dropping off a cliff and look likely to see a further net exports contribution to Australia’s Q4 GDP number.

Clearly, the demanding 7% GDP growth target for 2015 has not yet been eschewed and iron ore imports are still benefitting from China’s need to soften the slowdown.

Australia

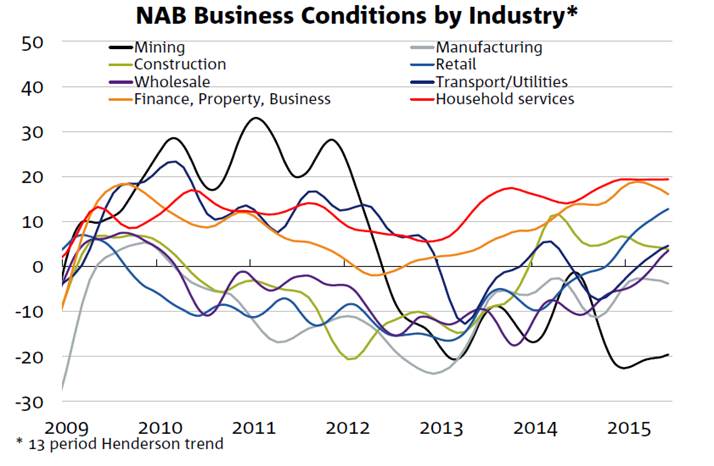

The economic data out of Australia were also relatively upbeat today despite their inability to stem the selloff in the Aussie dollar or the ASX. The weekly ANZ-Roy Morgan consumer confidence number bounced back after the previous week’s Paris-attack-influenced dip. And the NAB Business Conditions held at a strong level of 10 with a rapid acceleration seen in retail, wholesale and transport/utilities sectors. This further indicates a steady pickup in the non-mining sector and, if net exports manage to hold up in Q4, we’re increasingly unlikely to see a rate cut by the Reserve Bank of Australia (RBA) over the coming months.

The ASX replicated the virulent selloff seen in the energy sector in the S&P overnight, with the sector as a whole diving 6.2%. News that Woodside Petroleum Ltd (AX:WPL) had retracted its bid for Oil Search Ltd (AX:OSH) only added further fuel to the fire with the takeover premium coming out of the stock price and the stock seeing a massive 15.8% decline. But the pain was felt throughout the sector with Santos Ltd (AX:STO) also having a terrible day as it lost 11.8%. The big question will be whether they will still be able to hold out against the takeover offer from Middle Eastern private equity company Spectre Group at these price levels.

The strong rally in the US dollar during the past 24 hours and the disaster seen in the oil price has spilled over to other commodities, with iron dropping into the US$30 handle. The materials sectors have similarly seen a serious selloff, losing 3.3%, with the two big miners’ market caps weighing particularly heavy on the index as a whole. BHP Billiton Ltd (N:BHP) dropped 5.1% into the A$17 handle and Rio Tinto PLC (N:RIO) lost 4%.

The banks were not saved from the selling - three of the big four all lost almost 1% and financials as a whole dropped 0.6%.

The huge selloff in oil, however, did look to be positive for airline stocks. Qantas Airways Ltd (AX:QAN) and Air New Zealand Ltd (AX:AIZ) both gained about 5% on the day.