DXY was up Friday night:

AUD is on a rampage:

Oil eased:

Metals too:

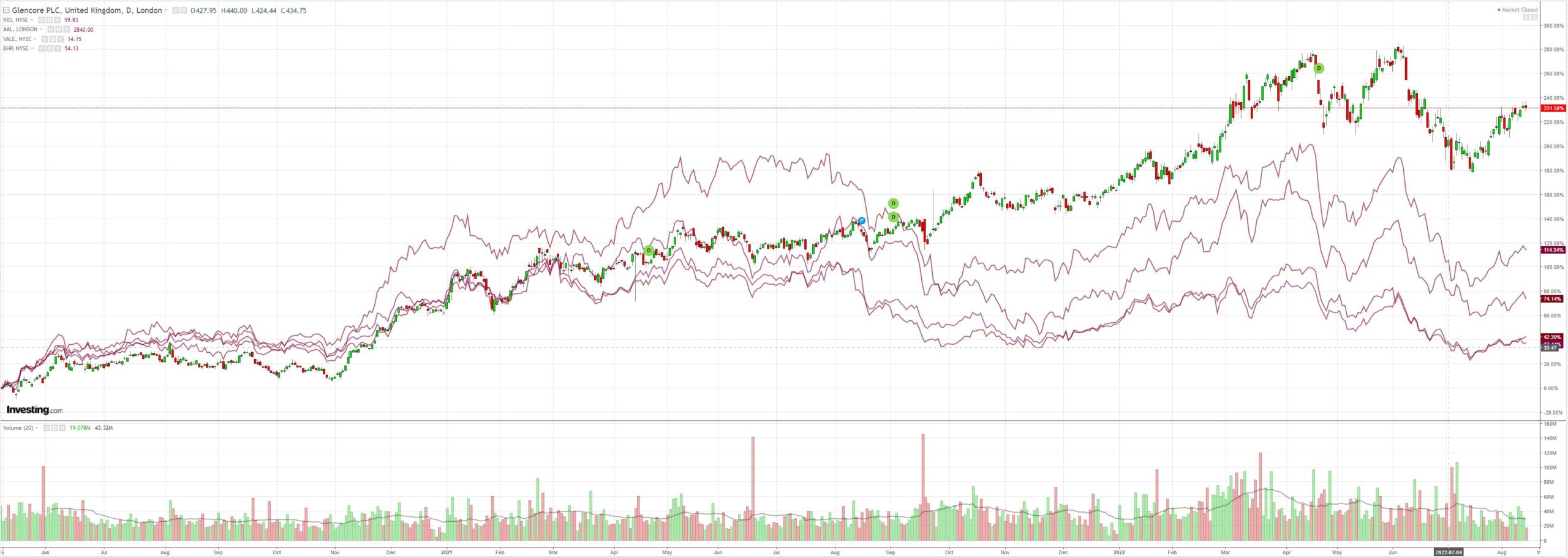

The AUD miners (LON:GLEN) are not rebounding much:

EM stocks (NYSE:EEM) popped:

Junk (NYSE:HYG) is food for bulls:

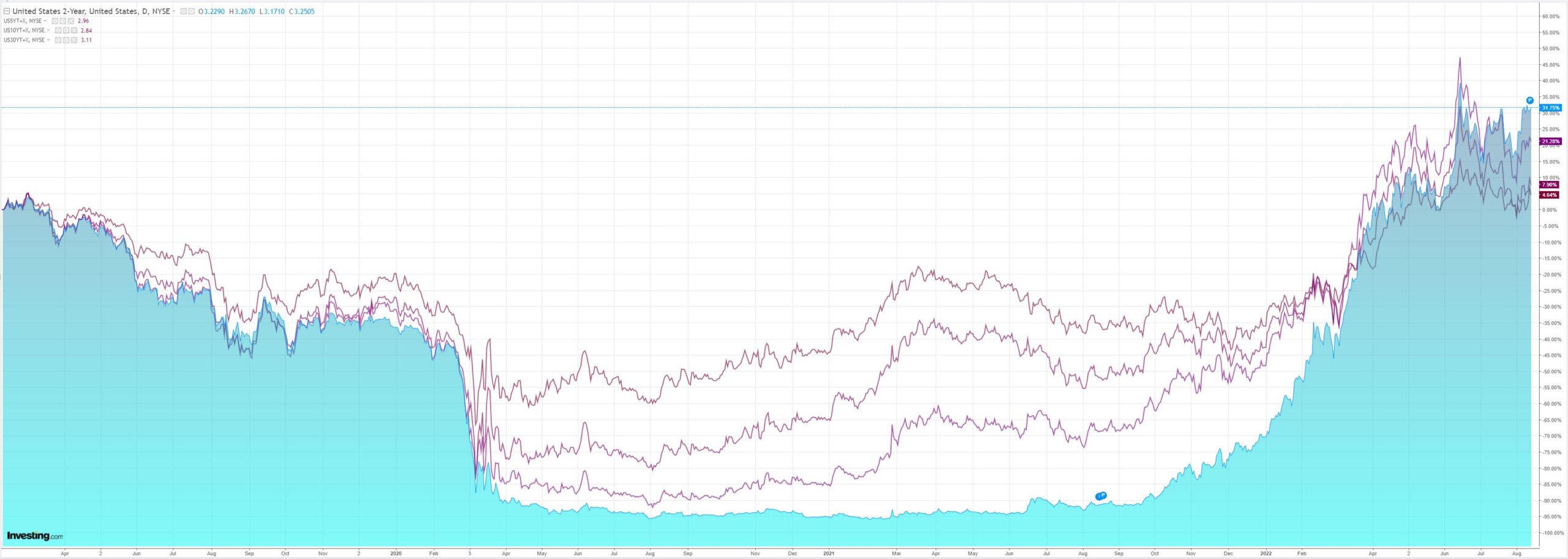

But the Treasury curve is still deeply inverted:

As stocks price Nirvana:

Contrary to wider bullishness and FOMO, markets are getting more short AUD:

While stock shorts are blasted:

There is scope here for a higher AUD given positioning in the short term given it so out of step with broader risk flows.

That said, it may also provide some insight into why US assets are flying despite still very high inflation. The Chinese economy is not storming back so that can provide ongoing disinflation to the US as the goods bull whip effect inverts and would weigh on AUD positioning despite border “risk on”.