New figures from the Association of Superannuation Funds of Australia (ASFA) revealed the price for a comfortable retirement increased 6.1% in the June quarter amid surging grocery and insurance expenses.

- Comfortable retirement costs have outpaced inflation, rising 6.1% over the 12 months to June compared to 6% CPI.

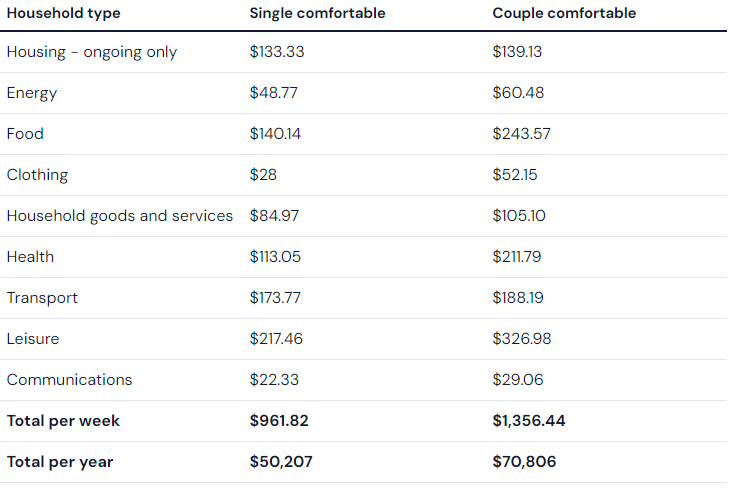

- To live a comfortable retirement, couples need almost $71,000 per year while singles need just over $50,000.

- Rising food and insurance costs are the primary drivers lifting retirement costs up.

This figure was slightly above the Consumer Price Index (CPI) of 6%.

The annual budget for a comfortable retirement now sits at $70,806 for a couple over 65 and $50,207 for a single.

Meanwhile, a ‘modest’ retirement costs $45,946 for a couple and $31,867 for singles - which can be largely covered by the age pension.

ASFA Deputy CEO Glen McCrea said retirees are having to fork out more money on basic staples.

“Retiree budgets have been under substantial pressure for nearly two years due to high costs of essential goods and services," Mr McCrea said.

"Price rises in the cost of food were significant in the June quarter. The price of bread increased more than 5% and is up 14 per cent over the year.

"The cost of vegetables was up almost 4% over the three-month period, with the noticeably higher cost of potatoes due to a shortage linked to unfavourable growing conditions last year.

"Once again, putting dinner on the table became more expensive, with the cost of poultry, dairy, vegetables and potatoes up significantly.”

Seniors have also been hit hard by soaring insurance costs, with quarterly growth recording its strongest rise in 23 years - up 5.3%.

Over the financial year, insurance costs across house, house contents, and motor vehicle insurance have climbed 14%.

According to ASFA, the lump sum required to retire comfortably at 65 years is $690,000 combined for couples, and $595,000 for singles.

Australians contribute $165bn in superannuation

The latest statistics from the Australian Prudential (LON:PRU) Regulation Authority (APRA) revealed the total amount of money in superannuation by the end of June 2023 was $3.54 trillion - 7.6% higher than the previous year.

“The growth in superannuation over the past year was driven by strong contribution inflows, reflecting higher employment growth, higher wage inflation and strong investment market returns,” APRA explained.

Employer contributions increased by 12.9% over the year to $122.5 billion, while member contributions lifted 13.1% to over $42 billion.

Meanwhile, total self-managed super fund (SMSF) assets rose by 3.9% to $876.4 billion.

"No slowing down: cost of a comfortable retirement lifts again" was originally published on Savings.com.au and was republished with permission.