Farther and farther from the seasonal average—that’s where weekly withdrawals of natural gas are headed as warm weather across the United States creates little need for indoor heating.

Reduced burns for both heating and power generation have routed the spot price of gas on New York’s Henry Hub from near seven-year highs of $6.47 in October to just around $3.63 two weeks ago—a drop of 44%.

While the market has found support at above $3.80 lately, weather conditions haven’t, remaining too balmy for this time of year.

That’s bumped up US gas inventories by more than 4% since the end of September as demand has been unable to mitigate steady production of dry gas—despite a step up in exports of LNG, or liquefied natural gas.

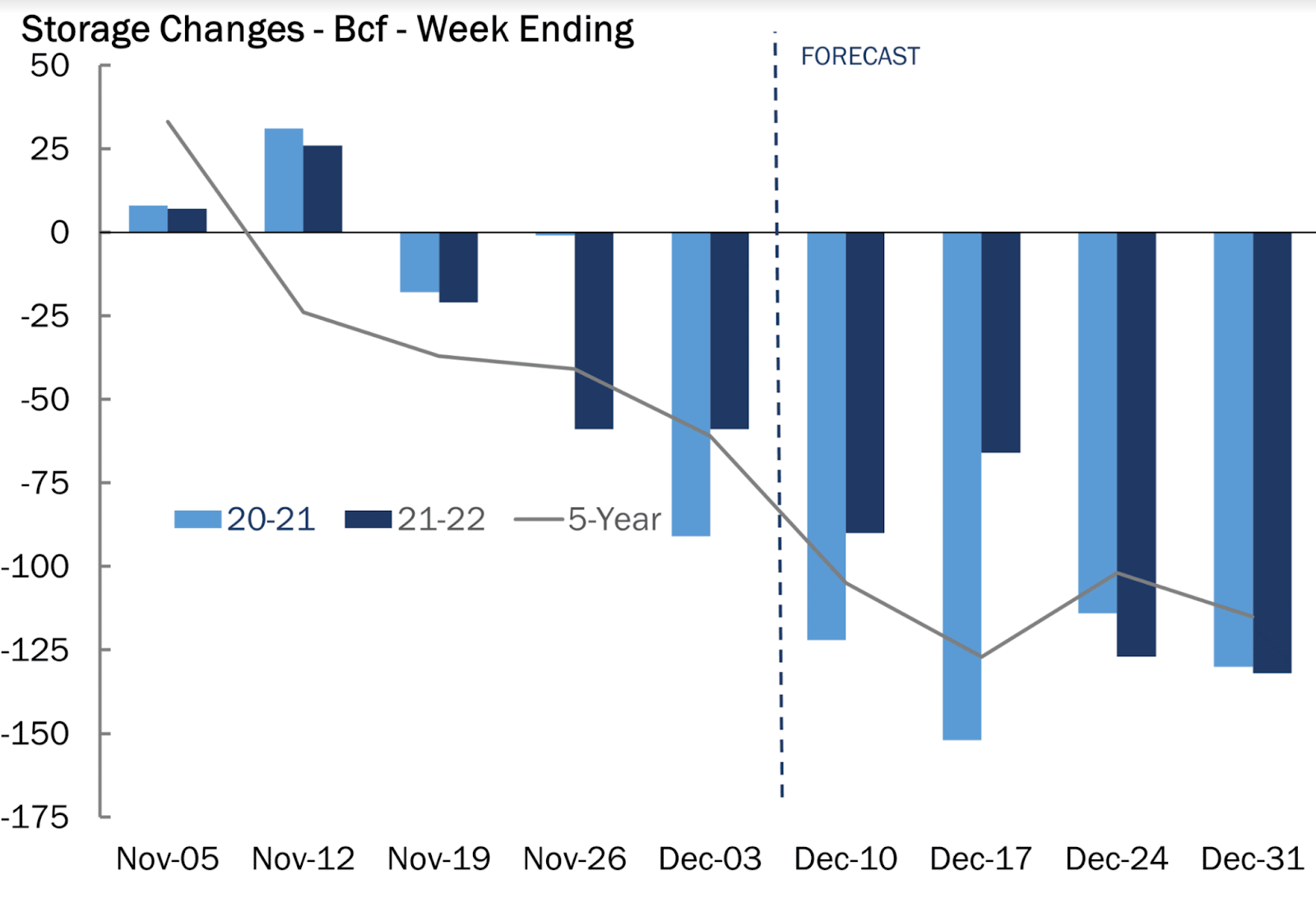

As market participants await another weekly update on US gas inventories from the Energy Information Administration, the consensus among analysts tracked by Investing.com is that utilities pulled a smaller-than-usual 86 bcf, or billion cubic feet, of gas from storage last week due to milder-than-normal weather.

Source: Gelber & Associates

“The warmth is still present in the current system, with many cities in the Midwest approaching their record highs (in terms of temperatures) today as temperature anomalies across some regions in the Plains and Midwest trend above 30 degrees,” (Fahrenheit), said Dan Myers, analyst at Houston-based gas consultancy Gelber & Associates.

Last week’s weather was milder than normal with 141 HDDs, or heating degree days, compared with a 30-year normal of 161 HDDs for the period, according to data provider Refinitiv.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

The 86-bcf withdrawal forecast for last week compared with a withdrawal of 118 bcf during the same week a year ago and a five-year (2016-2020) average withdrawal of 114 bcf.

In the prior week to Dec. 3, utilities withdrew 59 bcf of gas from storage.

If analysts are on target, the withdrawal during the week ended Dec. 10 would leave gas inventories in storage at 3.419 tcf, or trillion cubic feet, some 1.8% below the five-year average and 8.7% below the same week a year ago.

At the end of September, gas in storage stood at 14.3% below the same week a year ago.

“Looking ahead into the future, the current warmth is also expected to affect next week’s storage forecast and limit it to a 66-bcf withdrawal, while the five-year average remains at triple-digit levels,” Myers said in an email on Wednesday to clients of Gelber & Associates that was shared with Investing.com.

Myers noted that the last two gas storage reports of the year were expected to surpass 100 bcf as milder temperatures in the United States dissipate later near the end of December. The analyst added:

“Currently, December 2021 is on track to become the second warmest December in the last 70 years, with only December 2015 ranking lower in terms of monthly HDDs.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.