- Reports fiscal Q4 2022 results on Monday, June 27, after the close

- Revenue expectation: $12.09 billion

- EPS expectation: $1.07

The current economic environment doesn't seem conducive for sportswear giant Nike (NYSE:NKE) to report impressive earnings when the Beaverton, Oregon-based company releases its latest quarterly numbers later today. Global supply chain disruptions, China COVID restrictions, and cost pressures are likely to squeeze margins despite robust consumer demand.

Fearing that outcome, investors have sent Nike shares tumbling more than 30% this year. That performance is much worse than that of the benchmark S&P 500 Index which is down about 20% for the same period. Nike shares closed on Friday at $112.91.

While the maker of Air Jordan and Air Force 1 sneakers navigates supply chain snarls and works to get its Asian suppliers back to full production, there are also strong signs that these problems are short-term in nature making the stock's current weakness a good buying opportunity.

Executives told investors in March that factories making the company’s goods in Vietnam were operational and that footwear and apparel production had returned to volumes seen before pandemic-related closures late in 2021. During the first quarter, the company's container shipping rates have also begun to normalize.

However, persistent inflation and the Russia-Ukraine crisis pose challenges to sales in upcoming quarters. The company announced in March that it plans to close its stores in Russia, citing increasing difficulty managing its business after the Ukraine invasion. It has about 116 locations in Russia, and the company said it would still pay its employees in the region.

Direct-To-Consumer Shift

While these challenges linger, Nike’s accelerated shift to direct-to-consumer selling is helping to cut costs and improve margins.

Under Chief Executive Officer John Donahoe, direct-to-consumer sales have been the focus for Nike. This initiative has pulled the brand back from many wholesale partners in favor of Nike's own website. Revenue in its direct business grew 17% in Q2 and accounted for about 42% of total sales.

Chief Financial Officer Matt Friend said Nike is “now moving into the next phase” of that strategy, having cut wholesale accounts worldwide by over 50%. Nike will now invest in the physical stores that it decided to continue partnering with and work on more of its own retail concepts.

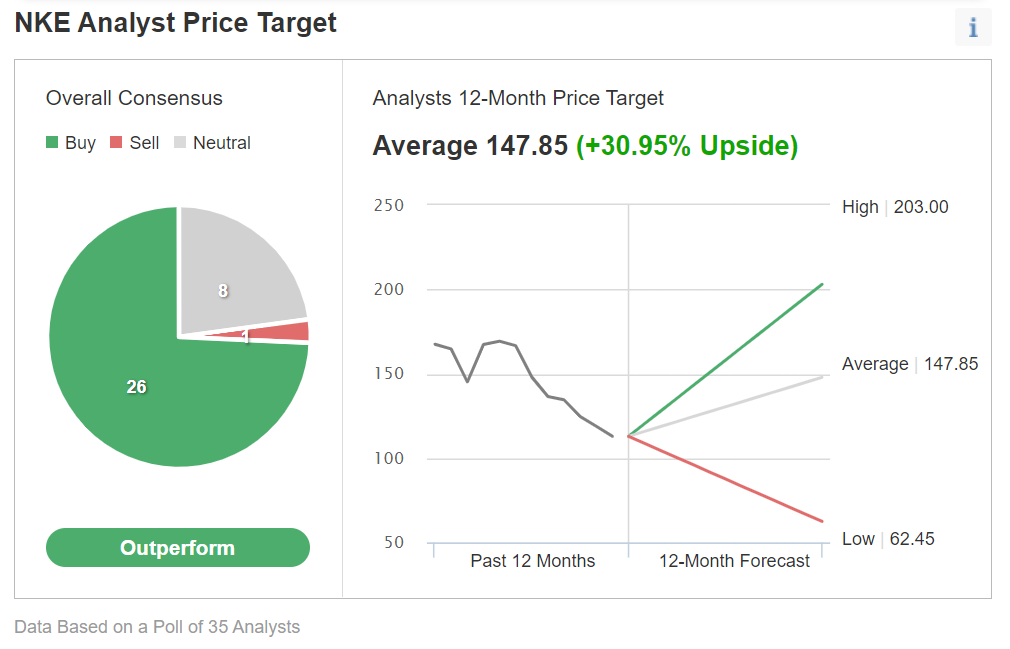

Due to Nike’s strong brand appeal, robust consumer spending, and the success of its direct-to-consumer strategy, the majority of analysts rate Nike a buy.

Source: Investing.com

In an Investing.com poll of 35 analysts, 26 recommend buying the stock. Among those surveyed, there's a 12-month average price target of $147.85 on shares, implying about 31% upside.

While reiterating its ration on Nike as 'outperform,' Morgan Stanley said in a recent note that Nike’s long-term value remains intact:

“The mkt expects a 4Q EPS miss & ’23e guide below consensus. We don’t expect any resolution on the China debate near-term, which means investors likely continue to wonder when NKE will return to delivering its long-term targets.”

Guggenheim also reiterates the stock as a buy, saying Nike is facing transitory issues and that investors should stick with the stock.

“While we do not believe Nike is immune from the numerous challenges brought on by COVID-19, logistics, and other geopolitical uncertainties, we believe many of these issues are transitory in nature. We remain BUY rated and believe this uncertainty provides a buying opportunity.”

Bottom Line

Nike may not show its full earnings potential as long as supply chain issues are not resolved and demand doesn’t return to normal in China, the company’s second biggest market. But the weakness in its stock, in our view, is temporary as the global appeal of Nike's brands remains strong as does its excellent execution capabilities.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI