The New Zealand dollar fell strongly overnight as a highly negative Global Dairy Trade (GDT) result saw bearish selling mount. The pair now looks to be under significant pressure as price action falls rapidly below the 100-Day moving average.

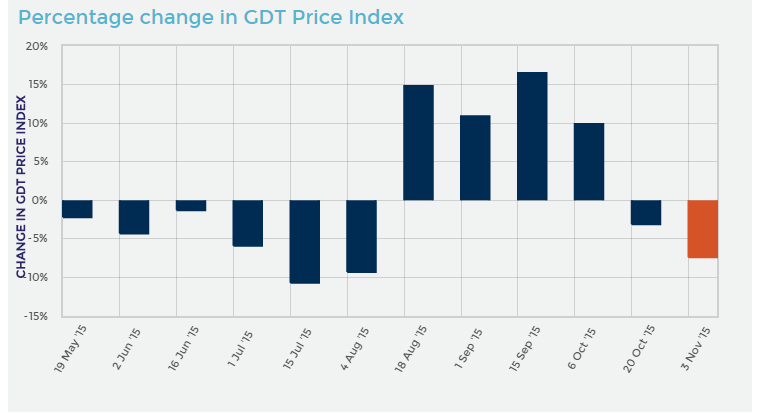

The Kiwi Dollar has had a rough few days as the pair has been beset by further falls in the price of their key export, dairy products. The Global Dairy Trade result turned sour overnight and posted a negative result of -7.4%. This is a significant decline in prices and will be certain to impact New Zealand export receipts negatively.

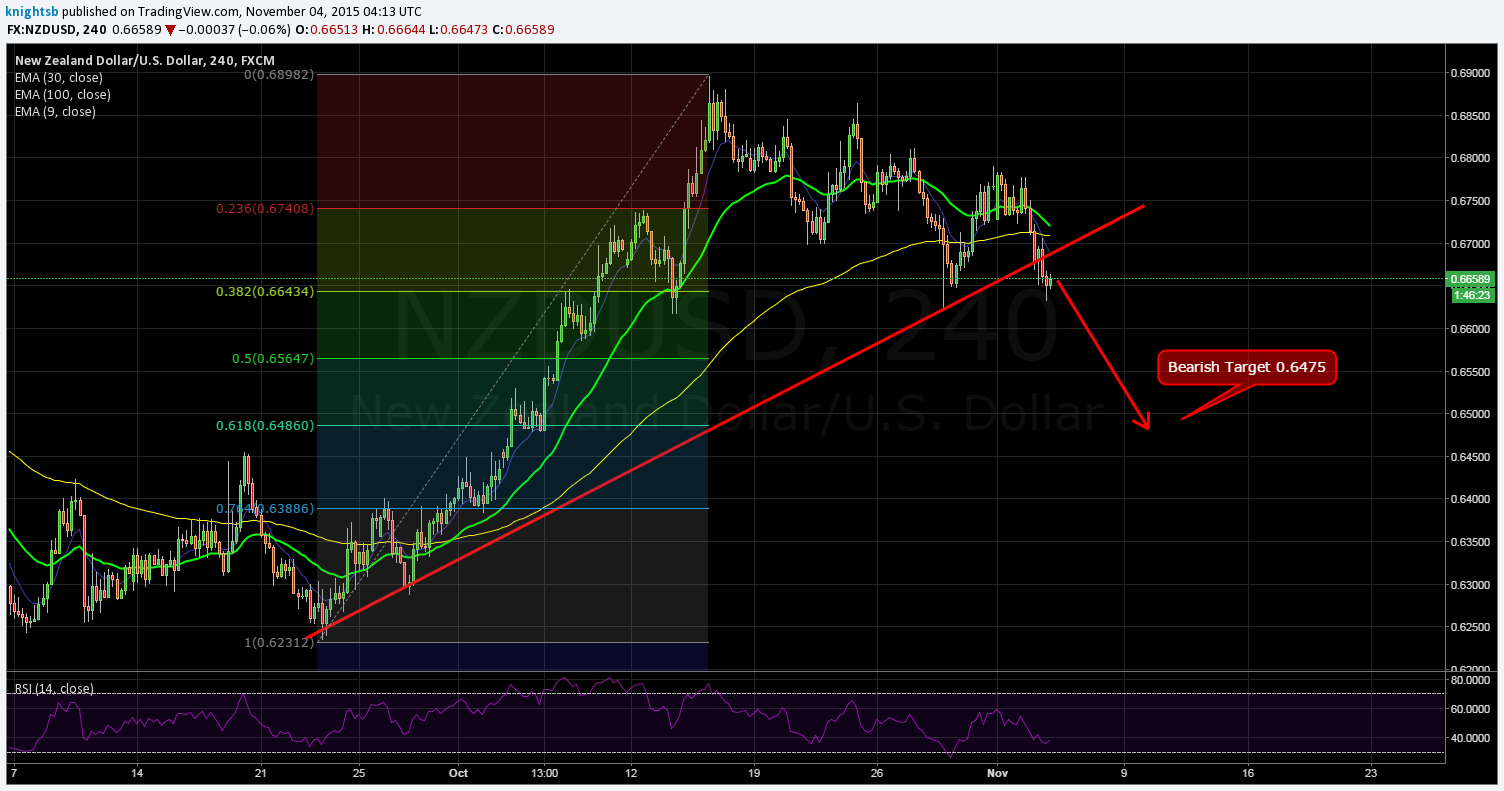

Given some of the relatively flat economic data emanating out of New Zealand of late, it’s no surprise that the overall performance of the NZD has been lacklustre. Following the GDT result, the NZD declined sharply to trade around the 0.6654 mark. The current pricing level has seen the pair fall sharply below the short term, supporting trend line, as well as the much watched 100-Day moving average.

It would appear that the bears are very close to returning the NZD back to a linear downtrend as the key support level at 0.6616 looms. Any subsequent breach of this support is likely to see the Kiwi Dollar in free-fall with a downside target around the 0.6475 mark, which also happens to coincide with the 61.8% retracement level.

In addition, RSI supports this proposition, especially given the fact it is bearishly trending lower within neutral territory and not yet over-sold. Subsequently, there is plenty of potential for a further correction and an additional bearish leg. However, it should be noted that the stochastic oscillator has just dipped below 20, into reversal territory.

Due to price actions position below the 100-Day moving average, along with a looming critical area of support, our bias remains for a significant correction, if 0.6616is breached. However, keep a close watch on the upcoming US NonFarm Payroll (NFP) result as it is likely to cause significant volatility for the pair and also set the trend in the coming days.