The S&P 500 dropped by around 35 bps on the day, with most of the decline coming in the final minutes. Yesterday, there was a large sell imbalance that was $4.1 billion, which helped to create that wave of selling into the close.

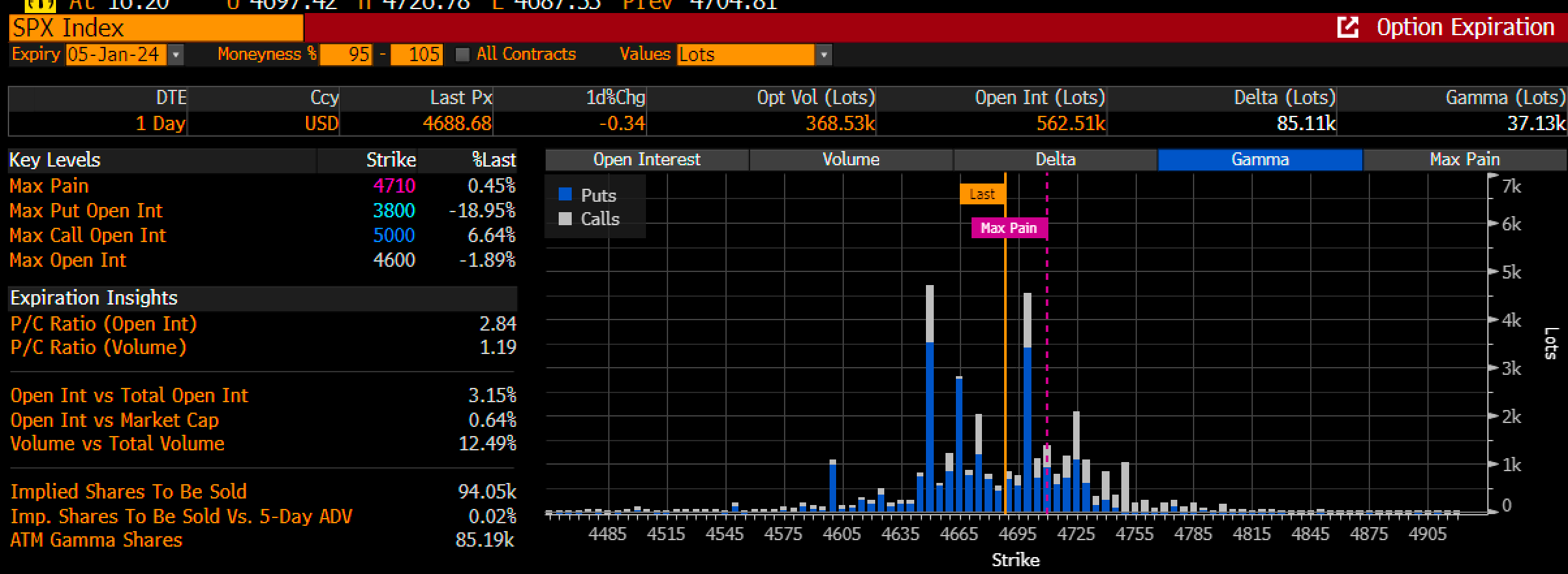

The level of support was 4,700, which has been the important level for a few days, which has been the put wall in the 0DTE complex.

With the monthly OPEX so far away, I tend to think the 0DTE complex carries weight at this point. But with that level now broken, the next level from a gamma perspective will come at 4,650 today.

Crucial Jobs Report Awaits

Today is the job report; the data will determine what happens from here. I think it is simple: data that comes in mostly inline or stronger likely leads to higher rates and odds for rate cuts in March getting pushed out to May or June.

Analysts’ median estimates are 175,000 and don’t seem overly aggressive, while the unemployment rate is expected at 3.8%. The Bloomberg whisper number is 185,000 today, and Kalshi shows expectations for an unemployment rate of 3.7%.

Even if the numbers come in at analysts’ forecast, arguing that the Fed should rush to cut rates is tough. It would take a big miss on the headline numbers and the unemployment rate to get the Fed to cut rates sooner rather than later.

Volatility Is Creeping Up

The market doesn’t seem overly nervous heading into the report with the cost to buy an at-the-money put and call for today’s expiration at just 62 bps, while the VIX is at 14.

Granted, the VIX is up off the lows of around 12 at the end of December. But this 14 level has been important, and moving above 14 likely opens the door to expanding levels of volatility.

I think the odds for volatility to expand are pretty good here because, for equities, it needs the data to come in just right. If the data is too hot, rates will rip; if it is too cold, then growth concerns and recession worries will mount.

There isn’t much data to support that the BLS should miss estimates because most of the job data we have witnessed has been consistent with a strong job market.

The data today is a government report, and government reports aren’t always the most reliable and tend to be subject to big revisions in, might I add, a presidential election year.

S&P 500: Gap Higher or Lower Will Determine Trend

That said, if the market can gap higher today and take out 4,725, it can be off to the races and maybe even fill the gap at 4,770.

However, if the gap is lower, it would create a breakaway gap, which could put us on a course to 4,640 and probably lower than that over the coming days.

10-Year Back to 4%

We also saw the 10-year yesterday move back to 4%; while it needs confirmation with a move higher today, the 10-year Treasury may have broken out, and that could be setting it up to run to around 4.1% to start, potentially on to 4.25% and beyond.

Please watch my latest YouTube Video:

Well, Let's see what the job report says today.