Last week saw a resurgent New Zealand Dollar as the embattled Kiwi finally found its legs. However, a risk event looms upon the horizon as the RBNZ considers a cut to interest rates that could send the NZD tumbling once again.

The New Zealand Dollar had a relatively positive week as the NZD closed up significantly higher following a gain of 3.6% in global dairy prices at auction. Surprisingly, New Zealand business confidence was also up at 14.6 (10.5 prev) which will certainly be pleasing to the RBNZ. Subsequently, the NZD managed to close the week around the 0.6725 mark, fuelled by the better than expected data and a sentiment swing away from the US dollar. The NZD also benefited from the volatility present over the ECB monetary policy decision, which saw capital seeking a safe haven.

The week ahead is likely to focus strongly upon the RBNZ’s pending interest rate decision and monetary policy statement. The decision will be keenly watched by the market and it is currently anyone’s guess as to which path the venerable central bank will take. On one hand, inflation has remained stubbornly below the central bank’s target of 1.00%-3.00%, but the broader trends in both GDP and exports have remained robust, which makes the case for a rate cut problematic.

Subsequently, the RBNZ’s direction remains largely a coin toss and open to speculation. Complicating the issue is the US Fed’s future positioning and whether a potential rate hike in December will occur. Given the current value of the NZD, the RBNZ is likely wanting to avoid a situation where their attempts at depreciating the NZD to an appropriate level are undermined by policy action from the US central bank. Subsequently, the New Zealand decision may be an important indicator as to the Fed’s bias in the weeks ahead.

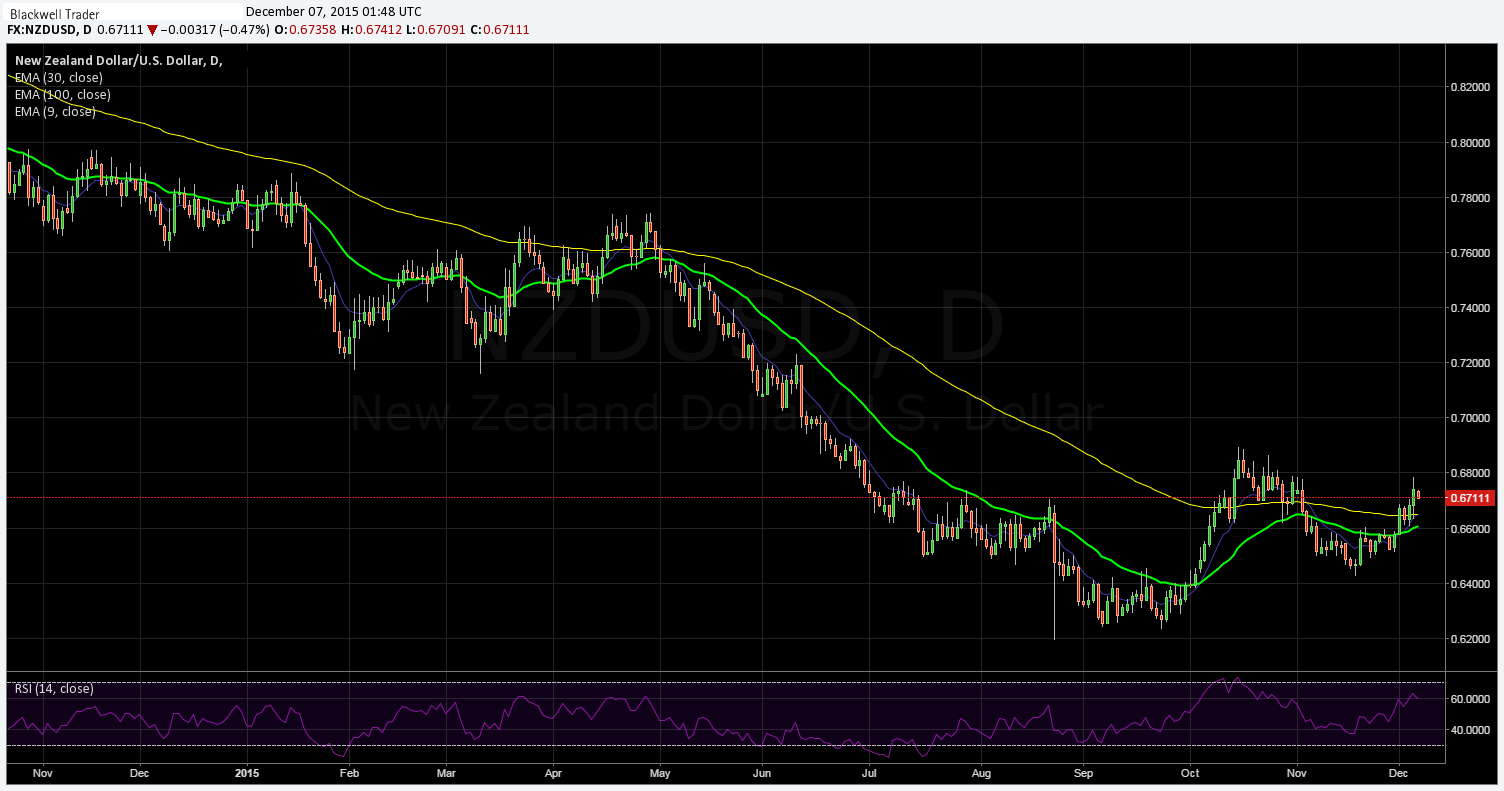

From a technical perspective, the NZD’s price action has risen strongly above the 100-Day moving average and beyond the short term bearish trend line. RSI remains relatively buoyant, within neutral territory, whilst the 12 and 30 EMA’s trend higher as the ABCD pattern looks to reach completion. Overall, the pair still retains a bullish bias but there are plenty of risk events to monitor in the coming days. Support is found at 0.6616, 0.6426, and 0.6234. Resistance is found at 0.6788, 0.6898, and 0.7013.

Ultimately, the week ahead is likely to be volatile for the pair leading up to the RBNZ decision. Any rate cut or dovish sentiment from the RBNZ could see the NZD tumbling and the key 65 cent handle coming back into focus. However, monitor the decision closely because RBNZ Governor Wheeler has an uncanny ability to alter the market through his considerable jawboning expertise.